Hungary: Time for a rating upgrade?

After its outstanding economic and fiscal performance in 2018, Hungary awaits an S&P rating review this Friday. An upgrade seems quite possible but could it really happen now?

| BBB- |

Sovereign debt rating (S&P)Outlook: Positive |

The background

This Friday (15 February) S&P will be the first rating agency in 2019 to have an opportunity to deliver its sovereign rating verdict on Hungary. According to previous signals and comments from the agency, Hungary can be optimistic about a possible ratings upgrade from ‘BBB-‘ to ‘BBB’, which would be its best rating since December 2010. S&P affirmed Hungary’s ratings in August 2018, but signalled that it could raise these in the next 12 months if certain criteria were met.

Arguments for

We believe that Hungary has fulfilled the requirements for an upgrade. Financial stability has further improved since the last review. The NBH's latest financial stability report (November 2018) pointed out that “the shock-absorbing capacity of the Hungarian banking sector is strong (…), profitability is outstanding”. Lending activity is also on the rise, while non-performing ratios are shrinking across all sectors. The fiscal situation has also improved, with both public debt and the deficit to GDP lower than planned. Public debt dropped to around 71% of GDP with the FX-share now at 20%, meaning that the external vulnerability of the country has declined further. The current account balance remained in surplus (at around 1.5% of GDP) despite the strong domestic demand and a weaker external environment. Domestic factors pushed GDP growth to 4.7% YoY in 2018, a rate not seen in the past couple of decades.

Arguments against

On the other hand, S&P could point out that the recent exceptional economic activity has been fuelled by temporary factors, while the potential for growth in Hungary is still low (at around 3%, we estimate) and the government has not made much progress in improving the country’s growth rate for the long run. In its latest review, S&P highlighted that the worsening relationship between Hungary and the EU could lead to negative consequences. Since this assessment the EU has voted to trigger the Article 7 sanctions procedure, but so far this hasn’t led to any apparent fiscal or economic consequences. That said, it could have an effect on the next Multiannual Financial Framework, when Hungary could face a significant fall in EU money in real net terms, especially when compared to the previous programming period. Last but not least, S&P pointed out in August it could upgrade Hungary over the next 12 months and so might take its time to further assess recent developments. This would delay the decision into August, when its second (and last) review in 2019 takes place.

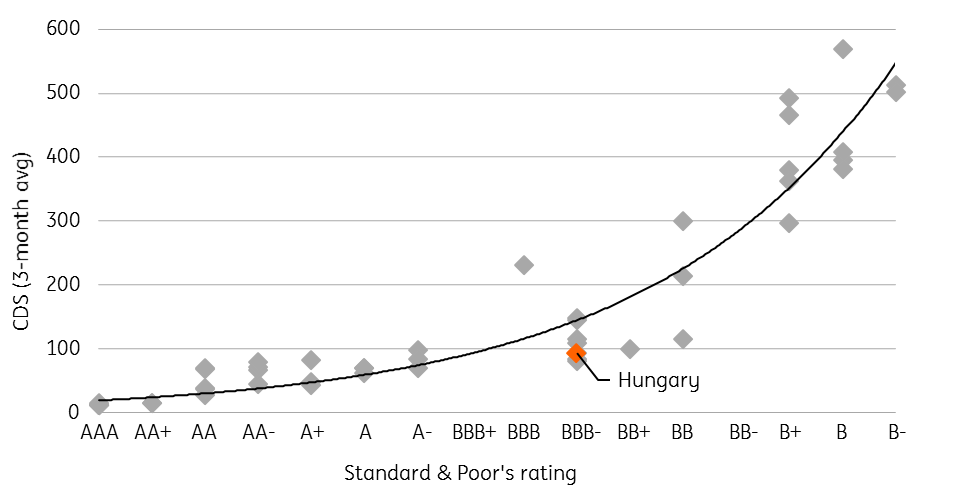

Based on market pricing, Hungary should have a better rating than 'BBB-'

Our expectation

All in all, we see the pros outweighing the cons and a rating upgrade to ‘BBB’ (Outlook: Stable) seems highly likely, but not necessarily a market mover. Given that Hungary’s status as 'junk’ (non-investment grade) has long gone, and based on CDS pricing which shows investors treating Hungary as a ‘BBB+’-country anyway, we don’t expect any major market move in the aftermath of this decision. If anything, we expect EUR/HUF to edge lower, approaching 315.

Schedule of rating reviews in 2019

| Fitch Ratings | Moody's | S&P |

|---|---|---|

| 22 February | 03 May | 15 February |

| 16 August | 25 October | 16 August |

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

13 February 2019

In case you missed it: More battles lie ahead This bundle contains 9 Articles

Peter Virovacz

Peter Virovacz is a Senior Economist in Hungary, joining ING in 2016. Prior to that, he has worked at Szazadveg Economic Research Institute and the Fiscal Council of Hungary. Peter studied at the Corvinus University of Budapest.

Peter Virovacz