Hungary: Real chance of a rating upgrade

After strong second-quarter GDP data, Hungary may be set for more good news by the end of the week. S&P upgraded Hungary's credit outlook to 'positive' a year ago, will it finally raise its rating?

| BBB- |

Sovereign debt rating of HungaryOutlook: Positive |

The pros and cons

After an uneventful sovereign debt review by Moody's in June, S&P will deliver its verdict on Hungary's economy this coming Friday. The rating agency revised its outlook from 'stable' to 'positive' in August 2017 and given the favourable developments in the economy since then, we think Hungary has a realistic shot at an upgrade, from ‘BBB-‘ to ‘BBB’, which would be the best rating since December 2010.

When considering an upgrade, debt agencies focus on some issues more than others. As Márton Nagy, Deputy Governor of the National Bank of Hungary, pointed out recently, S&P primarily monitors the banking system, especially the proportion of non-performing loans (NPLs), both among households and corporates as well as the country’s external indebtedness and vulnerability. This is in line with the latest S&P commentary released in February, regarding a possible Hungarian upgrade:

“We could raise the ratings in the next 12-18 months if recent improvements in the financial sector enhance the authorities' ability to influence domestic monetary conditions. This would be signalled, for example, by a stronger recovery of bank lending alongside continued economic growth, accompanied by contained fiscal deficits.”

We've seen further improvements in the banking sector, a clear pro

Taking into consideration the changes since the last sovereign debt rating, we have seen further improvements in the banking sector. For example, households’ NPL ratio dropped to 6.1% from 7.5% in 1Q18. In addition, upward risks stem from a robust 2Q GDP figure. According to S&P’s last forecast, Hungarian GDP growth will reach 3.5% in 2018 overall. With the 1H18 economic activity at 4.5% on average, we see this as a strong argument favouring an upgrade. Moreover, it's not just about GDP itself, which came in better than expected. A stronger-than-expected reduction of the debt-to-GDP ratio, compared to S&P’s base case, also helps.

The recent market turmoil and the dispute with the European Commision could be considered cons

On the other hand, S&P could also find good excuses not to upgrade Hungary. First of all, the aforementioned 12-18 month period cited in February does not necessarily suggest an upgrade is imminent. Secondly, current geopolitical risks in Turkey and possible spillover effects to the whole emerging market space could give S&P pause. And finally, the rating agency could argue that the high cash-flow based deficit and high financing needs of the budget could derail the debt reduction plan if Hungary isn't able to resolve its issue with the European Commission over EU funds. Based on the latest news, it seems the dispute will be settled soon and at least HUF752 billion could be released from Brussels in 4Q18.

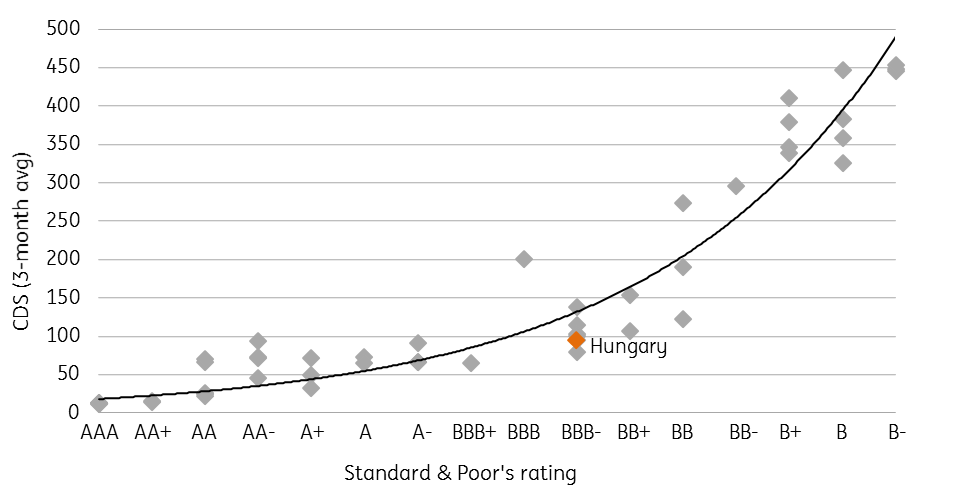

Based on market-pricing, Hungary should have a better rating than 'BBB-'

The verdict

We see the pros outweighing the cons, so there is a real chance that S&P will be the first to upgrade Hungary to ‘BBB’, although a simple affirmation of the rating cannot be excluded. Given that Hungary has long since shed its 'junk' status (non-investment grade) and based on the CDS pricing, which shows investors are treating Hungary as a ‘BBB’-country anyway, we don’t expect any major move in the market in the aftermath of this decision.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

Peter Virovacz

Peter Virovacz is a Senior Economist in Hungary, joining ING in 2016. Prior to that, he has worked at Szazadveg Economic Research Institute and the Fiscal Council of Hungary. Peter studied at the Corvinus University of Budapest.

Peter Virovacz