Hong Kong: Bank rate hikes heap stress on borrowers

With some Hong Kong banks increasing their benchmark lending rates, mortgage repayments could become increasingly difficult, affecting demand for properties and other asset markets, too

Stressed mortgages

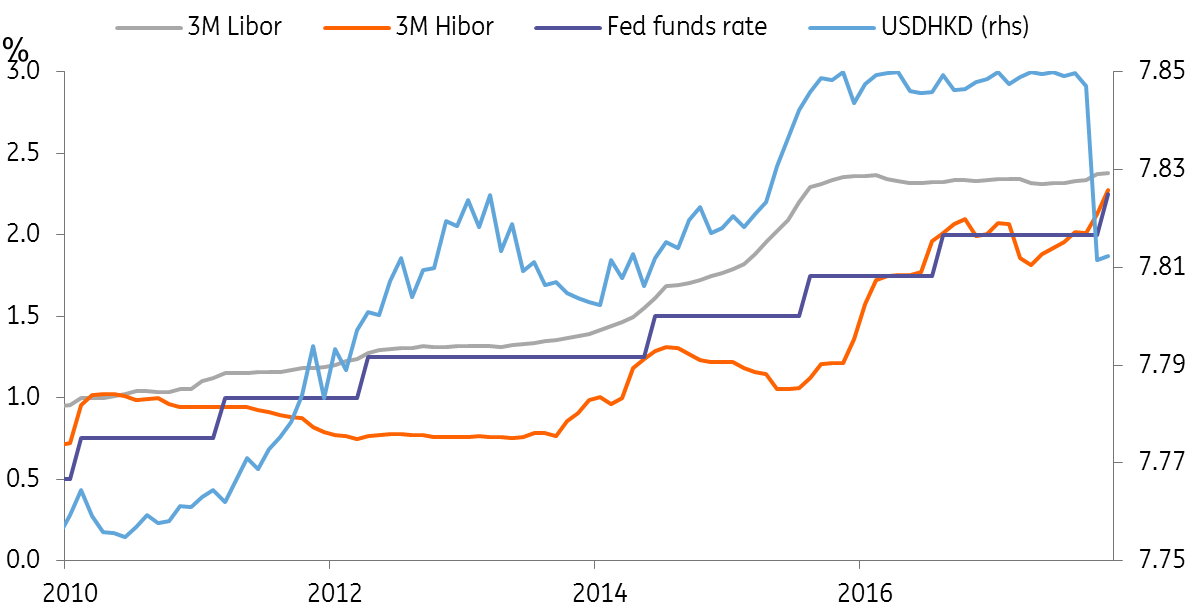

Hong Kong's interbank rates (HIBOR) rose after last night's Federal Reserve rate hike prompting some banks, including big banks, to increase the prime rate, which is a benchmark rate in their mortgage businesses. This move will increase mortgage repayments of existing borrowers at a time when the economy, which is highly correlated with Mainland China's economy, is starting to struggle.

HKMA, the banking regulator of Hong Kong, has a stress test framework in place to test repayment ability. The stress test is a three percentage point increase in the mortgage rate on the application.

With the Fed likely to raise rates further, the stress test will become increasingly taxing for mortgage applicants. If each incremental rise in the Hong Kong prime rate is 0.125 percentage point, we could see a full percentage point increase by the end of 2019. And if the HKMA's stress test remains in place, a mortgage applicant will face a 1+3 percentage points test, which would be very difficult.

The test protects banks and mortgagors by ensuring that customers are able to repay, but at the same time, it could deter new home buyers and therefore accelerate the fall in property prices in bad times.

Other asset classes are affected as well

Some borrowing in Hong Kong has been based on mortgage refinancing. If the refinanced cash is used to invest in other asset classes, whose interest rates may also depend on the prime rate, borrowers could be hit twice.

Asset markets could become increasingly stressed if borrowed money from the Hong Kong market is the main source of funds in the asset markets.

Still, we don't have to panic right now, as the Fed's tightening cycle has another year to go and the fall in asset prices would likely take time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

Iris Pang

Iris Pang is ING's Chief Economist, Greater China. She joined ING in 2017. Iris was previously employed by Natixis and OCBC Wing Hang Bank. She earned a PhD in economics from Hong Kong University of Science and Technology.

Iris Pang is no longer part of the ING THINK team