Holiday over in China

China's National Day-related holiday from 1 October to 7 October is now over - and the return to work will be greeted by the Caixin PMI indices. Some other Asian data today is already out, including Japan's labour cash earnings numbers - they were again poor, though consumption tax distortions may be supporting spending.

Whither Caixin?

The Caixin manufacturing PMI for September rose from 50.4 to 51.4, a surprisingly strong reading, but we note that this index seems to be quite sensitive to public stimulus measures, and these seem to provide an occasional burst of improved sentiment. Indeed, on a trend basis, the Caixin index has been on an erratic uptrend since its trough in January this year, when it dropped to 48.3. It now suggests that the more export focussed private sector firms that constitute the bulk of this survey are actually seeing activity increase. Even the export orders index, which remains in negative territory, seems to indicate that things are not falling as fast as they were.

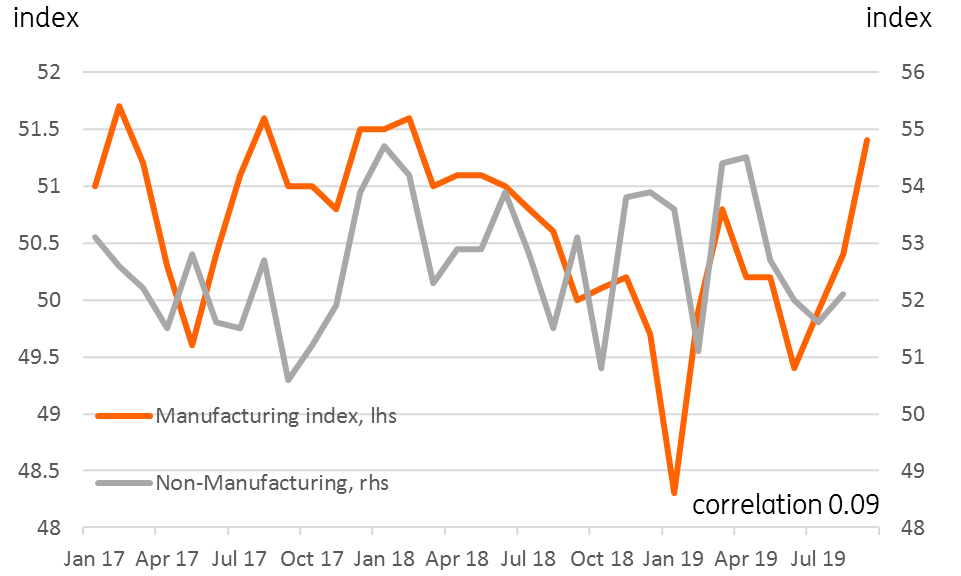

It is less clear that the Caixin services indicator, which is released today, will be similarly affected by such stimulus. Consensus sees the index virtually flat at 52.0 (52.1 in August). That seems a reasonable guess. Though this survey is far more erratic and almost anything seems possible. If I had to guess, I would say that this survey should converge on its manufacturing counterpart, though the correlation between the two seems virtually nonexistent (0.09 since the beginning of 2017). A modest uptick today would not seem totally outlandish. But the scope for two-way surprise is high.

Caixin PMI indices

Japan's cash earnings still very weak

Japan's labour cash earnings just released were in line with expectations, falling 0.2%YoY in August. In real terms, earnings fell 0.6%YoY, an improvement from -1.7% in July. But these figures are still dreadful, and with business investment and exports in Japan hampered by the ongoing tech slump and trade war uncertainty, if the outlook for consumer spending is not supported by earnings, then overall GDP growth has little underpinning.

Fortunately, the consumption tax hike is providing some impetus for continued spending, and household spending is bucking these earnings figures and growing by 1.0%YoY (August figure). That's unlikely to last.

Day ahead - not much

There isn't much else on the calendar for the day ahead. In truth, markets are really hanging on for news on the US-China trade front, though Liu He is not in Washington until Thursday, and the limited deal China is apparently looking for may not be what President Trump wants, though honestly, it is hard to say for sure.

Other than that, some Australian business conditions will be worth a quick look at 08:30 Singapore time, if only to see whether RBA Governor Lowe really is right that the Australian economy is at a gentle turning point. If so, then the market is probably pricing in too much easing from the RBA, who might be done for this easing cycle (a further cut of the cash rate to 0.5% is priced in).

In the G7, Germany releases industrial production numbers, which have been awful since April. The consensus is not looking for a big improvement, though there may be a small rebound from the -0.6% MoM July figure.

As ever, keep an eye on the small business NFIB survey from the US tonight. As a grassroots indicator for where the US is heading, there isn't much to beat this data, and with more warnings of global slowdown form the World Bank overnight, such insights can prove useful.

We don't expect anything sensible to say on Brexit until Friday. We should know then (what we already really know now) that the EU is going to reject PM Johnson's proposals. It only then remains for Johnson to abide by the Benn bill and ask the EU for an Article-50 extension, and then either call for an election, or have one foist on him by the opposition. Either way, we need to get through that hurdle to know which way we turn next in this never-ending saga.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion