Good news, for once

Trump and Juncker talks sound positive for averting a trans-Atlantic trade war, and China provides further stimulus…is this too good to be true?

Good things come in threes, what's next

The apparent goodwill between the EU and the US emerging from the Juncker-Trump talks was quite unexpected. At risk, trade in autos between the two economies, and probably an escalation of retaliatory tariffs from the EU. Nice words yesterday, but then we have been here before. Trade talks with China looked to be proceeding nicely, with Chinese markets opened and tariffs cut, only for the US to slap on tariffs anyway, I'll believe it when I see it, but markets are far more trusting than me, and will take comfort on all of this today and probably into the weekend.

There is also good news out of China, where a more relaxed PBoC on capital rules and more proactive fiscal policy should all help to offset the damage from US Tariffs. It all helps to support our forecasts for Chinese GDP growth, which we have trimmed far less than some other economies in the region, despite it being in the vanguard for the trade war.

Is 2Q18 Korean GDP the third spot of good news?

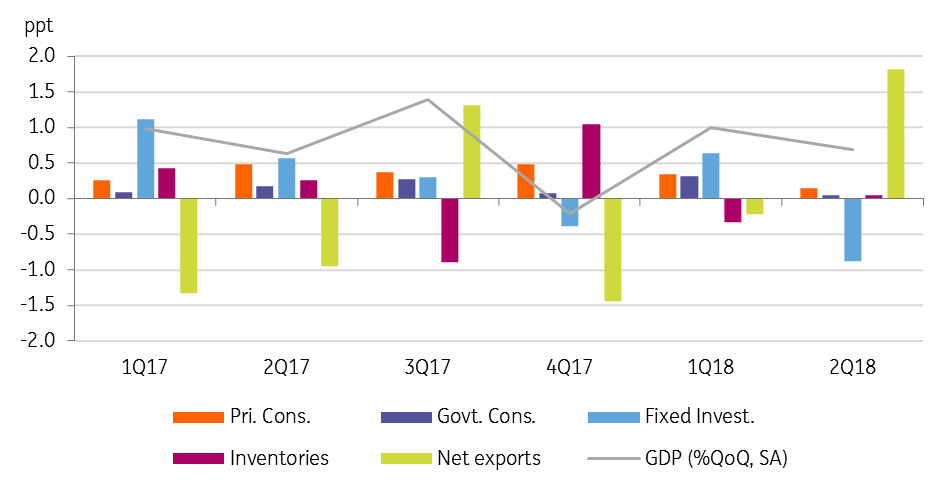

The answer to the question above (is Korean GDP the third bit of good news?) is a categoric "no". Though on the face of it, the 2Q18 GDP print was better than we had been expecting (0.7% vs ING f 0.5%). However, we find it a far less pleasing result than is being reported elsewhere. By components, it looks as if the most significant contribution to growth was a drop in imports in 2Q of 2.6%QoQ, a reversal from a 4.9% increase the previous quarter. The export growth rate of 0.8% is being reported as stemming from semiconductors, which is only partly true, as the biggest growth was in exports of services (3.4%), and goods exports rose only 0.5% (down from 4.5% in 1Q18).

Private consumer spending growth was only 0.3%, down from 0.7% the previous quarter, and government consumption was also much weaker as earlier stimulus waned, and all aspects of investment were actually negative.

The Bank of Korea full-year forecasts for 2018 were revised down to 2.9% from 3.0%, which suggests that they too are less than overjoyed with the way the economy is shaping up; We are revising down our Korea GDP figures too. Prior to this release, were toying with a 2.5% growth figure for 2018. We may need to push this up a little now, but will certainly end up below the BoK's 2.9%.

Korean GDP QoQ - not as good as it sounds

Singapore's June industrial production - peaking

Slap a moving average line through Singapore's industrial production growth, and it is very clearly peaking out, with today's consensus figure of about 3-4% YoY likely to see that moving average trend declining further to about a 5% YoY rate. Recent non-oil domestic export figures were weak, and that can be a helpful indicator for these production statistics.

But the key question is, can it fall further? And the answer to that lies in the details of the earlier part of this note: What is the outcome of the global trade war? How badly is China affected, and how much can they shift the pain elsewhere?

In 2015, Singapore's production fell by about 5%YoY on a trend basis throughout most of the year. But there are too many unanswered questions to make a confident prediction of what happens over the rest of this year and next. There is also little that domestic policy can do to swing the trend around.

Singapore production trends

ECB - in case you are still interested

The ECB seems to have managed to suck out most of the interest in European monetary policy with its drawn-out taper and creeping forward guidance. We know when the taper starts (September) we also have a good idea when the negative deposit rates will be removed (September next year). What is unclear, is how Mario Draghi will manage to inject any interest at all into today's press conference. He probably won't. "Dull", is a complement or central banks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

26 July 2018

Good MornING Asia - 26 July 2018 This bundle contains 1 Articles