FX Hot Topics: A ‘Mercantilist and Mercurial’ Dollar Policy

- It feels like everything we expected to happen to the US dollar over the course of 2018 – has in fact transpired over the first month. The 'mercantilist and mercurial' dollar policy of the Trump administration has added fuel to the dollar's structural weakness.

- As such, we have revised our end-2018 USD/JPY forecast from 110 to 100. Equally, further dollar weakness this year means that we have revised our end-2018 USD/CNY forecasts down to 6.10 from 6.30.

- We also provide our latest thoughts on EUR and GBP - where the story remains one of patience before chasing further upside. We still look for EUR/USD at 1.30 by year-end, while GBP/USD should appreciate to - and then stabilise around - 1.45 over the coming months as the UK economy regains its cyclical swagger.

ING Major FX Forecasts – February 2018

USD: Mercantilist and Mercurial Dollar Policy means more pain in 2018

- Mercantilist: Hard for White House to put the ‘weak dollar’ genie back in the bottle

It feels like everything we expected to happen to the US dollar over the course of 2018 – has in fact transpired over the first month. But it’s not been without any fuel – reports of China diversifying away from US Treasuries, US imposition of tariffs and more recently US Treasury Secretary Mnuchin’s ‘weak dollar comment’. While the administration’s objection to a strong dollar is not ‘new news’, we suspect it is the sheer frankness of Mnuchin’s comment and the idea that the Trump administration is happy to employ ‘America First’ mercantilist policies – even if it means at the cost of a weak dollar – that has caught markets by surprise.

It will now be very difficult for Washington to put the ‘weak dollar’ genie back in the bottle. The damage is already done. Uncertainty over US trade policy has merely fuelled the dollar's structural weakness – a function of factors such as a late US economic cycle, relative US asset valuations and the twin deficits – and the natural tendency will be for the greenback to fall over the course of 2018.

- Mercurial: Unpredictability of an 'America First' Trump a key pillar of our bearish $ view

A subtle pick-up in US political uncertainty can have big negative consequences for the dollar. One of the reasons we cited at the start of the year for our strategically bearish USD view is the markets’ relative under-appreciation of the fragile US political backdrop in a mid-term election year. Moreover, a potential shift in America’s status in the world political order may also have long-run economic consequences for a country reliant on ‘the kindness of strangers’ to fund its twin current account and fiscal deficits.

There are, however, two types of dollar decline to consider - orderly or disorderly - depending on the size and extent of US trade policy risks.

- If it’s ‘all talk, but no serious action’ from President Trump on US trade policy, then we may just see a small protectionist and policy uncertainty premium priced into the US dollar over the coming year. With the rest of the world growing, the dynamics of global investors slowly rotating out of US assets and US investors themselves putting more money to work overseas will also gently weigh on the dollar.

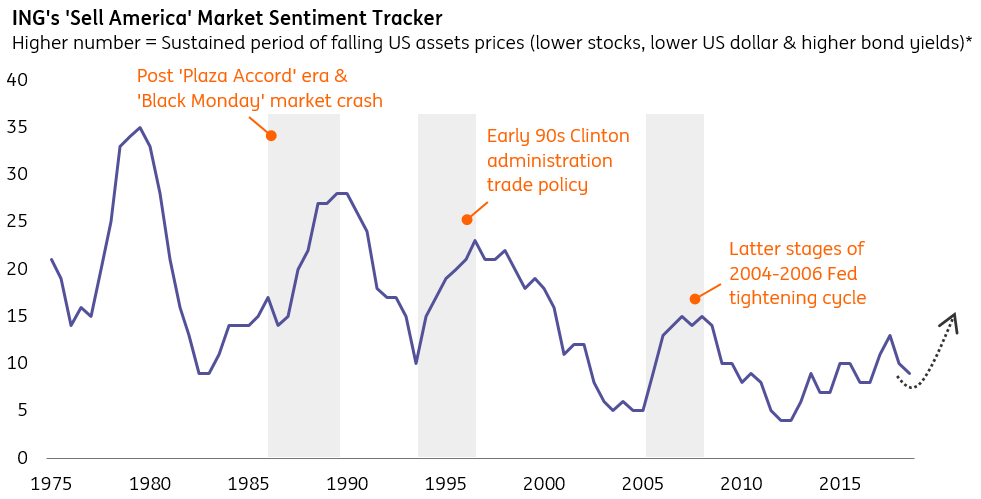

- But should mercantilist 'America First' policies quickly lead to a 'Sell America' sentiment in global markets, then the dollar’s decline could transpire quicker than we currently project. A ‘Sell America’ theme – drawing parallels to what we saw in the early 1990s when the Clinton administration tinkered with US trade policy – could see dollar weakness overshoot in the near-term. In this extreme scenario, EUR/USD could move beyond 1.30 this year (and potentially towards 1.35), while USD/JPY could fall below 100. This is not our base case, but certainly a risk worth flagging.

- Predictable Fed a bore for the US dollar; US economic outlook for 2019 matters more…

Beyond the structural and political factors, the short-run dynamics for the USD are now a function of the US economic story in 2019 and beyond. For the US dollar to meaningfully re-couple with interest rate differentials, what we need to see is investors positively reassessing their outlook for the duration and extent of the US economic cycle. For now, this seems unlikely – with US tax reforms in our view more a shot of adrenaline to a late-cycle US economy – rather than causing a structural shift in the supply potential of the economy. Only incoming US data over the next 3-6 months can prove us wrong.

Trump's Dollar Policy is a 90s Throwback

GBP: Relight my fire? Patience before markets Take That positive UK macro bet

GBP has moved above our long-held conviction call of 1.40 against the USD for this quarter – but even we're slightly surprised by the speed at which we have got there. Sure, most of it has to do with extensive dollar weakness – which has evolved pretty much in line with our thinking. But one can also detect a subtle shift in the directional sentiment for GBP – not least as the doomsday Brexit tail risks gradually fade (for good reasons, they will never fully disappear).

We’re now looking for GBP/USD to move up to 1.45 as the UK economy regains some of its cyclical swagger – but we do think that patience is required before markets take that bet. We cite two non-mutually exclusive catalysts for this to happen: (1) positive UK data surprises and (2) reduced UK economic uncertainty in the form of an agreed Brexit transition deal.

- Governor Carney offers GBP bulls a glimmer of hope. Expect a ‘goldilocks job’ at the Feb BoE meeting

Governor Carney did not divulge much at his testimony to the House of Lords, though there were a few glimmers of hope for GBP bulls ahead of next week’s Super Thursday BoE meeting (Feb 8). The Governor noted that the IMF’s latest forecast of 1.5% growth for the UK economy was ‘light’, potentially signalling upside risks to the central bank’s own GDP profile – - not least given the constructive 4Q release last week. Moreover, if you’re reading between the lines, there was some hint that the low growth and above-target inflation trade-off is shifting in a way that allows the BoE to press ahead with another hike at some point in the first half of the year.

We expect a ‘goldilocks job’ from the BoE at next week’s meeting – sounding not too hawkish and not too dovish, but getting the balance just right to keep markets where they are. Officials will remain content on letting the data do the policy talking. With the next 4-6 weeks fairly crucial in regards to Brexit transition talks and UK politicians providing much-needed clarity to domestic businesses, one could foresee a fairly neutral and non-committal tone for now.

- GBP has learned to live with domestic politics... and markets are still structurally short the pound

Noise around a fragile Tory government may act as a limiting factor for the currency – but note the bar to actively sell the pound on UK politics is high. This is evident in GBP positioning data with speculative investors having turned net long in recent months (shorts bailing).

Equally, broader markets remain structurally short GBP – and the currency’s resilience around key technical levels is one indication of this. However, to get any meaningful shift to more neutral GBP positioning levels, investors will need to see a fundamental UK economic story emerge.

EUR: ECB’s path of least resistance will be a gradual EUR/USD rally to 1.30

We’ve been calling for EUR/USD at 1.30 by end-2018 for some time now – and we’re not in any rush to upgrade this forecast yet. For us, right now it’s a question of how – not if – we get there. Part of our thinking is that the ECB’s path of least resistance will be a gradual EUR rally.

- ECB’s tolerance for a stronger EUR may be higher than previously anticipated

We estimated that the central bank’s ‘pain threshold’ – that is the point at which currency appreciation starts to weigh on the real economy – is a sharp move above 1.25 in 1Q18.

EUR/USD at 1.25, however, is the lower bound of the ECB’s ‘macro pain threshold’– and might only be a necessary but not sufficient condition for increased ECB caution. We point to three reasons for why the ECB’s tolerance level for a stronger EUR may be higher than envisaged:

- The latest quarterly business survey released this week shows that EZ firms have not seen any marked change in their competitive position since October despite expectations for – and more lately materialisation of – an appreciation in EUR/USD. So long as the global growth and inflation story holds, we think the pass-through effects of a stronger currency on the EZ economy may remain more passive than usual.

- It is the trade-weighted EUR that matters more for macro analysis – and given that this has been relatively contained over the past few quarters it’s hard for the ECB to credibly cite the currency as an outright negative for the domestic economy at this stage.

- Macro implications are more linked to overall Eurozone financial conditions. Any negative effects from a strong EUR would be exacerbated if we also saw an overall tightening of financial conditions (ie, higher bond yields and lower equity prices). EUR/USD’s more recent rally to 1.25 has not been associated with these dynamics.

- Still a positive ECB re-pricing story coming through… but it’s an early summer story

President Draghi may have stolen the show in Brussels last week by openly criticising the US administration for breaching the IMFC agreement on exchange rate policy, but the ECB chief’s acknowledgement that a key pillar of the EUR’s rally has been the relative strength of the EZ economy suggests that the currency’s sensitivity to data outturns may pick-up.

Markets still remain relatively underprepared for the ECB’s next policy normalisation steps. Our expectation for German bund yields to break out and move higher over the summer – as markets position for the end of ECB QE and the start of a 2019 hiking cycle – will set EUR/USD on a path to 1.30 by year-end. The bigger effect may be seen on EUR crosses – in particular, we still like EUR/CHF moving up to 1.20 in the summer and see the recent scale-back as temporary.

| 100 |

ING forecast updateUSD/JPY end-2018 forecast lowered from 110 to 100 on US trade policy risks |

JPY: Lowering our $/JPY target from 110 to 100 on US trade policy risks this year

We have revised our target for USD/JPY by year-end down from 110 to 100 for 2 reasons:

- A US dollar protectionist and policy uncertainty premium

- JPY no longer being a sell on the Japanese macro story

Back in the early 1990s, USD/JPY traded more than 30% below ING’s fair value estimate based on medium-term fundamentals. That fair value calculation now stands at 105 – suggesting our revised year-end target of 100 is not excessive (and only a reflection modest US trade risks)

Raising the yield curve target – and allowing for the JGB yield curve to steepen a bit more – is not an unrealistic scenario in 2H18. It would require the domestic Japanese economy to remain resilient, but also (a) other major central banks to normalise policy and (b) the global risk environment to stay positive. The latter two factors would help to avoid a sharp appreciation in the yen - especially on a trade-weighted basis - which is something the BoJ would be wary of engineering themselves.

But equally there has been a positive Japanese economic story unfolding over the past year - and the lack of observed JPY weakness may in part be down to this. Certainly, in the context of positive GDP surprises and stubbornly low inflation, Japan is looking like less of an economic outlier these days.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinionAuthors

Viraj Patel

Viraj is an FX strategist at ING. He has been with the firm since January 2015 and covers developed markets. Prior to this, he worked at Barclays and the Bank of England. Viraj read Economics at the University of Cambridge and is currently working towards his CFA charter.

Viraj Patel is no longer part of the ING THINK team

Chris Turner

Chris is Global Head of Markets and Regional Head of Research for UK & CEE. Together with his team, he provides short and medium-term FX recommendations for ING's corporate and institutional client base. Prior to joining ING in 2005, he was a senior partner and head of FX research at IDEAglobal, a research consultancy specialising in independent financial market research for the investment banking, hedge fund and central bank community. He holds a BSc in Economics and Accounting from Bristol University.

Chris Turner