Market mumbo jumbo

Any hint of looser monetary policy and bond yields rise? Is this what we've come to?

If this is the new normal, give me the old one back

Attempting to make market sense of the economic newsflow has been a 28-year struggle, though it is usually achievable, at least after the fact. But this morning's attempt to try to explain a 6.7bp increase in 10Y US Treasury bonds has taken me to a place I didn't think I'd ever go. In recent months, it has been possible to explain the decline in US Treasury yields as a reversal of tighter policy trades, which you can see in terms of the decline in USD OIS implied yields. Basically, if you take a very rough and ready approach to forecasting bond yields, you can make a case that the 10Y should bear some relation to peak Fed funds in a business cycle, adjusted for time preference and so on. That sort of works...It's a variant of the envelope theory of interest rates if that rings any bells with any of you?

Today, while the newsflow from the US, on the whole, looks fairly supportive for the bond market - a failed Senate infrastructure vote and rising Covid cases, what seems to be driving the outsize move up in Treasury yields is a rumour that Fed Chair Powell has the nod for a second term as Fed chairman. This, the reasoning goes, means that the Fed will be more likely to maintain its dovish stance, and keeps hawks like Bullard and Kaplan in check. A prolonged dovish policy will help to keep growth hopes alive, and allows for higher bond yields through both a higher real yield and higher inflation expectations.

If this doesn't sit comfortably with you, here's why you might be struggling to digest this. And it is probably because it implies that any deviation from current zero interest rates will quickly start to undermine the growth story. If so, then the US economy is in a far more delicate state than it would appear. With growth tipped to achieve about 7% this year and close to 5% next, this is a hard story to swallow. And that's without even thinking about inflation.

It also suggests that the current stance of policy is actually providing some genuine support to the economy, other than through lifting financial asset valuations. And though this was probably the case at some point, I'm just not sure that the monetary stance is all that relevant for the growth outlook now. Personally, I would find a shifting fiscal stance a far more reasonable cause for a change of market outlook. Show's what I know...!

Watch the EURUSD today

Today's other main source of market interest is the ECB meeting. With the ECB strategy review already out of the way, the time has come to see how strategic change will affect policy, if at all.

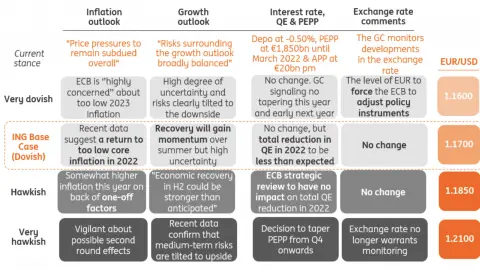

The linked crib sheet from Carsten Brzeski and Petr Krpata shows the likely scenarios for the alternatives we think are most likely, and their take is that it is a question of how (little) asset purchases will be reduced in net terms once the Pandemic Emergency Purchase Programme (PEPP) ends next year. In other words, it should move EURUSD down. I'll just throw in the newswire take on this to play devil's advocate, as they are asserting that the EUR is oversold right now, and are weighting their bias to a EUR rally. I think our guys would see that result as a failure of communication on the ECB's part if that happened. Anyway, read their piece and make your own mind up.

Asia still dominated by Covid

As well as the ebb and flow of global financial markets, closer to home, Asian markets still seem to be being dominated by Covid, with what I am terming the Covid-3 of MYR, THB and IDR all at the softer-end of the FX spectrum yesterday. At the other end of the pack, the CNH made further gains.

For newsflow today, we have further announcements of tightening of movement restrictions in Java and Bali, which seems to fly in the face of yesterday's suggestion from President Jokowi that measures may be eased by July 26. As we stated yesterday, we are still alarmed by the combination of high (though falling) daily cases and a high and rising death tally. It doesn't feel to me that this is the time to be easing up on movement constraints in those countries where death rates are still accelerating.

Bank Indonesia meets today, Nicky Mapa in Manila writes, "Governor Warjiyo is widely expected to keep rates steady today to provide support for the economy. With the country hard hit by a surge in Covid-19 infections, monetary authorities will likely provide support for as long as possible although additional rate cuts are likely off the table given the recent pressure on IDR. With options limited for Governor Warjiyo, we expect the central bank to resort to other programs to help jumpstart bank lending such as incentives for loans to particular sectors of the economy".

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

22 July 2021

It’s ECB day: What you need to know This bundle contains 5 Articles