Dollar strength dominates

Dollar strength is evident across FX space, with notable gains against the KRW and AUD. Strong US data combines with weakness in Asia exports to amplify the effect.

Tech weakness still weighing on Asia

My journey into work each day involves sitting on public transport reading the daily summary of economic and market views from one of the big providers. I'll leave you to guess which. We don't get paid for advertising.

Today, I counted three specific company references to weak semiconductor/tech earnings expectations or demand, which tells you that the global tech slump is still a force to be reckoned with. For sure, there may be some activity going on in China related to the 5G rollout. Our Iris Pang referred to this in a recent industrial production note. But foreign firms exposed to China are not seeing any strength in tech demand, which either means it is all being sourced locally (doubtful, though in time that may become more likely as China pushes forwards its self-sufficiency in tech) or the big boost in China 5G activity is more infrastructure-related - laying of cables, transmitting stations etc. It doesn't mean we are on the verge of a technological breakthrough that will see Asian economies fly again. Though that day will come eventually.

Engineers I have spoken to recently in Singapore tell me that there are still fundamental problems with making 5G work, and suggest 2022 is a more likely blast off date to have at the back of your mind. So it's great that Chinese data is looking strong again, but what is good for China, isn't necessarily going to have a very big impact on the rest of the region whilst this tech weakness prevails. Singapore's industrial production data for March due out later this morning will, I think, back up this gloomy prognosis.

Local factors overlay on USD strength

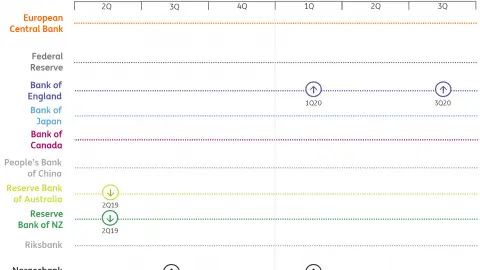

The USD is strong, but let's not get too bogged down with the USD, some Asia/Pac currencies are actually "weak", in their own right, and for good reason. The AUD took a bath this week on low inflation. We can argue about the timing of the RBA response - there is the small matter of the election on May 18 to deal with, which may postpone any easing until June (May 21 minutes could provide a big clue) - but the ultimate direction of travel now seems clear.

And despite their protestations, the Bank of Korea (BoK) must surely also soon have to throw in the towel and concede that all the official BoK and government forecasts for growth this year are grossly optimistic, and require some additional assistance to supplement the insufficient budget stimulus penciled in so far. We have one cut forecast for this quarter. But to be honest, that may not be enough.

Japan at a crossroads

Yesterday saw the Governor of the BoJ admit his frustration with the BoJ's inability to meet its 2% inflation goal. This came with an increasingly fierce pushback on what he was terming "Modern Monetary Theory" or MMT, which is shorthand for saying that ultra-low interest rates don't work. Personally, although I hate the MMT monicker, I think there is a more than a grain of truth in some of this critique of ultra-low rates, which I have written about repeatedly in this note. Kuroda's gift to the markets this time was to change the wording on the BoJ statement, which replaced "extended period" for describing how long low rates would be in place, to "around Spring 2020".

To paraphrase his explanation, he suggested that the market was misinterpreting "extended period" and was anticipating rate hikes much sooner than was probable. Governor Kuroda almost certainly doesn't read this note, but if he did, I would have to respectfully suggest that this assessment is completely without substance. Not only does the market not believe that the BoJ will meet their inflation target over the BoJ's forecasting horizon, but many of us also don't believe they will meet it, ever (notwithstanding some slightly better Tokyo CPI figures today). A tweak to forward guidance as delivered yesterday is as meaningless as it is irrelevant, and markets shrugged it off as they should have done.

I am more interested in a Japan story running today that backs up our current forecast that the Consumption Tax hike, planned for October, will be delayed again this year. Isabel Reynolds on Bloomberg (OK, I've told you now), runs through four factors to watch out for, which will indicate whether or not we are right to have ditched this tax hike from our forecasts. These include a turn in public opinion, evidenced from the July Upper House elections, a further decline in the June Tankan, the summoning of renowned economists (I won't be on that list, sadly), and a worsening in the global outlook. This seems like a good list to me.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

26 April 2019

In case you missed it: Secular stagnation? This bundle contains 8 Articles