Covid-19 goes global

Markets likely to show extreme caution in the face of global spread of the Coronavirus - this is no longer solely an Asia issue

Italy joins South Korea at the top of non-China infections

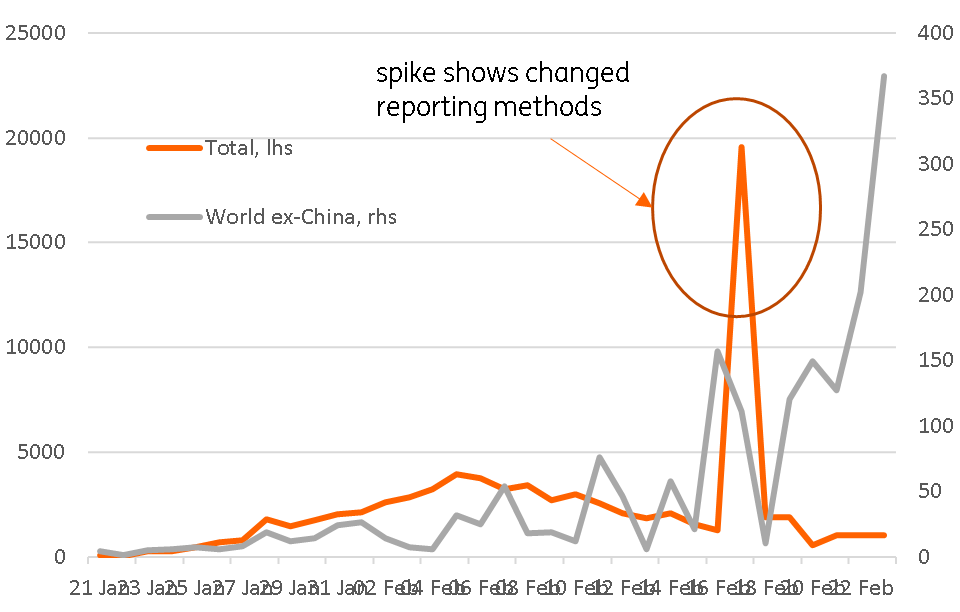

We use 2 different sources for following the spread of Covid-19 - the first, the Worldometer website is helpful in giving the latest updates and most up-to-date tally of total infections and infections by country.

But as a rolling total, it is difficult to use the Worldometer data to highlight new cases unless you look at it at exactly the same time each day, so for that, we use the World Health Organization situation reports.

Either way, the glaring message coming from the data is that Covid-19 is going global. China has a total of 6942 cases, but S Korea on 602 is really beginning to pick up pace, and alarmingly, this is also gathering pace in Italy, with 157 cases, and Iran on 43.

Reassuringly, Italy is implementing similar lockdown processes to those used with some positive effect in China, mobilizing the army to prevent movement in or out of the affected towns and stopping sporting and cultural events. The next few days will hopefully show whether Italian actions were quick enough to nip this in the bud, or whether this virus has now gained a toe-hold in Europe. Already, this is beginning to have impacts on intra-EU travel, with a train stoped at the Italian / Austrian border due to suspected infected passengers.

New cases China and Ex-China

Markets reverting to risk-off, but this move can go further

The equity market seems to be slowly waking up to the fact that something is wrong, though last Friday's move in the S&P500 looks small relative to the scale of the potential shock that is coming. But maybe Italy seems closer to home for US investors than China or South Korea, so that might help change the mood in the market.

The G-20 meeting at the weekend gave rise to various woolly comments that central bankers "stand ready to blah-blah blah etc". Sure, I think we can all now imagine that rate cuts that looked like a downside risk in the event of something going wrong are now beginning to look more like base cases. The Bank of Korea meeting later this week is a good case in point. We didn't think there would be any more easing from them this cycle. Now, well, why not? And it is quicker to mobilize a rate cut than to come up with fiscal support. But even the most optimistic equity investor might be hard pressed to accept that rate cuts will do much to improve the economic situation caused by the spread of this virus. In other words, if we are approaching the point where the optimists throw in the towel, then we can expect to see further sizeable down moves in US Treasury yields, and further local currency weakness in the Asia Pacific region.

A working hypothesis, which admittedly requires some more testing, is that Asia-Pacific currencies where there is greater room for a policy respose will fare better than others. Though the reality is that room for action is narrowing in all economies in the region.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

23 February 2020

Good MornING Asia - 24 February 2020 This bundle contains 3 Articles