Australia - inflation risks not so different

Meaningful changes to the Reserve Bank's guidance and policy framework yesterday bring it more into line with market expectations and what we expect in other countries

Governor Lowe's policy statement

Just back from vacation and on opening my screens, things look notably different compared to how they looked before I went away a little more than two weeks ago.

Perhaps the biggest change in the APAC region is in Australia. Yesterday, the Reserve Bank axed its 10bp yield curve control target on the April 2024 government bond. Markets had already bust that bond yield way above its target and it is clear that it was no longer serving any useful purpose. Indeed, Governor Lowe referred to the target as "...losing credibility...", which in our view is certainly true. So kudos to him for biting the bullet and getting rid of it.

But like any bold forecast which turns out to look challenged as time goes on (we've all been there), the RBA seems reluctant to entirely abandon the previous 2024 guidance for the first rate-hike, even as Governor Lowe repeatedly pointed out that in all likelihood, 2023 was looking a more probable date (click here for the statement - it's short and very readable and you can make your own mind up about the nuance in the text).

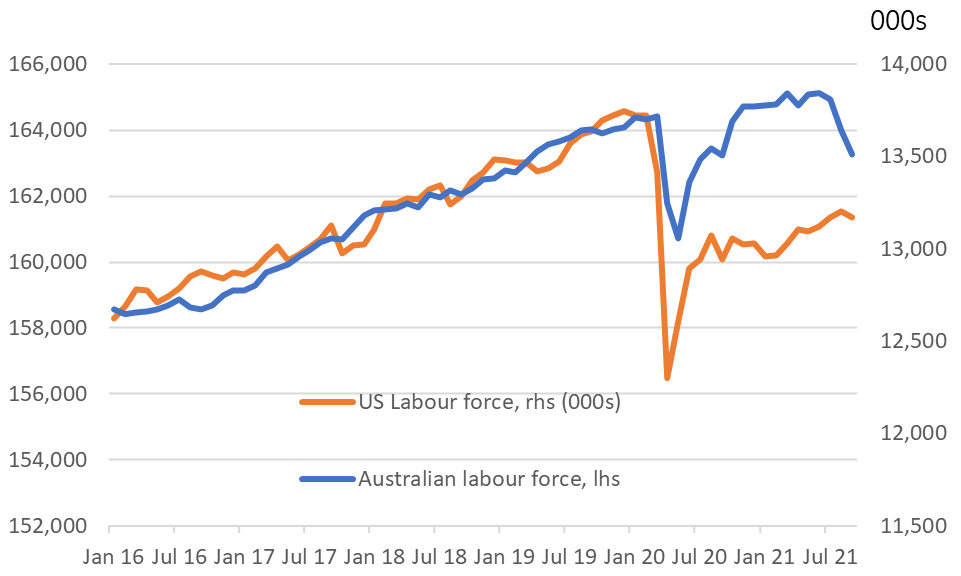

Much of Governor Lowe's argument for maintaining the 2024 date as still being "plausible" even if the balance of risks for the liftoff date have now changed, rests on differences between the Australian labour market with other economies that have seen larger falls in labour force participation and therefore, higher wage and price pressures.

In the chart below, we show how this looks in practice, plotting seasonally adjusted Australian labour force numbers against their US equivalent. And yes, it is true that the Australian labour force has fallen by far less than it has done in the US. But importantly, US labour participation is now on the rise, whilst in Australia, it is still declining. So against such a moving target, it is probably right at least that the guidance now points to a much broader range of possible outcomes than was previously being suggested. But I would also suggest that it is right that the central expectation for that liftoff date also shifts closer too, and I would expect the RBA to formalise that in time.

That being said, markets were already largely pre-empting the latest change in RBA guidance. The April 2024 bond yield pushed above 0.7% at the end of last week. It has actually fallen back now despite the RBA's guidance shift. So too has the longer end of the Australian yield curve.

As I've written before on central bank forward guidance, to be effective it needs to be credible and to be credible, it needs to be consistent with the macro fundamentals. The prior guidance was neither consistent nor credible. But it is now both. Still, this remains a moving target. And what looks consistent today may not do so in three months time.

I am, however, encouraged that markets are demonstrating that they have a mind of their own. Instead of waiting zombie-like to be told what to do, they are watching the data and moving ahead of guidance changes. It should be like this. But in recent years, with markets so heavily driven by policy efforts, it often hasn't been. Perhaps things really are returning to normal as emergency policy measures are ditched.

Anyway, as far as markets go, with the US Federal Reserve due to meet tonight, the shape of markets in our region may be driven more by what happens to Treasury and dollar markets overnight than what happens locally. So APAC markets are likely to be quite rangey today ahead of a likely taper announcement from the Fed tonight. See here for my US and FX colleagues note on this event.

Australian and US labour forces (seasonally adjusted)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion