A more prescriptive Fed?

Using rules to set Fed policy would create more problems than it would solve

Trump victory makes a rules-based approach more likely

The election of President Trump and the fact that Fed Chair Janet Yellen’s term ends early 2018 has increased talk of a regime change at the Federal Reserve. Some Republican lawmakers are keen on reining in the powers of the central bank and adopting a rules based system for setting monetary policy is one way of doing this. While this would arguably increase transparency there is the issue of what data to use and the flexibility it would allow to respond to fast moving events.

With Trump’s popularity looking shaky, it would seem highly unlikely he would opt for this approach

In any case the credibility it gives a central bank is not required when inflation and inflation expectations are already so low. Then there is the question of whether President Trump would actually go for it.

Having said the Fed was keeping interest rates too low during his election campaign, his failure to get fiscal stimulus and tax reform through is hurting his chances of achieving promised 3%+ growth.

It may make more sense for him to re-appoint “dovish” Janet Yellen, much like Obama and Clinton re-appointed incumbents, rather than have a model hiking rates aggressively ahead of mid-term elections.

Taylor rule says rates should be much higher

The main argument in favour of adopting a rules based approach to setting monetary policy is it increases transparency. If people know how the Fed is likely to behave then businesses and households will be better able to plan for the future. The best known of these is the Taylor Rule, named after Professor John Taylor from Stanford University. Given the Federal Reserve has a dual mandate of stable prices and maximum sustainable employment he created a formula for setting interest rates that minimises the deviation from these goals.

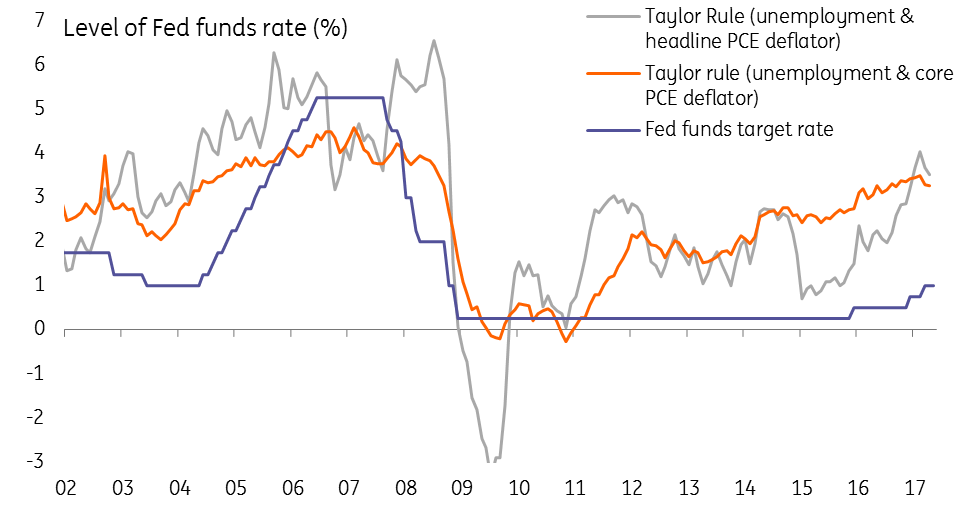

This suggests the Fed funds rate should be 2-3 percentage points higher than the Fed currently has it.

The Taylor Rule

More problems than solutions

The chief problem with adopting such a prescriptive approach as the Taylor Rule is the quality of the data that can be put into the model. The output gap (the difference between actual and potential output) is not directly measurable. Therefore proxies such as the difference between GDP growth and what trend growth is assumed to be or the gap between the unemployment rate and the assumption for “full employment” are used.

Then there are questions over what the real Fed funds rate is in the current environment before we even consider the degree to which inflation is overstated. Because the index doesn’t properly account for quality improvements of new goods and services coming onto the market some academics suggest inflation is overstated by a full percentage point. This leads us to question if you can’t trust what you are putting into a model, why do you trust what comes out?

Taylor rule currently points to higher rates

As can be seen in the chart above, the Taylor Rule models (depending on which inflation measure, output measure and weighting scale you use) can give very varying outcomes, but all suggest interest rates would be higher if the Fed adopted this approach formally.

In any case, the Fed already looks at such rule based outcomes, but according to Fed voter Neel Kashkari, “ultimately we use judgment and historical precedence to decide if that guidance makes sense given other important economic trends that rules don’t consider.”

The formal adoption of a Taylor rule looks unlikely

President Trump may well be grateful for this in the end. He has struggled to make headway on his fiscal stimulus and tax plans and the economy looks increasingly unlikely to receive any benefit from it until well into next year. If the Fed funds rate was at 3% as currently prescribed by the Taylor Rule then the outlook for GDP growth would be weaker, the jobs market softer and the dollar significantly stronger given ongoing loose monetary policy elsewhere.

With the mid-term elections little more than 16 months away and Trump’s popularity already looking shaky, it would seem highly unlikely he would opt for this approach. Instead, the momentum seems to be shifting towards Yellen being asked to serve a second term. Given Trump’s admission in April that “I do like the low-interest rate policy”, and that Yellen is “not toast”, the chances of a formal adoption of the Taylor Rule look slim.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

James Knightley

James Knightley is the Chief International Economist in New York. He joined the firm in 1998 in London and has been covering G7 and Western European economies. He studied economics at Durham University, UK.

James Knightley