Zinc: One last squeeze higher?

The best way to describe the attendees at last week’s Metal Bulletin international lead and zinc conference would be 'split and cautious'. We think zinc prices are nearing a peak, but low stocks make a last short and sharp squeeze higher a definite possibility

Key Takeaways

At a two day gathering in London, smelters, traders and miners continued to negotiate the annual benchmarks for zinc concentrate charges. The divergent views that have prolonged these negotiations were mirrored in our conversations amid the uncertainty whether prices can go any higher from here.

1) Higher zinc prices are encouraging a brownfield led mine response which will reduce concentrate tightness from the second half. ING identifies +400kt of new projects and restarts ex-China this year.

2) China’s fragmented zinc mine supply was hampered by environmental and safety inspections last year, but complete closures were minor. Re-organisation and consolidation of the sector will support stronger production in 2018.

3) Demand destruction is occurring in the die-casting sector (c.17% of zinc demand) in China above others. Galavanizer’s are looking to use less zinc, but attrition here is slower.

4) Nonetheless, refined markets will remain in deficit this year. MB research projects a 290kt shortage following 493kt last year.

5) Both off-warrant and on warrant zinc stocks were drawn down substantially, meeting local needs (e.g. offsetting Valleyfield strikes in the US) or shipped to China. Shipments were incentivised by open arbs that have since closed as domestic stocks swell. Below we question whether this artificially escalated last year’s LME tightness.

6) Funds betting short and traders holding inventories have been majorly squeezed by backwardations on the LME. The material was not only drawn down but made less available to the market amid longer-term financing deals. Deep funds and a trend to longer hedges allow large holders to withstand the sharp rolls but LME deliveries earlier in the month are evident of the submission to the squeeze.

7) Despite large refined deficits, physical zinc premiums (ex-China) have been flat, and consumers do not have issues sourcing metal. This is best explained by well-buffered supply chains and traders using off-warrant stockpiles to fulfil physical contracts. We heard that US galvanizers were frequently offered older slabs from storage in place of the preferred Jumbo. Others also point to limitations of spot assessments amid mostly contract business although those longer-term premiums have also been mild.

8) In China, premiums have actually been falling, and stocks have surged. A longer national party congress (NPC) and extended pollution restrictions is blamed for a slower recovery post new year. Galvanizing output and with it zinc demand is expected to rebound shortly.

9) Excepting a trade war, most see stable demand for this year, but galvanizers are facing pressure from tighter margins. In the US galvanizers are running “flat-out” so steel tariff's will pass through to galvanized sheet prices

10) As mine supply eases a lack of new smelting capacity will become the new bottleneck. Balances could be tighter than expected since many models are counting on smelter utilisation to approach historically unseen levels.

For upside coverage, its only options from here

Consumers are feeling the pressure from high prices. Galvanizers, in particular, are seeing strained margins and many cannot risk the possibility of another leg higher.

While respecting this concern and the high likelihood of another sharp squeeze higher as stocks draw down, history tells us that the probability of prices staying so high is low. In real terms, zinc prices are currently one standard deviation above the long-term average, a level it rarely surpasses for long.

Consumers concerned to further hedge upside would do well to consider this statistical improbability and look to options over futures to minimise the impact of paying margins on the more likely downtrend. This statistical likelihood is also reflected by widening discounts for calls vs puts.

Real zinc prices unlikely to stay so high($/mt)

The backwardation is everything

Zinc owes much of its stellar performance in the second-half to deep backwardations on the LME, and arguably prices ran ahead of themselves through the squeeze. Backwardated markets make it costly for shorts to roll positions and indeed LME open interest went down for much of the rally revealing short covering rather than fresh allocations drove prices.

Zinc prices came off the bottom in June last year as tighter far dated spreads squeezed the real money positions sitting beyond the 3-month date until November when the tightness transitioned to the front of the curve and the domain of the physical industry including stock financers. Much unwound stock sold for the highest premiums above warehouse incentives (e.g. China) or was used to fulfil existing physical obligations (e.g. during strikes at Valleyfield operations).

Deep pockets and a trend to longer rolls saw traders hold positions through the tightness until a combined 108kt of zinc was re-warranted and delivered in early March. Fitting with our theory that the backwardation is everything for zinc, as spreads softened prices also retreated. As live stocks since decreased however zinc spreads look to be tightening once more.

Zinc rally following spreads

Some stock is less available than others

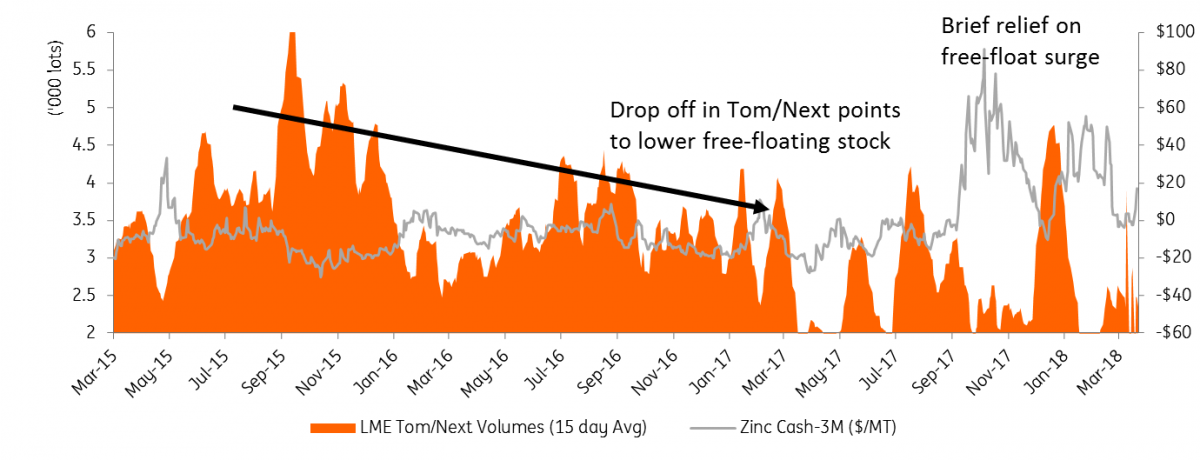

With LME stocks so low, it is the availability of stock that is crucial: free-floating vs tied up in financing. The cancelled stock is generally en route or tied up for longer periods, the same for off-warrant. After brief relief in December-January, zinc tom/next (one day roll) volumes on the LME are now back to perilously low levels. This short dated activity correlates to those free-floating stock levels being financed on just a one-day basis so that each day the stock holder is a readily available lender of spreads given a physical position that can close out any nearby short. Dangerously low free-floating stock levels make another sharp backwardation extremely likely.

We also note the relationship between large parties holding big concentrations of stock levels, and flaring backwardations. LME lending rules do enact criteria for dominant positions to lend the front one-day spreads which have been kept subdued, but evidently, the dominant holdings correlate with tightness further out. The size of these on warrant positions (currently a holder has 50-79% of LME stock) also tells about the concentrations of holdings in the off-warrant world where regulation does not impose on traders to make either spreads or physical flows available to the market.

Drop off in Zinc Tom/Next shows less free floating stocks

Exaggerated tightness on Chinese imports

While deficits are undeniable, we think the LME tightness overran physical conditions last year, because of a shift to less available stocks off-warrant and actually into China. This reiterates our position prices are nearing a peak failing one last LME squeeze higher.

Before stocks, apparent zinc consumption in China was up 3.8% last year driven while galvanized sheet production the main consumer fell 3%. Indeed CHR Metals estimates China was oversupplied by 300kt after accounting for imports which were up 60% last year. Tellingly Spanish imports accounted for 30% of imports last year the dominant portion of zinc stockpiles and 60kt above registered Spanish exports. Now, this over-zealous importing is reflected in surging domestic stocks (up 50% since December according to SMM) and premiums have been sliding for time.

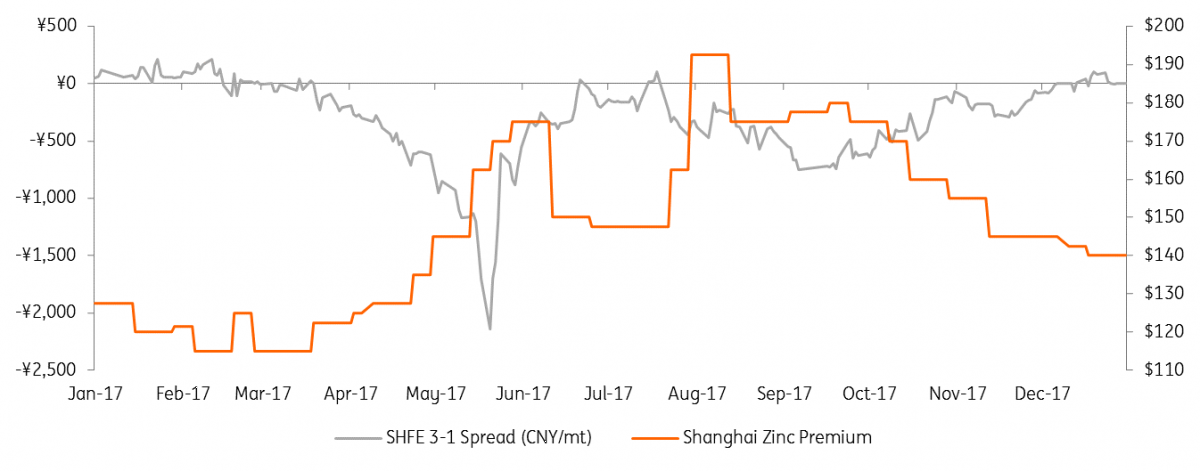

If not to feed consumption arbitrage motivated the surge in zinc imports through last year. We spoke to Chinese traders who told us that simply arbitraging the deeper backwardation on SHFE vs LME prompted masses to roll long SHFE, short LME positions in turn supporting a wider arb. We also noted a major technical backwardation in the middle of last year that inflated physical premiums above the fundamentals. Diverting metal away from its ability to ease tightness on the western exchange has played a key role in rallying prices, a final squeeze could be severe, but the fundamentals suggest briefly.

Technical SHFE squeeze artifically inflated premiums last year

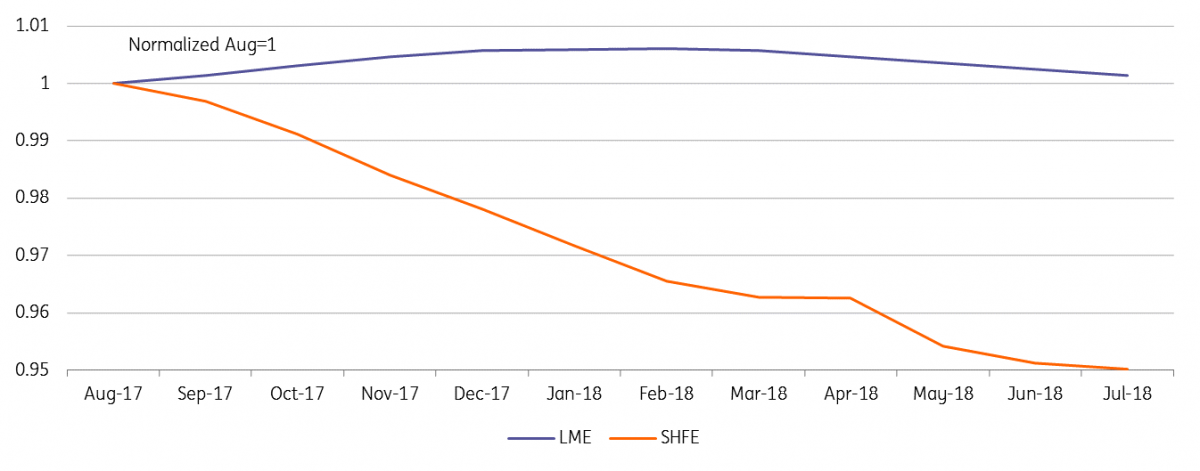

Roll profits across zinc forward curves perpertually widened the SHFE-LME arb

With a deeper backwardation on SHFE, traders made profits by rolling a long position on Shanghai vs a short position on LME. In turn, the flood of long SHFE positions and shorting on the LME widened the arbitrage.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ZincDownload

Download article