Zinc curve is tight: The short term bear trap

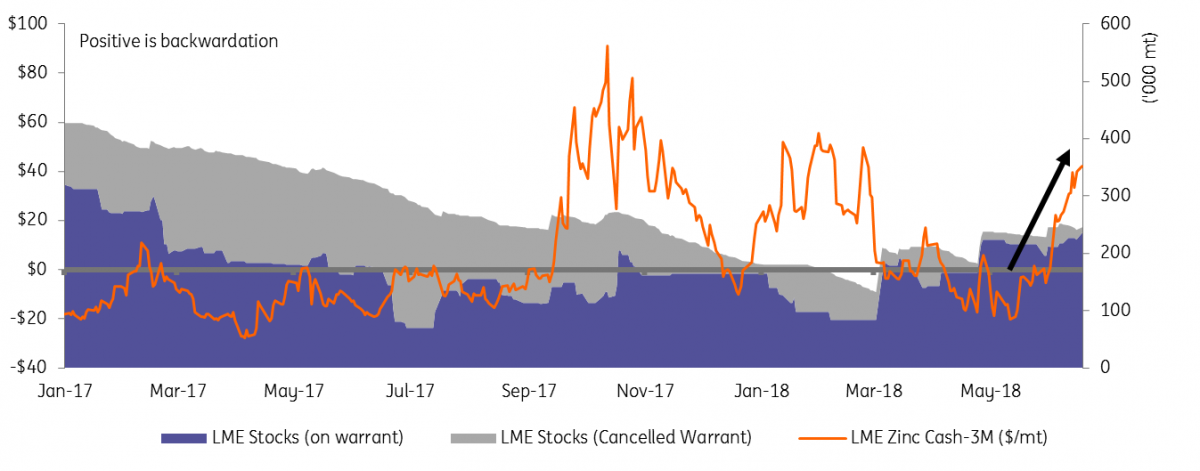

Zinc has swung into a deep backwardation on the LME squeezing shorts who took confidence in the apparently high availability of LME stocks. How this pocket of tightness rolls through the June expiry could determine if prices get their anticipated squeeze higher

Got to roll with it

Trading on the London Metal Exchange is often dominated by traders rolling positions between dates. This can either be to adjust a hedge to a more precise date/averaging period or to keep a position in the play, e.g. rolling forward a financing hedge of physical inventory, keeping a speculative position or avoid making/taking a physical delivery (roll away from expiry).

The shape of the curve is of central importance because it determines whether such a roll is profitable, i.e. rolling a short through a contango, long through a backwardation or costly, i.e. rolling a short through a backwardation, long through a contango. Nothing drives the market like a backwardation as it tends to create a spur of shorts exiting the market and entices funds to go long for the roll profits.

The shape of the zinc curve for the nearby months has changed dramatically last month. The cash-3M has swung from a contango $2.75 at the end of May to now a backwardation of over $40. In other words, those who previously decided to short zinc on the apparently looser spreads are now caught facing a hefty cost to roll. The sheer availability of LME zinc stocks, with only 4% cancelled, had directed spreads back to a contango since March and that situation hasn’t changed.

On warrant (un-cancelled) LME stock levels are higher than in early 2017 when the front of the curve stayed in contango. Neither does the LME data show any large stockholder or position holdings in front monthly dates. Yet, look how traders still short the June (3rd Wednesday prompt: 20/06/18) are now faced with a final option to pay $24 to roll positions to July or exit and the tightness is clearly resonating through the market.

What tightness? Backwardation but few LME stocks are cancelled

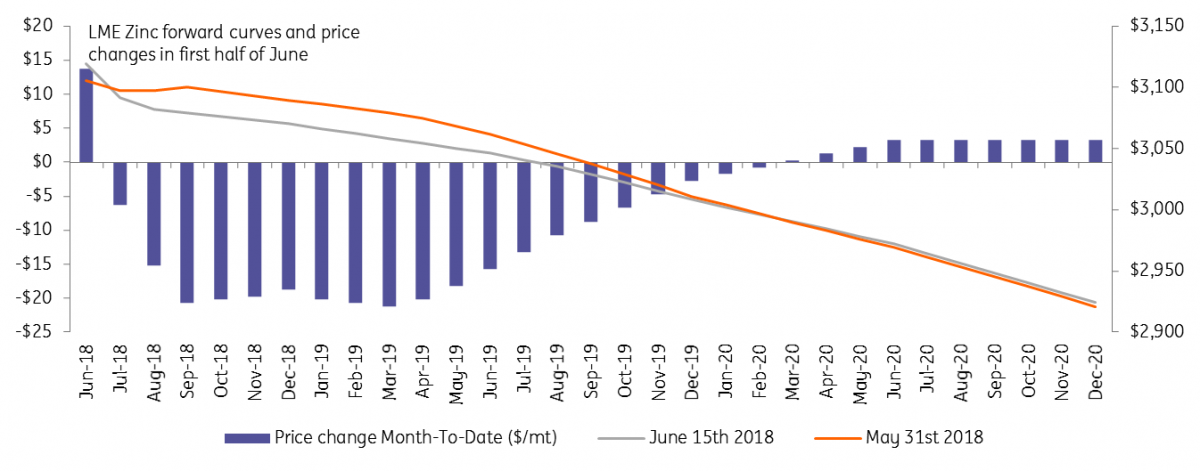

Zinc's twisting forward curve

Pinpointing the tightness

When tightness is so concentrated to just the front months, a technical rather than fundamental situation tends to be at play. Indeed, the trend of the further curve is more stably retreating but still in overall backwardation which fits with the fundamental narrative of an easing deficit into 2019. The 27-3M spread is at a $125/mt backwardation which is only a $10/mt decrease this month. The front of the curve is behaving much more erratically. Month-to-date the June zinc future has actually risen by $13.75/mt while all the further forward prompt dates have fallen.

Looking at open interest, a few oddities suggest activity around July/August contracts are the main drivers of the twisting curve so even after June rolls over the tightness could well remain for a few months. Selling of the July date seems to be ahead of schedule. The open interest here is down 44% month-to-date which wouldn’t normally start to unwind so quickly until after June expired. This liquidation may well have pushed the July price much lower than June while August appears to be concentrating a hefty amount of new shorts activity. Open interest there has swollen by 50% month-to-date meaning it is already 20% above the peak seen for August in 2017. The LME futures banding report also shows one entity has fluctuated between holding 30-39% and 20-29% of shorts on this August contract.

With August open interest surging, the tightness looks to sustain even as June-July rolls over. A pull of stocks into the exchange to alleviate the emerging tightness will, in turn, be pitted against the trend of premiums and arbitrage activity in China.

Open interest on LME Zinc contracts vs last year (lots)

A short term bear trap but bulls beware

The loose front of curve spreads has been considerable bearing in mind that the market for refined metal is expected to remain in deficit this year (ILZSG forecasts 263kt for 2018). Clearly, the LME stock situation could easily tighten significantly this year with the swing in spreads already putting shorts under pressure.

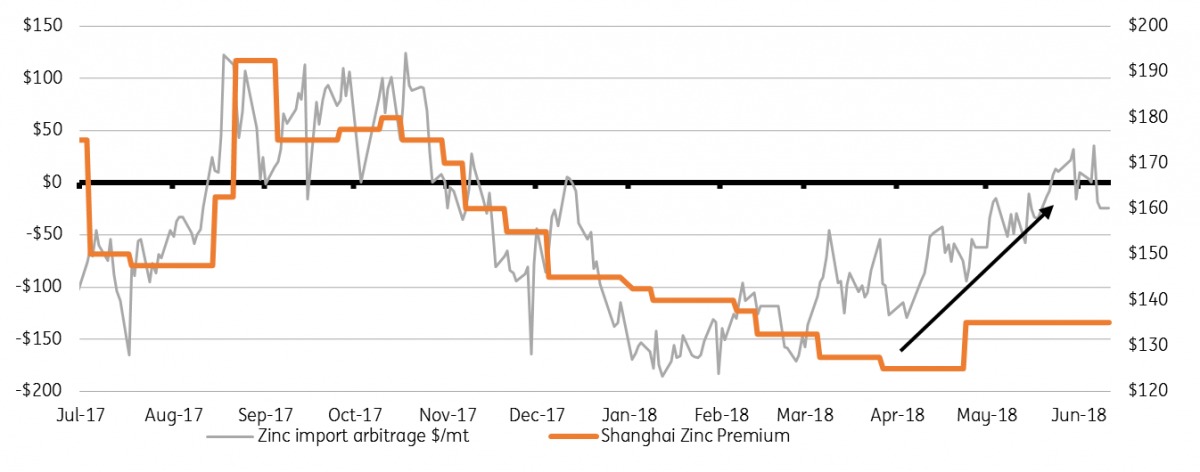

Largely we factored the easing LME stock situation with our understanding that last year’s tightness was exaggerated, boosted by excessive exports to China. As Chinese zinc imports died down so did the LME spreads gone into contango. The import arbitrage briefly opened once again at the beginning of June but failed to hold ground. Can it do so again, and for how long, is the key question.

Only a move sufficient to recover the flows west-east and spur decent cancellations/withdrawals of LME stock could see the tightness on the LME last as long as the positioning suggests (August). This would, in turn, squeezing out shorts and support prices. But bulls need to be weary that any last spurt will only last so long since zinc's fundamentals are unravelling and given the china pull is currently lacking its probably a question of sooner rather than later. If not the refined then concentrates will certainly be returning to a surplus as new mines ramp up.

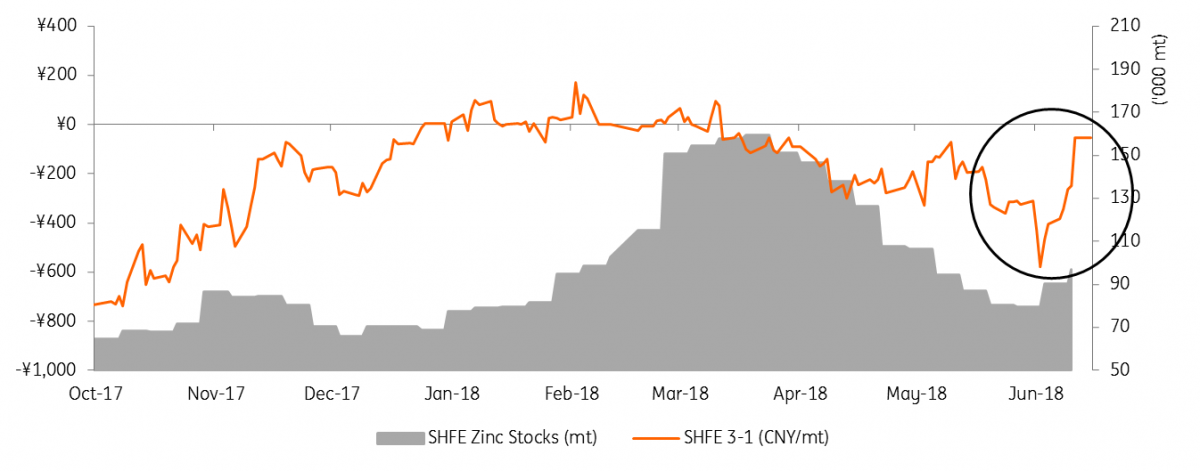

Most concerningly SMM reports the imports into China is resulting in swelling stockpiles (social inventories are 139kt up 22kt in a week) which unless consumed will quickly put an end for an open arb. Indeed the backwardation on Shanghai has almost evaporated. Maintenance at Chinese smelters has curbed output (down 4.8% in May) this year, but ultimately we are expecting an easing in the raw materials supply to see this recover. The spot treatment charges are admittedly reacting very slowly suggesting the market remains fairly tight although they are going in the right direction (MB sees $27/mt up from $20/mt at the beginning of the year).

Shanghai zinc backwardation has eased (CNY/mt)

Chinese import zinc arb opened just briefly

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ZincDownload

Download article