Yapi Kredi: $1bn cap raise brings relief

Yapi Kredi (YKBNK) reported strong 1H18 profitability, driven by TRY loan growth and strong NIM management, leading the bank to post RoE of 16.4%. The main story in 2Q was the successful $1 billion capital increase, demonstrating its parent's commitment to the lender and offsetting the effects of TRY depreciation. Asset quality remained steady

2Q results highlights

Yapi Kredi continued the theme we have seen from the Turkish banks so far of reporting very strong 1H18 profitability (net income +31% YoY to TRY2.5bn, though down 1% QoQ in Q2 on higher provisions), driven by TRY loan growth (+11% YoY) and strong NIM management (up 11bp YoY to 3.21%). This equates to RoE of 16.4%.

The headline loans/deposits ratio (LDR) also held up nicely at 114%, which is stronger than the sector average of 120%. In TRY, this ratio stood at a stretched 153%, while the FX ratio was very healthy at 89%. While we have also observed stretched TRY LDRs at YKBNK’s peers, YKBNK’s imbalance is more pronounced than most. Asset quality declined overall.

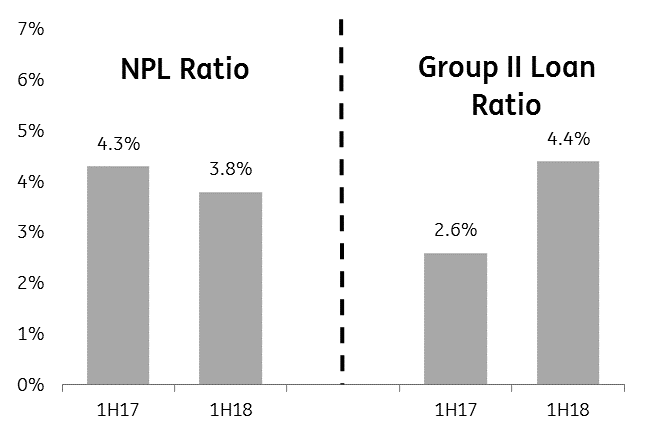

While the headline NPL ratio fell by 50bp YoY to 3.8%, Group II loans add another 4.4% of impairment (+40bp QoQ, +180bp YoY). The coverage ratio of 114% is fine but lower than most private-banking peers. Specific coverage of Group II loans stands at 11% (up from 4.4% at end-FY17), while that on NPLs is 82%.

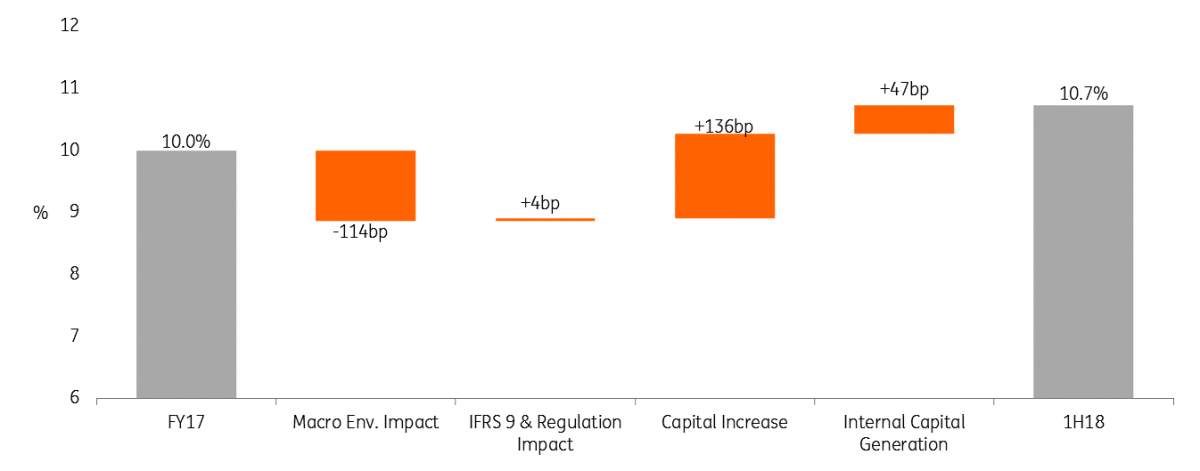

Capital ratios improved following the $1bn capital increase, with the Tier 1 ratio increasing 73bp HoH to 10.7%. The cap raise boosted the T1 ratio by 136bps, though TRY weakness over the period subtracted 114bp. The bank achieved 47bp of internal capital generation in H1. The Tier 1 ratio thus remains at the lower end of peers, although the prospect of this metric dropping below 10% the psychological 10% threshold has been pushed back for now.

Earnings in detail

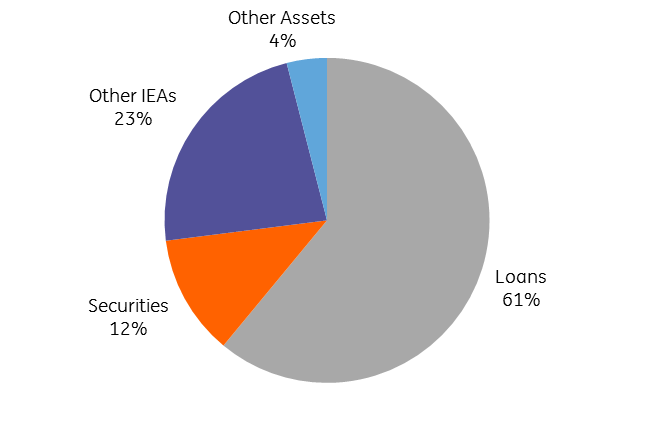

YKBNK’s 1H18 net profit increased by 31% YoY to TRY2.5bn, supported by strong revenue growth (though growth slowed QoQ, as elsewhere). In particular, net interest income rose 24% YoY to TRY5.3bn. Swap-adjusted NIM grew 10bp YoY to 3.2% and lending grew nicely (+20% YoY) to TRY 222bn. Loans were focused on TRY lending (+11%) against FX (+2% in USD terms). Net interest income makes up 72% of YKBNK’s revenues. Fees & Commissions, which account for 25% of revenues, rose 24% YoY to TRY2.1bn. Expenses are well under control. While core revenues rose 24% YoY to TRY7.4bn, operating costs increased just 8% YoY to TRY3.0bn. Consequently, the cost/income ratio strengthened from 40.5% to 35.1% YoY.

YKBNK’s provisioning charge of TRY1.4bn rose 26% YoY, suggesting that asset quality is continuing to decline. This equates to a cost of risk of 115bp, up from 106bp in 1H17. The specific cost of risk also declined from 96bp to 80bp over the period following a particularly low Q1 reading (CoR Q1: 50bp; Q2: 111bp). Bringing all this together, YKBNK achieved ROAA of 1.6% in 1H18, up 40bp HoH. ROATE increased from 13.6% to 16.3% over the period.

YKBNK’s TRY222bn loan book is of reasonable quality, though markedly weaker than peers’, as demonstrated by the NPL ratio of 3.8%, down 0.5ppts YoY but well above the sector average of 2.9%. The fall in the NPL ratio was mainly due to loan growth and the sale of TRY1.6bn of NPLs. Net NPL inflows actually rose from TRY880m in 1H17 to TRY1.1bn in 1H18, although TRY728m of that consisted of two big-ticket NPLs. Group II loans continued to rise, hitting 4.4% of total loans in 1H18 (1H17: 2.6%), as Turkey’s slowdown gathered pace. More encouragingly, YKBNK has maintained its total coverage ratio in excess of 100%. In terms of specific provisions, NPL coverage is 82% (1H17: 77%) and coverage of Group II loans stood at 11.0% (1H17: 4.8%).

YKBNK asset quality development (1H18)

YKBNK had US$21.7bn of FX loans outstanding at end-1H18 (+2% YoY), equating to 44% of total loans. All these exposures are in the Companies segment, which gives us some comfort. These exposures are offset by US$24.7bn of FX deposits (+4%).

YKBNK has a solid liquidity profile. Deposits make up 53% of liabilities, with borrowings comprising another 25%. 56% of deposits are denominated in FX, as opposed to just 44% of loans. The loans/deposits ratio of 114% represents only a modest decline (+2ppts YoY) and is better than the sector average of 120%. The bank is looking to reduce this further over time, particularly in TRY, where it has been stretched to 153% by the lending surge of 1H17, though this is an improvement on the 166% posted at year-end.

Borrowings are well diversified. The bank boasts US$2.9bn of syndications, US$2.6bn of subordinated loans (of which just over $1bn were contributed by UniCredit), US$3.2bn of Eurobonds and TRY1.17bn of covered bonds. The bank also boasts TRY2.1bn of local-currency bonds and bills.

Securities make up just 12% of assets, little changed YoY and low compared to historic levels. Of the TRY45bn of securities on YKBNK’s balance sheet, 28% are denominated in FX.

YKBNK – asset mix (1H18)

The benefit of the cap raise was offset by TRY depreciation

Capital ratios have been a key part of YKBNK’s story of late, following the announcement of a $1bn capital increase supported by its joint owners, Koc Holding and UniCredit. This transaction added 136bp to YKBNK’s capital ratios in H1, raising the Tier 1 ratio from the relatively low level of c. 10% it has occupied for a while. However, the macro environment (principally the depreciation of TRY) reduced this ratio by 114bp, erasing much of the gain made by the injection of funds. Internal capital generation remained solid, adding 47bp over the period. All this leaves YKBNK with a CET1 ratio of 10.7%, still weaker than most peers but further away from the psychologically important 10% threshold. CAR came in at 13.9%, up 50bp HoH, despite the -22bp impact of sub debt amortisation. The charts below show how these factors influenced the development of YKBNK’s capital ratios.

YKBNK - CET1 ratio development

Guidance tweaks suggest higher profits but risks to credit costs and capital

Finally, YKBNK maintained most guidance for 2018. It expects both loans and deposits to increase by 12-14% in FY18, continuing the theme of new lending being largely deposit-funded. NIM should be flattish, with the Cost of Risk and the NPL ratio both expected to fall marginally, with new NPL inflows expected to decline and NPL sales to continue. The loans/deposits ratio should also remain stable at 110-115%, though our focus will be on the TRY number rather than the headline figure. However the bank has tweaked three numbers: it now sees upside potential to its guidance for fees to grow in the low-teens area, while it sees downside risk to its guidance for a slight improvement in the cost of risk and for its aim to keep CAR >15%.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).