Does the US have a currency problem, as Donald Trump suggests?

A strong dollar has wiped off some $8.4bn of US profits in the first quarter, according to analysis by Kyriba Corp. And traders are also digesting recent Donald Trump comments that the US has a ‘big currency problem’. We have some answers to key market questions and what it could mean for the dollar

Does Donald Trump really want a weaker dollar?

Q: Why is the issue of weak dollar policy back in the headlines now?

A: Bloomberg Businessweek published an interview with Donald Trump on 16 July. His opening gambit focused on problems in the US manufacturing sector and the ‘big currency problem’ that the US faces today. He singled out USD/JPY and USD/CNY, focusing on the unfair competitive advantage that a company like Komatsu has over Caterpillar. These comments and his choice of JD Vance as running mate point to the focus on key mid-western swing states – with a heavy manufacturing presence - in the run-up to November.

Q: What does a weak dollar policy actually mean?

A: The US Treasury (i.e. the politicians) is in charge of FX policy and can express its views on the dollar through key G7 & G20 Communiques. Over the years, the language in those has settled on the need for flexible exchange rates which reflect underlying fundamentals and the need to avoid competitive devaluations. US Treasury Secretaries can be asked their views on dollar/dollar policy and were Donald Trump to win in November, the choice of any potential Treasury Secretary will be important for markets. So you might have, for instance, Jamie Dimon, who's unlikely to seek a weaker dollar, versus Robert Lighthizer who's seen as very protectionist and who could pursue a weaker dollar policy.

Q: What other tools does the US Treasury have to impact FX markets?

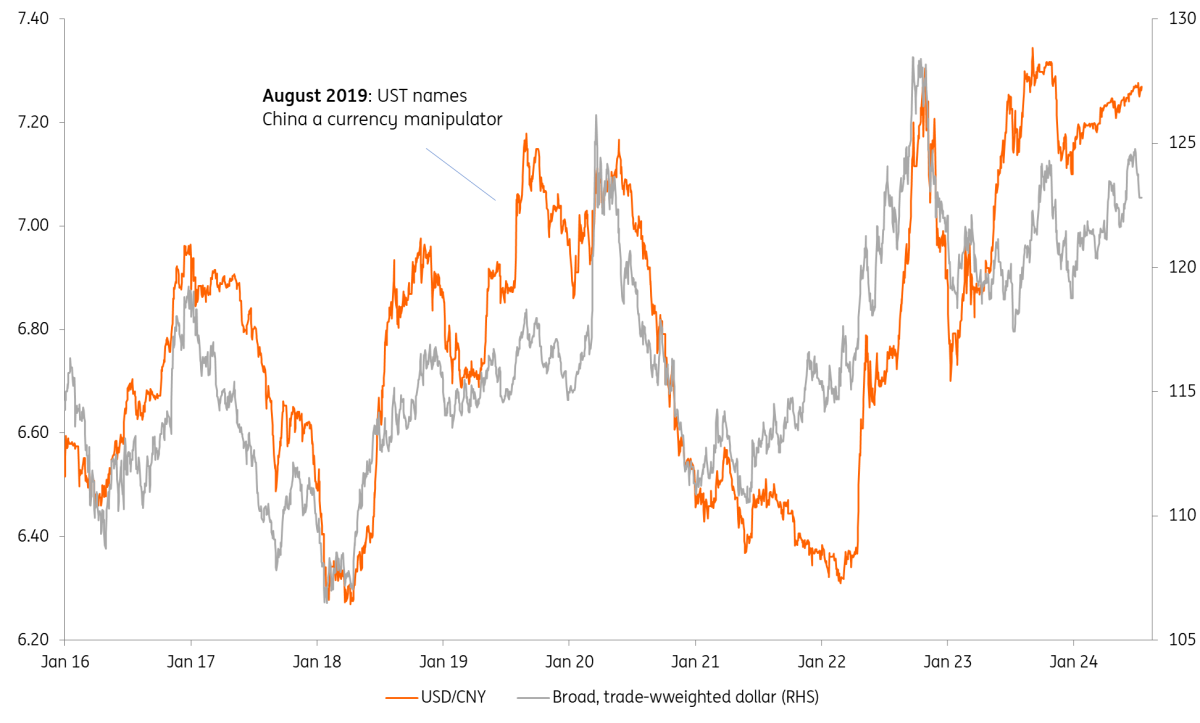

A: In theory, the US Treasury could intervene to sell dollars and buy unlimited FX, but that seems very unlikely. More in focus will be the use of UST’s semi-annual FX report to label China a currency manipulator and threaten/extend tariffs should China weaken its currency any further. That is what UST did in August 2019 when China gave into market pressure and allowed USD/CNY to trade higher. The chart below shows that the manipulator tag did not make much difference to FX markets, although likely created more space for US tariffs. USD/JPY is different. Tokyo wants a lower USD/JPY and is currently intervening to achieve it. The US will not be seeking particular tariffs for Tokyo over its FX rate/policy. But USD/JPY will probably be at the forefront of any adjustment were the weak dollar policy theme to gain traction.

USD/CNY versus the broad dollar trend

The macro context is key

Q: Should we distinguish between Donald Trump wanting a stronger CNY/JPY and wanting a broadly weaker dollar?

A: Yes. Mr Trump’s focus is on the competitive advantages enjoyed by China and Japan from weak currencies. During his last Presidency, he avoided going near a weak dollar policy. Assuming he has sensible people at the US Treasury, the risk of a weak dollar policy destabilising US Treasuries, driving borrowing costs up and equities lower, would likely discourage the UST from actively pushing for such an FX policy.

Q: Will US Treasury FX policy make much of a difference anyway?

A: The macro context will be key. Were Mr Trump to win the Presidency and Congress and then extend tax cuts while broadly raising protectionism to a new level, then this would be a dollar-positive policy mix. And the ongoing threats against the alleged undervalued renminbi (while still present) would not have much impact on the FX market. Should the economy weaken for whatever reason, the pressure to seek more stimulus through a weaker dollar will grow. In reality, a newly-elected Trump cannot try to suppress China (= less CNY demand), create four years of unprecedented US prosperity (= stronger USD), and really expect USD/CNY to trade lower.

Q: If UST did try to push a weak dollar policy, how far could the dollar fall?

A: We have models that try to gauge ‘risk premia’ in pairs like EUR/USD. For example, how far could EUR/USD trade away from levels suggested by short-dated rate spreads, yield curves and global equity markets – inputs which normally work quite well in determining short-term pricing. Our chart below shows that over the last 10 years, EUR/USD has traded +/- 5-6% around its short-term fair value, which could be a way to isolate/evaluate the impact of any weak dollar policy from the UST.

EUR/USD deviation from Financial Fair Value

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article