World trade’s path to recovery

After a surprisingly quick world trade recovery, container shortages and new trade barriers are likely to dampen the potential for world trade growth over the course of the year. Nevertheless, we expect 6% growth in 2021

Escaping lightly

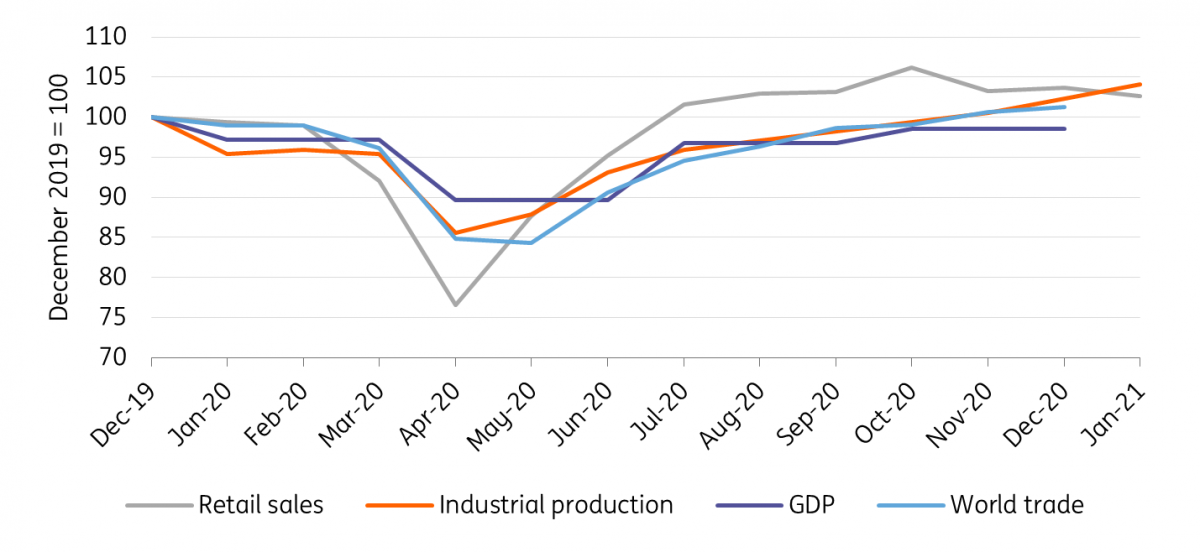

During the pandemic, world trade has benefited from global recoveries in retail sales and industrial production, while other sectors remain much harder-hit by lockdowns and uncertainty, such that global GDP is still below its pre-pandemic levels (Chart 1).

Chart 1: Import-intensive demand has bounced back

In some ways, lockdowns provided a positive shock to trade in goods, causing some expenditure shifting to consumer goods from services. However, this wasn’t the major driver of the recovery in world trade volumes, as intermediate goods (the inputs to manufacturing) and capital goods (the machinery used by industry, including generators and computers) continued to account for around two-thirds of world trade in 2020, in line with past averages.

Trade is again expected to escape lightly during the second wave of lockdowns, with a smaller overall hit to economic activity than in the first wave. As economies re-open, a shift back to services expenditure and away from goods is less of a risk to trade volumes than lingering uncertainty and/or the premature ending of fiscal support, which might hold back household consumption and business investment.

Headwinds from uneven growth and tight capacity

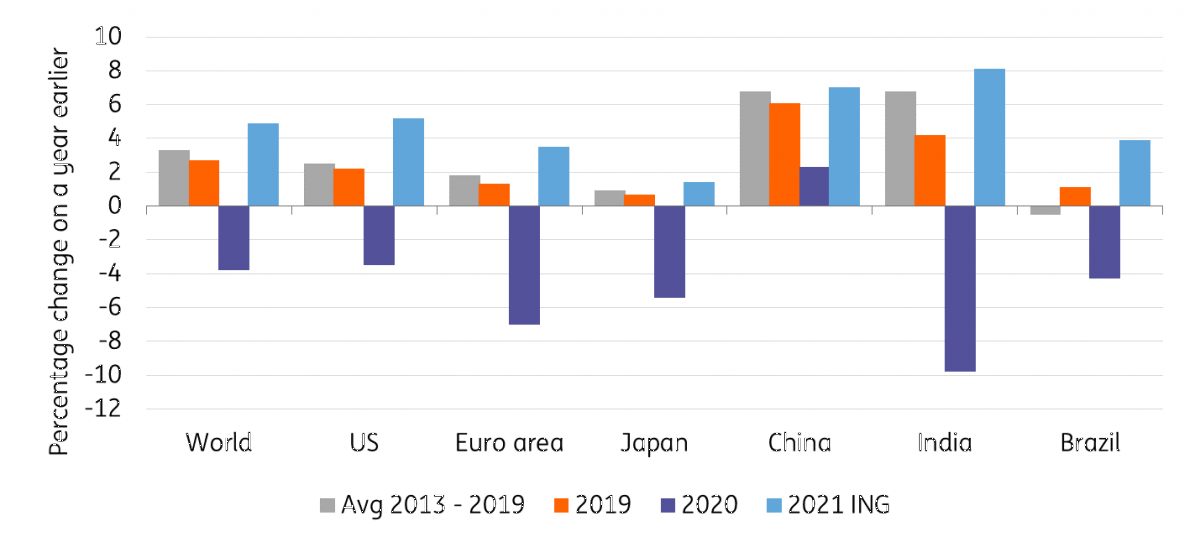

With vaccines proving effective against new variants of the virus, the global recovery is on track to take place in 2021 (Chart 2).

Trade volumes should also see a significantly better year in 2021 (Chart 3), but there are headwinds from uneven global growth and near-term constraints on capacity, while the state of trade barriers is significantly worse than prior to the pandemic.

Chart 2: Recovery is within reach, but will be uneven

The unevenness of the global recovery and slower than average recovery in the euro area will matter for trade volumes. Intra-EU trade normally accounts for around 20% of world trade, and the EU is the market for 13% of the rest of the world’s exports, so the gradual return to pre-crisis levels of activity will continue to have a dampening effect.

Capacity constraints will also affect trade’s recovery in 2021. International freight rates remain close to twice their pre-pandemic levels, reflecting container shortages resulting from past capacity cuts along major shipping routes and slower port handling speeds while health measures remain necessary to prevent the spread of the virus.

Increases in the supply of new containers and a return to pre-crisis levels of shipping capacity across major routes are already helping to stabilise rates. But tighter capacity management by shipping liners, managed through short-notice cancellations of container ships, are likely to continue. As well as keeping pressure on freight rates, this will also increase the chances of delays within supply chains.

Policy barriers

Exporters face a much more challenging environment in 2021 than they did before the pandemic.

In 2018-19, policy restrictions on trade jumped following US tariff increases and retaliation by other countries, which resulted in the average tariff applied by the US on its imports rising from 1.7% in 2016 to 13.8% in 2019.

Since 2016 there has also been a worldwide move to introduce and actively use ‘screening’ mechanisms for foreign direct investment, which allow governments to scrutinise potential investments and block them on national security grounds. These policies have increasingly expanded to lower-value transactions and across all sectors in the economy, adding up to a marked tightening in control of flows of foreign capital.

During the pandemic, other trade barriers less visible than tariffs have increased, but potentially just as significant. New export controls on some food and medical products, and subsidies to domestic industries, were primarily introduced as emergency measures. But they have largely remained in place as the pandemic has progressed, adding up to distortions affecting 13.6% of world trade, and making access to foreign markets more difficult for the majority of countries.

Though trade relations between countries are expected to be less adversarial than in the lead-up to the pandemic, many of the crisis-related measures remain in place with no automatic expiry date. And a global effort to dismantle both visible and invisible trade barriers is not on the cards. Instead, progress is unlikely to go much beyond piecemeal progress within the context of bilateral talks, such as the suspension of tariffs in the Airbus-Boeing dispute.

Spillovers from new strategies

In the wake of the pandemic, policy announcements in China, the EU and the US (including the Two Sessions, EU Trade Policy Review, Buy American, and ‘Securing America’s Critical Supply Chains’), have several common themes with implications for international trade. A big effort is underway to develop domestic capabilities, especially in technology, and create a degree of independence in the supply of essential medicines and technology goods.

These initiatives face their own challenges, not least working within (and simultaneously seeking to reform) international agreements. WTO members are committed to open public procurement, and limits and transparency around the use of subsidies. The US-China Phase One deal, and the EU China Agreement on Investment, also create enforceable mechanisms to allow foreign firms to invest and operate in China while retaining ownership of intellectual property. But one consequence of more support for domestic production will be to alter the relative costs of trade domestic production and imports, which may trigger a re-assessment of globalised supply chains.

We expect growth in 2021, but headwinds dampen potential

After the first wave of the pandemic, world trade started to recover swiftly. The surprising speed of the global trade recovery so far has caused problems of its own though. Reopening of economies and recovering demand remains the key driver for world trade growth in 2021, but the impact of supply chain hiccups and transport and input shortages related to the quick recovery of demand for goods will dampen global trade growth for the year. Still, our 6% growth forecast for 2021 reflects the fast recovery to pre-pandemic levels of import-intensive activity, and the re-opening of economies over the course of the year.

Chart 3: growth in world trade volumes over 2021

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

World tradeDownload

Download article