Why the US SEC’s proposed climate disclosure rules are a game changer

The SEC’s draft climate disclosure rules require public companies to report on Scope 1-3 emissions, carbon offsets, and climate-related risks. Higher climate data transparency and comparability will prompt businesses to pivot strategies and enhance investor confidence, but the implementation of the rules may be challenging

On 21 March, the US Securities and Exchange Commission (SEC) released its long-awaited draft rules on climate-related data disclosure. The SEC’s proposed rules reflect an ambitious set of requirements and include exemptions and phase-in periods for implementation.

Before we examine the details, it’s worth stating that the proposed disclosures have attracted quite a lot of criticism, including questioning the SEC’s legitimacy to require companies to make such disclosures. The SEC is in the business of protecting the investor, but some see these disclosure requirements as top-heavy and a burdensome environmental, social and corporate governance (ESG) oversight, framed in a way that makes it deemed necessary to secure full disclosure to investors. And then couched in an efficient market and capital allocation rationale.

The counter to such criticism is that the market has been crying out for a means to standardise ESG credentials. It’s far too easy for any corporate to amplify the ESG positives and dampen the negatives. Those that genuinely wish to show their fair credentials can far too easily be met with scepticism, as in the end there is no fair play arbitrator. While the SEC is not claiming to be this, common disclosures like these help to secure such an outcome, where ESG credentials can be scrutinised fairly.

There is a clear positive here for ESG investors, an area that has rocketed in popularity in recent years

There is a clear positive here for ESG investors, an area that has rocketed in popularity in recent years. Greenwashing has been the bane of the industry, especially in the US where there has not been a framework to latch on to, even a preliminary one. Well now there is, and we view disclosures like the ones being set out here as very likely to be agreed upon. They allow corporates that endorse positive ESG credentials a means to walk the talk, while shadier ESG claims will be exposed far more easily.

It’s interesting to also note the governance aspect of the disclosures. Corporate law is littered with requirements for corporate boards to be fully informed, and for shareholders to have access to board credentials. Decisions made need to be carried out with full knowledge of the subject matter at hand, even if coming from an advisory committee. The SEC proposals home in on this as an important underpinning, so that corporates steer the ESG waters on an informed basis. This is a game-changer, really.

Scope 3 emissions made its way to the proposed rules

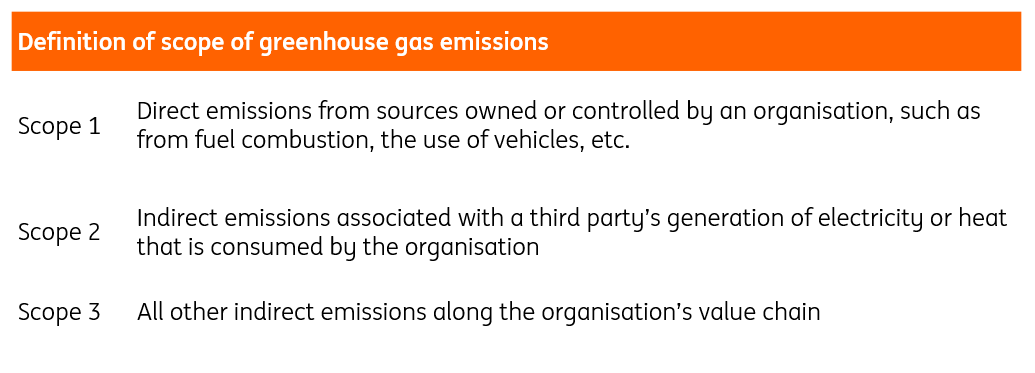

Not surprisingly, the SEC has announced that public companies will be required to disclose Scope 1 emissions (direct emissions) and Scope 2 emissions (indirect emissions from purchased power and heat) which are relatively easy to measure. It is worth noting that under the proposed rules, emissions disclosures should be made in absolute terms, both disaggregated and aggregated, and not include carbon offsets (explained in the next section). This will serve to enhance reported climate data quality and standardisation.

Whether to include scope 3 emissions – indirect emissions along an entity’s value chain – in the SEC’s disclosure rules was one of the most hotly-debated issues. Under the most recent proposal, the SEC chose to mandate companies to disclose Scope 3 emissions, but only if these emissions are material to a public company and/or are included in the company’s climate targets. This reflects the SEC’s ambition to make climate disclosure mandates more comprehensive in the US, but also shows a willingness to offer a degree of flexibility where applicable.

The SEC also sought to strike a deliberate balance, proposing exemptions for smaller companies. It also announced a safe harbour for liability from Scope 3 emissions disclosures. Emissions reporting will also be mandated in phases, with the largest companies – those with more than $700m worth of shares – required to start reporting Scope 1 and 2 emissions from the fiscal year 2023.

The discussion about Scope 3 emissions is important because Scope 3 emissions account for between 65% to 95% of a company’s total emissions, and there is a growing belief that effectively managing a company’s Scope 3 emissions will be key in the global decarbonisation process. Although the number of companies voluntarily reporting climate data is on the rise globally, only about 20% of them currently include Scope 1-3 emissions as well as data verification. With listed companies representing roughly 40% of the global emissions, mandating them to report all scopes of emissions helps hold them accountable for their carbon impact.

Number of companies disclosing climate-related information to CDP*

Carbon offsets will need to be specified

Carbon offset refers to the action of controlling an entity’s own emissions through emissions-reduction activities elsewhere. Such activities include planting trees, land restoration, or the purchasing of carbon offset credits from entities that engage in those activities. Although carbon offsetting markets, either mandatory or voluntary, are expanding globally and will continue to boom, some argue that they could be used by corporates to delay their own decarbonisation efforts.

While acknowledging the importance of carbon offsetting, the SEC has decided to require companies to report carbon offset information separately if it is included in their climate plan. This includes both the amount and source of carbon offsets used. Such a rule would help investors identify how much of a company’s emissions reduction comes from offsets.

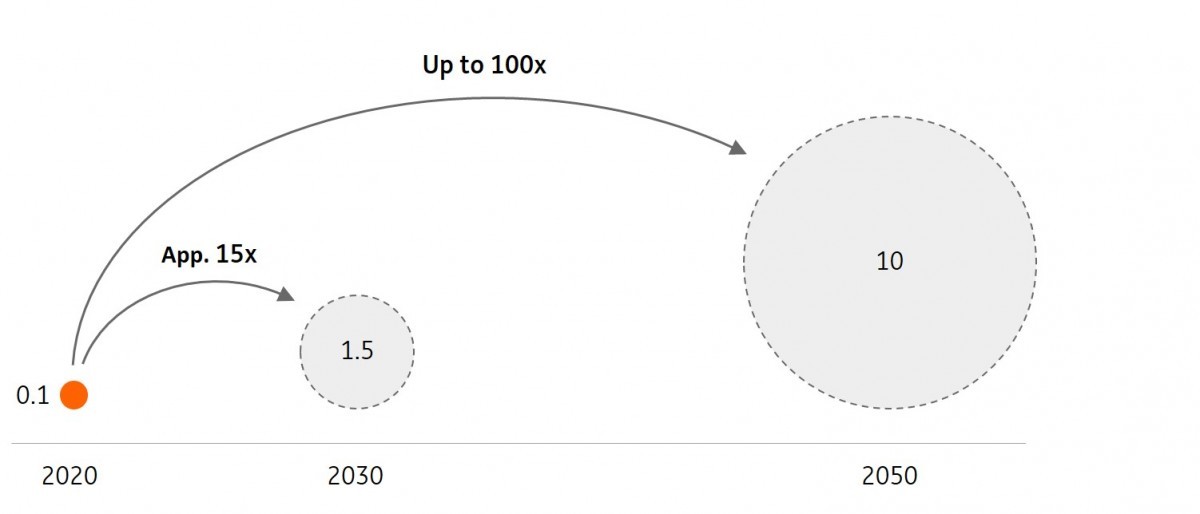

Global demand for voluntary offsets is expected to boom

Voluntary demand for carbon credits, gigatons of CO2 per year

Climate-related risks will become more transparent to investors

The SEC is also proposing to require public companies to disclose information about how climate-related risks will materially affect their financial statements, business models, and business outlook in the short, medium, and long term. Companies will also need to report how they identify, assess, and manage climate-related risks, as well as whether these processes are integrated into their overall risk management mechanism.

Companies will need to report how they identify, assess, and manage climate-related risks

This requirement would help investors better understand what a company’s climate-related physical and transition risks are; it could also encourage the company to better prepare itself to mitigate these risks. For instance, a company with significant physical assets in areas that are likely to suffer from increasing and more severe flooding may need to consider factoring in the potentially higher costs of operation related to flooding, include it in its risk management plan, and disclose it to the SEC.

Assurance requirements to come in phases

The SEC also specifies that public companies will need to eventually obtain assurance for their climate-related disclosure. Assurance would work in similar ways as auditing and verification to ensure the credibility of a company’s reported information. The largest companies will be asked to provide reasonable assurance starting in the fourth year after the initial Scope 1 and 2 emissions disclosure compliance date.

Ambitious rules, likely implementation hurdles

The inclusion of Scope 3 emissions in its rule proposals, as well as the specified requirements for carbon offsetting, climate-related risks, and assurance, shows the SEC’s vision to establish a comprehensive and detailed climate reporting framework for US public companies. And, to level the playing field with other jurisdictions such as the EU and the UK, which are set to start mandating climate disclosure in 2024 and 2025, respectively.

The SEC points to a more effective allocation of capital

With more climate-related data required to be reported in a standardised and comparable way, the SEC points to a more effective allocation of capital to companies or projects with higher performance or greater progress in managing sustainability. The proposed mandate is also for the benefit of the sustainable finance market, where more credible data should help boost the confidence of investors in green and sustainability bonds.

Now that the draft rules have majority support from the SEC commissioners, they will enter a 60-day period for public comments before the commission makes any further changes and finalises the rules. The SEC currently aims to start implementation of the rules by the end of the year.

However, the proposed rules could face legal challenges and other implementation difficulties. One of the SEC commissioners and some industrial players have already questioned whether the SEC has the authority to mandate the disclosure of climate information. Estimated costs of compliance, especially the cost to report Scope 3 emissions, could also become a point of debate, as the SEC is mandated to establish regulations that are cost-effective. This means the SEC could face litigation, which could delay the finalisation of the rules, if not completely overthrowing them.

Moreover, if the SEC receives an overwhelming number of comments – the commission must address every significant comment or data from the comments – it could take the SEC longer than expected to address all of them, and cause delays.

The upcoming midterm elections in November will likely not have significant disruptive effects on the direction of the SEC’s proposed climate disclosure rules. The SEC is a regulatory entity independent from the government and has enjoyed and maintained its independence of rulemaking. Nevertheless, it is not impossible that implementation gets (slightly) delayed by the midterm elections.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article