Why the Bank of England won’t be an outlier with rate cuts in 2024

Investors expect the Bank of England to start rate cuts later and act less aggressively than the ECB or Federal Reserve. That might be because UK services inflation is proving stickier. But this is likely to change, and differences between UK and eurozone services inflation rates can't be fully explained by differing economic conditions

UK inflation doesn't look that different to the eurozone after all

Financial markets have significantly ramped up bets for 2024 rate cuts over recent weeks. But what's striking is that investors still expect the Bank of England to start rate cuts later and cut less aggressively overall than the European Central Bank or Federal Reserve. Admittedly, this divergence has narrowed after some encouraging wage figures and poor GDP numbers this week. Even so, investors are pricing a little over three UK cuts for next year starting in June, compared to five at the ECB starting in May.

All of this resurfaces memories of last summer, where investors widely thought the UK had a worse inflation problem than either the US or the eurozone. Three-quarters of ING clients/colleagues agreed with this sentiment back in June. And at its most extreme, financial markets were pricing a peak for the Bank of England’s interest rate at 6.5%. Over a two-year horizon, investors thought UK Bank Rate would stay a full two percentage points higher than the US.

Fast forward six months, and the story has moved on. The BoE hasn’t hiked rates since August, and it’s becoming increasingly clear that the inflation backdrop isn’t all that different to elsewhere.

For large chunks of the inflation basket, it’s evident that the UK is simply lagging behind what’s happening elsewhere in Europe. Take energy prices, where the UK’s regulated price system meant that higher natural gas prices hit consumer bills more slowly on the way up, and it’s been the same as wholesale prices have fallen too. Food inflation peaked higher and later in the UK than in the eurozone – but the trends now look identical. With producer price inflation now negative, the rapid downtrend in consumer food inflation is only set to continue. It’s a similar story for goods prices more broadly.

UK vs eurozone inflation

UK services inflation is proving sticky. But...

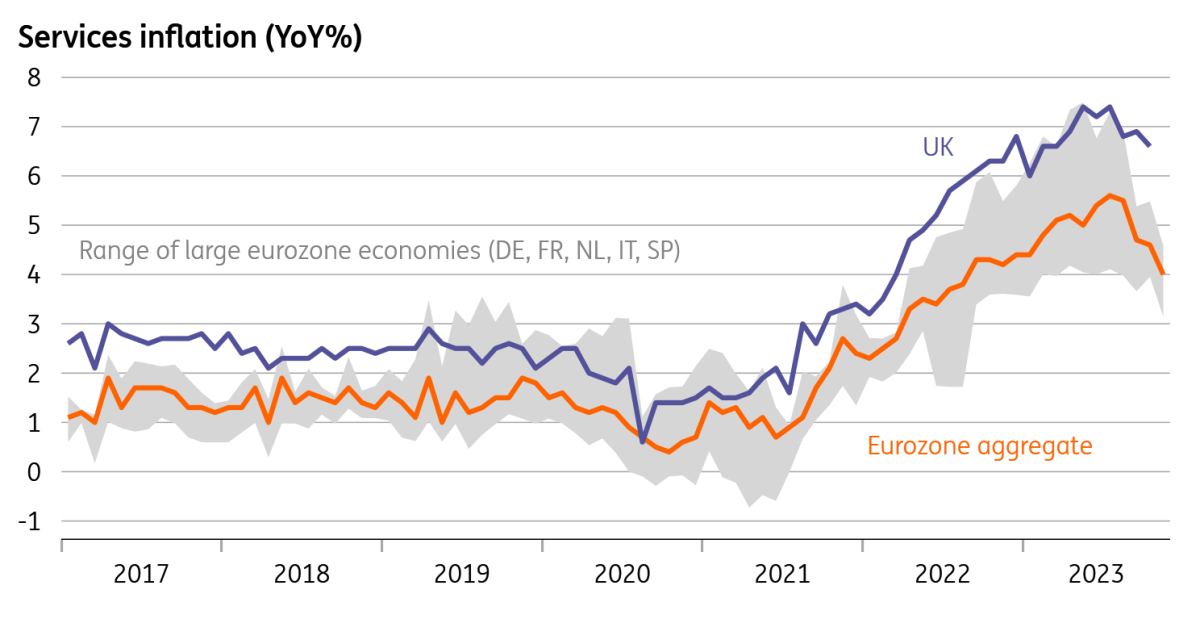

The outlier is services inflation, and this is what’s bothering the Bank of England. Where services inflation has started to fall more noticeably in the eurozone, we’re yet to see the same in the UK – at least not to the same extent. The BoE has said that services inflation is one of two out of three metrics that will guide policy. And that might help explain why markets expect the Bank to cut rates later and less aggressively than the ECB.

But once you get into the weeds, it’s clear that not all of this divergence in services inflation is explained by differences in economic conditions. By extension, expecting the UK to be later to the rate-cutting game because of higher services inflation is potentially misguided.

UK vs eurozone services inflation

Higher services inflation not explained by recreation

Take recreation prices, which account for almost half of the UK services inflation basket. This is what we traditionally think of when we think of services, and it includes things like catering, holidays and entertainment. These are areas that are intrinsically linked to domestic economic conditions, like the strength of the labour market. Our previous research has shown that these areas also exhibit the most “persistent” trends, something the BoE has put particular emphasis on.

Once you adjust for the fact that recreational services have a larger weight in the UK relative to the eurozone, the difference in inflation rates and contribution to overall services inflation is actually fairly minimal. Price growth is slowing in this area as the jobs market starts to cool and the lagged impact of lower energy prices continues to feed through to service providers.

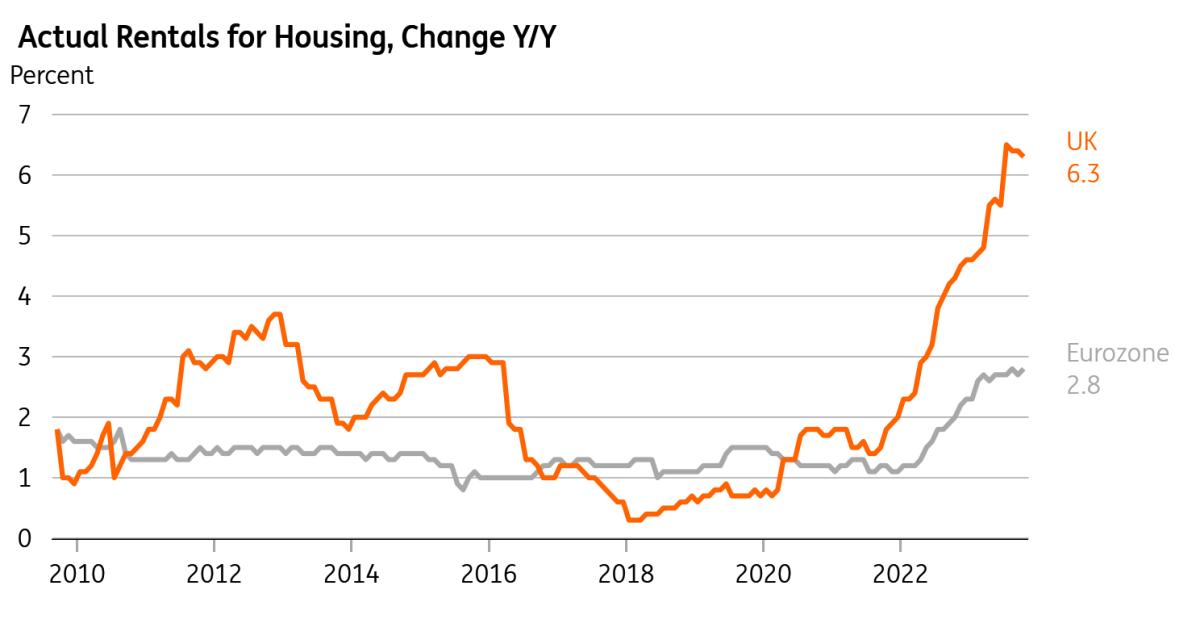

The differences are more noticeable with housing, where rent inflation is noticeably higher in Britain than on the continent overall. This is partly down to much less rent control and regulation in the UK relative to elsewhere in Europe. According to the OECD's rent control index, the UK is at the bottom of the pack – even lower than the US. British rent inflation is showing little sign of slowing and is being amplified by a shortage of rental properties. This is something the BoE will have its eye on, but on its own, it’s not a compelling argument for UK rates staying higher for longer than elsewhere.

UK vs eurozone rents inflation

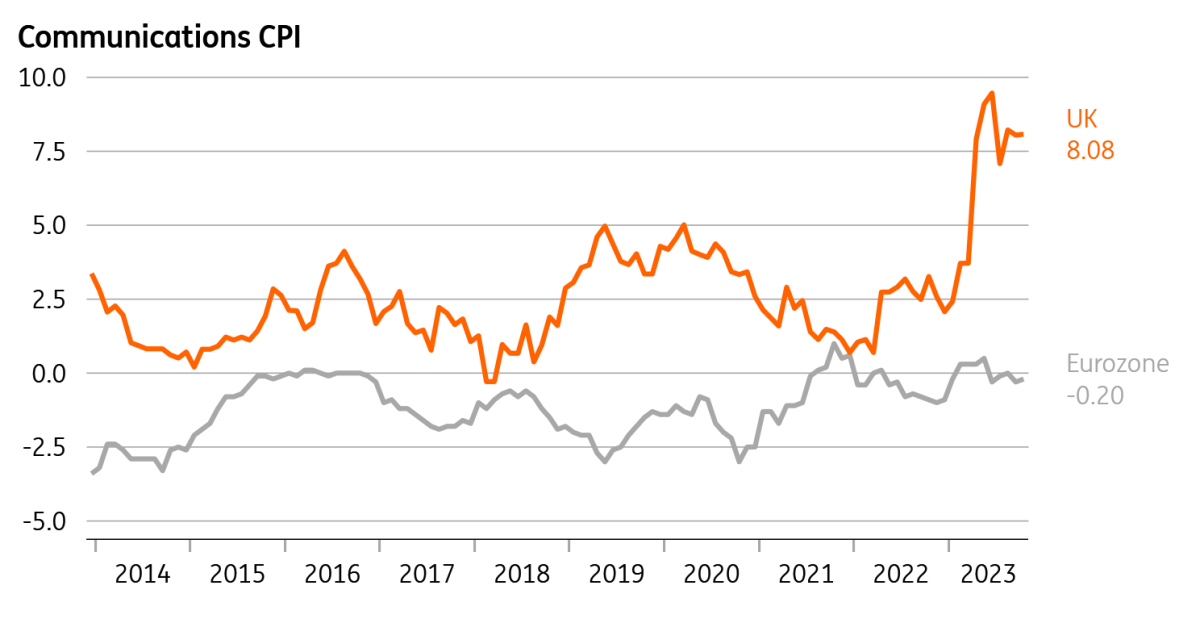

The same argument can be made in other areas, like communication. This includes the likes of mobile phone and internet contracts, and inflation here is running at 8% in the UK and zero in the eurozone. Without getting too bogged down in the details, we think this can only be explained by differences in the way the data is collected or adjusted (even though the UK is supposedly “harmonised” with the eurozone's methodology). Potentially, it could be down to the way different countries “quality adjust” prices, for example when internet speeds increase over time. Similarly, transport services – which include public transportation, car repairs and insurance – are another consistent source of divergence that appears to have little to do with underlying economic conditions.

UK vs eurozone communications inflation

Bank of England to cut rates more aggressively than the ECB

If these sound like boring technical arguments, that’s because they are. But they do provide some explanation as to why UK services inflation has been noticeably higher than we've seen in Europe over recent months. They also help explain why even before Covid, UK services inflation was more than a percentage point higher on average (between 2017-19).

Overall, we think that we shouldn't overplay the stickiness of UK services inflation relative to Europe. We think the recent fall in eurozone services CPI will be mirrored in the UK over time. While we expect it to stay in the 6% region into early next year (6.6% currently), we expect it to reach 4% next summer. Together with mounting evidence that private sector wage growth is trending lower, we think there will be enough there for the Bank to start cutting rates by August. We expect 100bp of rate cuts in the second half of next year.

That’s pretty similar to what markets are now pricing, so our conclusion perhaps says more about investor expectations for the ECB than the BoE. Our own house view is that the ECB will be less aggressive on easing next year. Put another way, if markets end up being right that the ECB cuts rates by 125bp next year, then we suspect that the BoE will also do that, or more.

There’s a broader message here too, which is that we should be naturally cautious about market narratives that paint the UK as a material outlier relative to other parts of Europe. Last summer's story about the UK having a worse inflation problem subsequently proved to be exaggerated. Similarly, we're now sceptical that the Bank of England will stand out from the crowd when it comes to rate cuts in 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article