Why Spain’s housing market is set to cool this year

A downturn is expected in the Spanish property market due to the rise in interest rates and tighter credit conditions, which could cause property prices to stagnate this year. However, a crash like the one seen during the financial crisis seems unlikely. The market is still expected to outperform the eurozone average thanks to robust demand

House price growth to stall next year

Despite the sharp rise in interest rates and economic uncertainty, Spanish house prices rose by an average of 7.4% in 2022, Eurostat figures show. However, this trend is expected to end in 2023. The favourable tailwind of falling interest rates has reversed over the past year. Moreover, it is anticipated that credit conditions will become stricter, and interest rates will continue to increase in 2023, ultimately slowing down the property market's momentum. We forecast that property prices will remain stagnant throughout 2023, with a possible decline in the first half of the year. While the nominal price decline will be limited, the price decline in real terms is likely to be much larger: inflation-adjusted house prices are expected to fall by 7% in three years, from 2022 until 2024.

Moreover, even after 2024, it is unlikely that house prices will continue to rise as rapidly as in recent years, as the leverage of falling interest rates has disappeared. Over the past 10 years, mortgage lending rates have fallen continuously, resulting in an increase in household borrowing capacity that has outpaced income growth. However, this trend ended abruptly last year with the sharp rise in interest rates. Since we are unlikely to return to the extremely low interest rates of the past, this may mark the end of the rapid price growth seen over the past decade.

Evolution of average annual house price growth, including ING forecasts for 2023 and 2024

Data from Eurostat shows that house price growth was already slowing in the fourth quarter of 2022, from 7.6% year-on-year in the third quarter to 5.5% in the fourth quarter. Tinsa's monthly data, which is closely linked to the Eurostat quarterly index, showed that the slowdown in house price growth continued in the first two months of this year. Although all regions showed a downward trend, there were significant differences between regions. Prices cooled the most on the Mediterranean coast and in the Balearic and Canary Islands, where house prices rose by 4.5% and 3.4%, respectively in February compared to last year. In contrast, prices in metropolitan areas continued to rise by 7.9% year-on-year. The cooling seems to be more gradual there. Due to limited land availability in metropolitan areas, strong growth in demand for housing can easily outstrip the available supply, pushing up prices.

Tinsa house price index by region, % annualised, February 2023

Property demand remained strong in 2022 despite rising mortgage rates

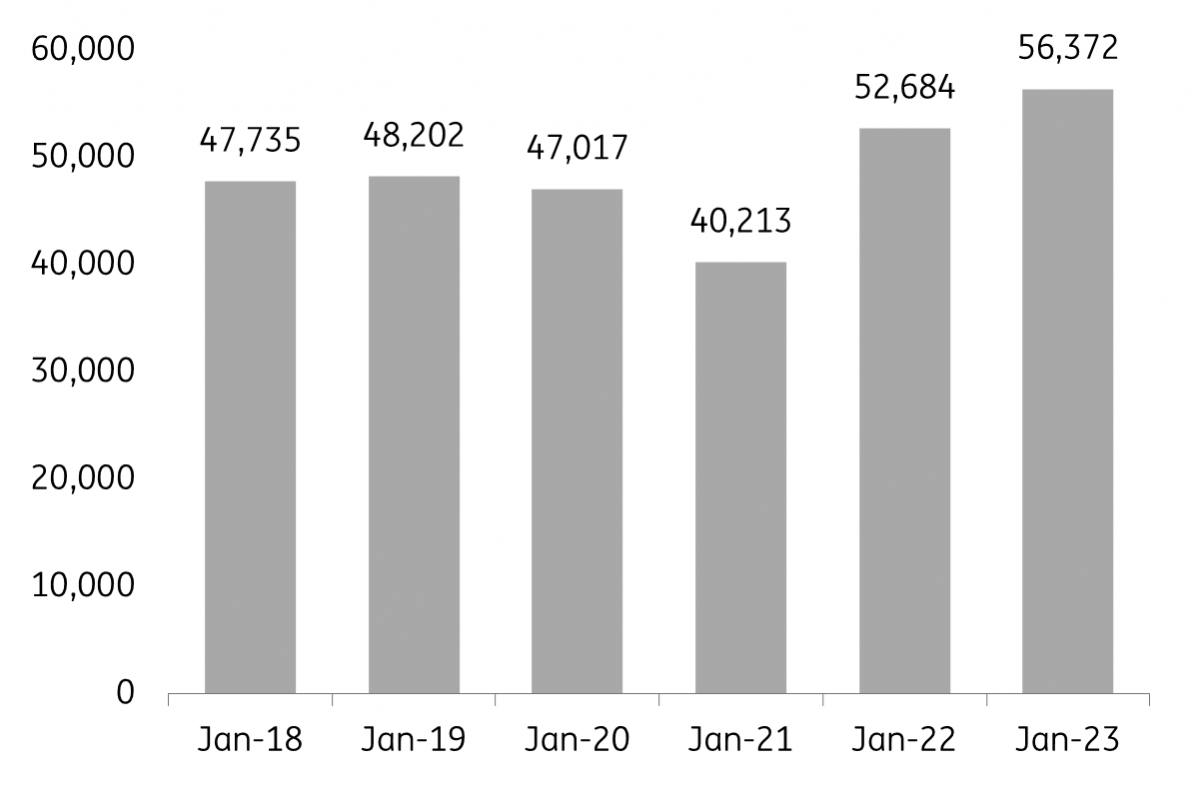

Despite a significant rise in mortgage rates, demand for real estate remained strong in 2022, with a 16% surge in the number of transactions and an 11% uptick in mortgage production compared to 2021 which was also an exceptionally strong year. The number of mortgage loans granted remained consistently higher than the five-year average throughout 2022. The January figures published earlier this week also show that mortgage production in January was still above the average of recent years. The same is true for the number of transactions.

Compared to other eurozone countries, demand for housing in Spain has fallen relatively less since the previous summer season. This can be attributed to several factors. First, Spain's population has grown faster than in many other eurozone countries, which has led to a stronger increase in housing demand. Second, Spain is a sought-after location for international buyers, especially from the UK and northern Europe, driving up housing demand. Third, Spain's GDP growth has outperformed that of most other major eurozone economies since 2015. Also in 2022, growth rates were significantly higher than the eurozone average. Strong Spanish GDP growth, coupled with a significant drop in unemployment, which has also fallen faster in Spain than in other major eurozone economies since 2015, has also fuelled demand for housing. A final contributing factor is Spaniards' optimistic view of the property market. According to the European Central Bank's latest bank lending survey, demand for loans has fallen less in Spain because Spanish households are relatively more confident in the property market compared with other eurozone countries.

Number of transactions, 2018-2023, January only

Although mortgage production and home sales remained strong in 2022, a gradual weakening of demand is projected in 2023. The main reason is the rise in mortgage rates whose impact will be increasingly felt. Additionally, a decline in economic growth and the effect of high inflation on purchasing power will also contribute to the deceleration of the market. Certain factors that boosted the property market last year are also expected to fade away in the current year. The demand for housing last year was likely boosted by families utilising their accumulated savings during the pandemic to purchase a house. In addition, many buyers may have accelerated their purchase decisions last year to get ahead of rising interest rates. However, these factors are expected to lose momentum this year. Finally, a further tightening of credit conditions will also weaken demand. The European Central Bank's recent Bank Lending Survey shows that Spanish banks expect a further tightening of credit conditions, after also noting a significant tightening in the fourth quarter of 2022. The recent turmoil in the banking sector will reinforce this trend. So there are several clear signs that demand will weaken in the first half of this year, which will also weigh on house price growth.

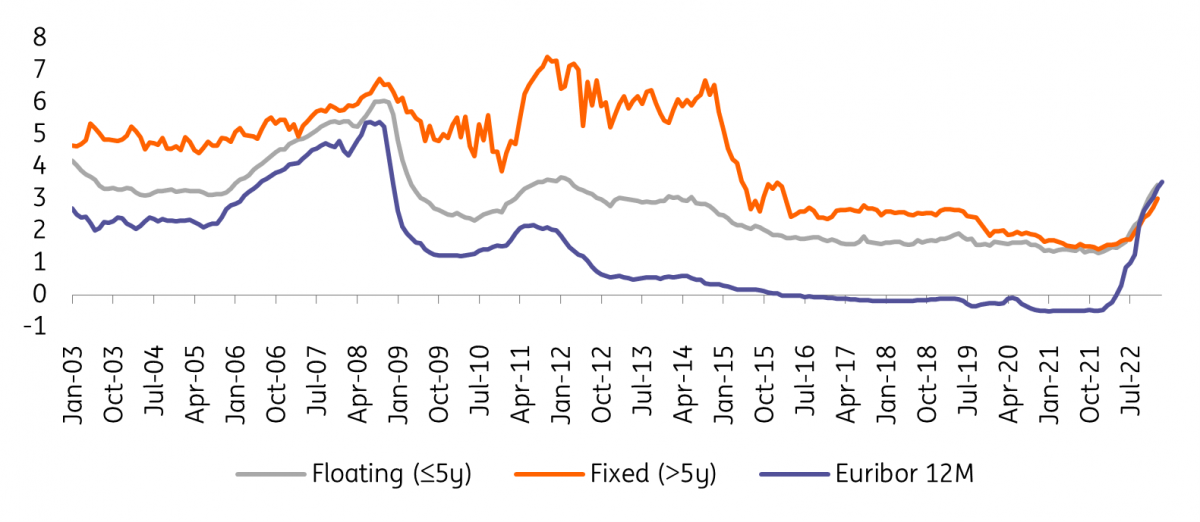

Mortgage rates to rise further in 2023

The 1-year Euribor rose from -0.5% on 1 January 2022 to 3.5% at the end of March, leading to a significant increase in mortgage lending rates. Mortgage rates are expected to rise further in the first half of 2023. As shown in the chart below, the gap between Euribor and mortgage rates has narrowed significantly recently, suggesting that mortgage rates have yet to catch up, with fixed rates posing the biggest upside risk. Following the collapse of Silicon Valley Bank and the acquisition of Credit Suisse by UBS, Euribor fell significantly. Despite this, it is unlikely that mortgage rates will follow suit. The banking turmoil has caused banks' funding costs to rise sharply, leading them to further tighten their lending conditions in the coming months. According to the ECB's latest Bank Lending Survey, conducted before the issues in the banking sector, Spanish banks were already planning to tighten lending conditions in the first quarter of this year. The recent turmoil will further reinforce this trend. In addition, we expect the ECB to raise interest rates further in the coming period to curb inflation. Despite a fall in headline inflation due to lower energy costs, core inflation in the eurozone remains stubbornly high. We assume the ECB will raise policy rates by 25 basis points twice before pausing. Consequently, all these factors could lead variable mortgage rates to exceed 4% in the second half of the year, while fixed rates could rise to 5%.

Fixed and floating rate of new loans for house purchase & Euribor 1Y

Variable-rate mortgages on the rise again

Since 2015, the share of new fixed-rate mortgages has risen rapidly to more than half of all loans in 2021, from less than 5% before. Many homeowners took advantage of low interest rates to secure their borrowing costs, especially in view of the uncertain outlook and expected further interest rate hikes last year. In July 2022, three out of four mortgage loans had fixed rates, but this trend seems to have reversed since then. Recent data from INE shows that more borrowers are again opting for variable rates, as the share of variable rates rose from less than 25% in July 2022 to almost 35% in November. This seems to indicate an increase in the number of households speculating on a possible fall in mortgage rates. In the short term, however, there are still upside risks to mortgage rates, which will increase borrowing costs for those who recently took out variable-rate loans. While we expect mortgage rates to peak by the summer, we do not expect a sharp fall in the second half of the year. In the longer term, while interest rates may fall again, they are unlikely to return to the extremely low levels of early 2022. Moreover, variable interest rates have recently moved higher than fixed rates, making a fixed contract relatively attractively priced at current rates.

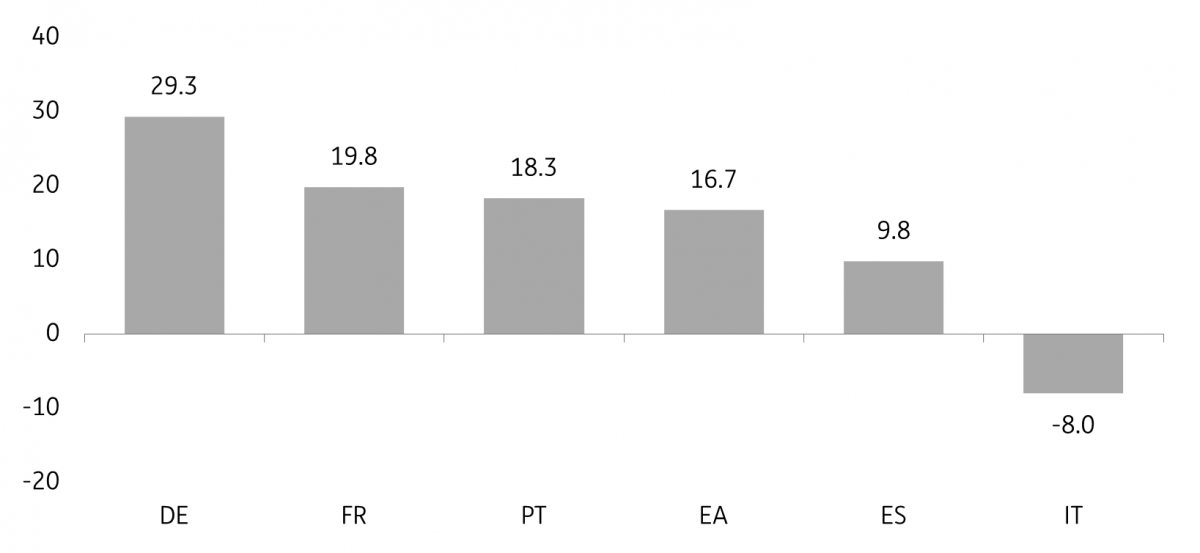

Spanish houses almost 10% overvalued according to the ECB

According to the latest overvaluation estimates from the ECB, the Spanish property market seems to be better positioned to withstand the cooling down period compared to other major eurozone economies. The ECB estimates the current overvaluation at 9.8%, which is lower than the eurozone average of 16.7%, and significantly lower than overvaluations in countries like Germany (29.3%) or France (19.8%). As Spanish house prices rose more slowly during the pandemic than in other countries, overvaluations also increased less strongly. This lower overvaluation indicator suggests that the Spanish property market is expected to experience a milder price correction than other countries. Moreover, the ECB's overvaluation estimate is expected to fall in 2023, even without a nominal fall in house prices, as house prices will rise less rapidly than inflation and mortgage rates will stabilise in the second half of the year.

ECB average overvaluation estimate in 3Q 2022 for major eurozone economies

Spain has the third worst performance of all European countries in reducing carbon emissions in the residential sector

Buildings in Spain play an important role in the country's total energy demand. In 2019, buildings accounted for 28.7% of the country's total energy demand, which is slightly lower than the European average of 39.7%, but still a substantial share. Furthermore, buildings in Spain contribute to 62.9% of the total electricity demand, which is even higher than the European average of 58% (based on the Annual Energy Data Report, click here for the link to the report). To achieve the EU's climate goals, it is, therefore, crucial to encourage energy innovations to improve the energy efficiency of buildings and reduce electricity demand. Spain has the great advantage of having a favourable starting position. In 2020, for instance, the Spanish residential sector emitted only 0.32 tonnes of carbon emissions per capita, about half the European average and significantly lower than in other major eurozone economies, such as Germany (1.08), Italy (0.74) and France (0.57). This can be attributed to Spain's favourable warm and sunny climate and Spanish lifestyle that involves spending more time outdoors.

Residential sector carbon emissions, in tonnes per capita, 2020

But despite these good figures, Spain has a slower rate of improvement compared to other European countries. From 1990 to 2020, per capita carbon emissions in the Spanish residential sector only fell by 1.5%, compared to an average European drop of 33%. Furthermore, it is the weakest decrease among all European countries, after Portugal and Greece, where emissions even slightly increased during this period. In addition, the reduction in carbon emissions is mainly due to the mild winters in recent years, and without this favourable effect, emissions would likely have increased. Therefore, Spain must increase its efforts to reduce emissions and improve the energy efficiency of its buildings to meet the EU's target of climate neutrality by 2050.

Improving the energy efficiency of buildings would not only benefit the environment but also sustainably reduce household energy bills, which is crucial for lower-income households. OECD figures for 2020 show that 23% of households in the lowest income quintile struggle to keep their homes adequately warm, and this figure is currently likely to be even higher due to the sharp rise in energy prices last year. A more energy-efficient building stock would therefore not only help the EU meet its climate target but also help low-income households in paying their energy bills.

Residential carbon emissions per capita, 1990-2020, 1990 = 100

In summary, a crash seems unlikely and Spain is likely to outperform the eurozone average

Despite the cooling down of the Spanish property market, there is no indication that the country is heading towards another crash similar to the one seen during the financial crisis. On the contrary, the market is in fact expected to outperform the eurozone average. Demand for property remains robust, with the number of mortgages granted and transactions still above the levels of recent years. Furthermore, various overvaluation indicators, such as the ECB's, suggest that overvaluation in Spain has increased less than in other countries. This suggests that the Spanish property market is better positioned to withstand the cooling down period. Additionally, Spain's economic recovery after the pandemic was stronger than in other countries, which will likely contribute to the resilience of the property market.

Finally, Spain will have to make an additional effort to meet the EU's climate target by 2050. Since 1990, greenhouse gas emissions from the residential sector have barely declined. Spain has a favourable starting position, but the gap with other European countries has narrowed considerably. An additional effort in this area will also help sustainably reduce household energy bills, which is especially needed for the lowest incomes. OECD figures for 2020 show that 23% of households in the lowest income quintile struggle to keep their homes adequately warm, and this figure is currently likely to be even higher due to the sharp rise in energy prices last year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article