How is Malaysia bucking the global slowdown?

Firmer growth, low inflation, and a healthy external payments position – everything is coming together to support investor confidence despite the current global economic turmoil. That said, we don’t think the authorities will relax just yet - we expect another 50 basis points of rate cuts in 2019

| 4.7% |

GDP growthING forecast |

So far so good – an economy that surpasses expectations

Malaysia's economy seems to be relatively unscathed despite the ongoing global trade and tech war, as well as the slump in the tech sector.

Last week, the country’s GDP growth improved to 4.9% year-on-year in 2Q19 from 4.5%. It wasn’t a complete surprise though. A pick-up in exports and manufacturing growth foreshadowed the GDP improvement, leaving the year-to-date economic performance on par with that in the full-year 2018.

Private consumption continued to be the key GDP driver from the spending side, making up for the continued slack in investment demand (both public and private), while inventory depletion also continued to drag headline growth downwards in the first half of the year. Stronger private sector performance was underpinned by persistently low inflation and accommodative monetary policy and weak public spending hasn’t been a surprise either as the government is reigning in its expenditure after a blow-out deficit last year.

Despite external headwinds, exports were almost flat in the first half of the year compared with sharp declines in neighbouring economies. As such, net trade contributed more to the GDP growth in the first half of the year than it did all of last year, which, in turn, was consistent with a near-doubling of the current account surplus to MYR 30.7 billion from a year ago.

Services remained the key growth driver from the industry side, though the improvement in the manufacturing contribution is noteworthy.

Expenditure and industry-side sources of GDP growth

What’s behind the export outperformance?

Following a 14% (USD denominated) surge in exports last year – the fastest in Asia - some export weakness was inevitable this year.

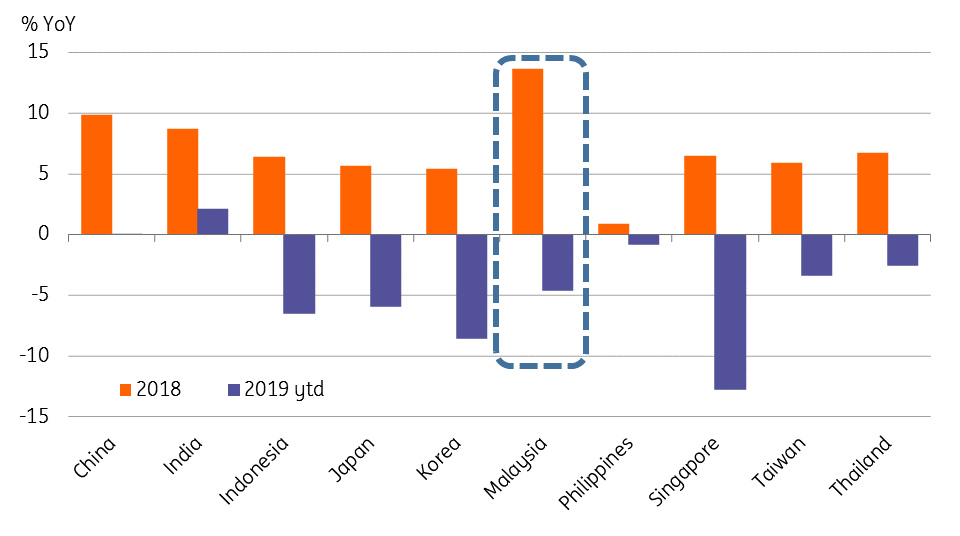

Given Malaysia's heavy export exposure to electrical and electronic goods, the outlook for Malaysia's export sector was about as bad as you could imagine. But a 5% fall in exports in the first half of 2019 from a year ago wasn’t at all bad in comparison with sharp export declines elsewhere in Asia.

Asian export performance

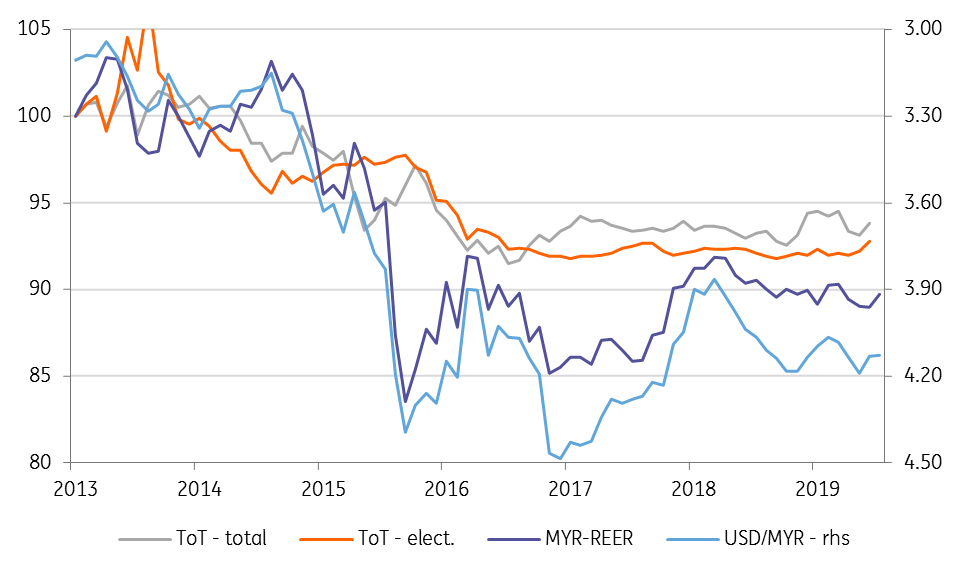

Among the key factors supporting Malaysia’s export performance this year are continued favourable terms of trade, an undervalued currency, relative electronics strength, and maybe some supply chain diversion.

- Terms of trade: The 2014 commodity price crash was a huge negative shock for Malaysia's commodity-driven economy. Commodity prices started to recover in 2016 but the terms of trade failed to follow suit. While the recovery in both global commodity prices and Malaysia’s terms of trade was further hampered with the onset of the trade war between the US and China last year, this probably helped sustain Malaysia's exports competitive advantage in international markets.

- Undervalued currency: The Malaysian ringgit (MYR) hasn’t escaped the emerging market contagion. The MYR lost 2% of its value against the USD in 2018 and another 1% so far this year. This despite a relatively stable economy with a healthy balance of payments. The weak currency is boon for exports.

Still favourable terms of trade, undervalued currency

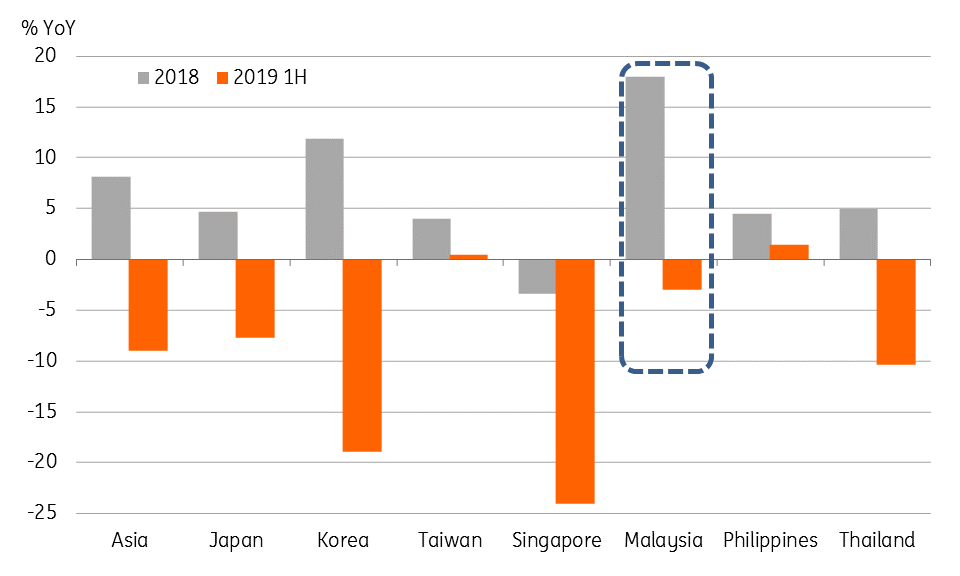

- Electronic export outperformance: Even though Malaysia's E&E exports aren’t immune to ongoing global electronics weakness, a 3% YoY fall in these shipments in the first half of 2019 compares very favourably with large declines elsewhere in the regions. (24% fall in Singapore, 19% in Korea, and 10% in Thailand's electronics exports). Malaysia isn't very far off the Asian outperformers including Taiwan (+0.4%) or the Philippines (1.5%), whose relative strength this year follows excessive weakness last year.

Asian electronics export performance

- Supply chain diversion: The outperformance of Malaysia’s electrical and electronics industry relative to its Asian counterparts may lead one to wonder whether Malaysia is taking market share from other Asian countries. Not necessarily from Singapore, though Malaysia appears to be gaining some edge here too.

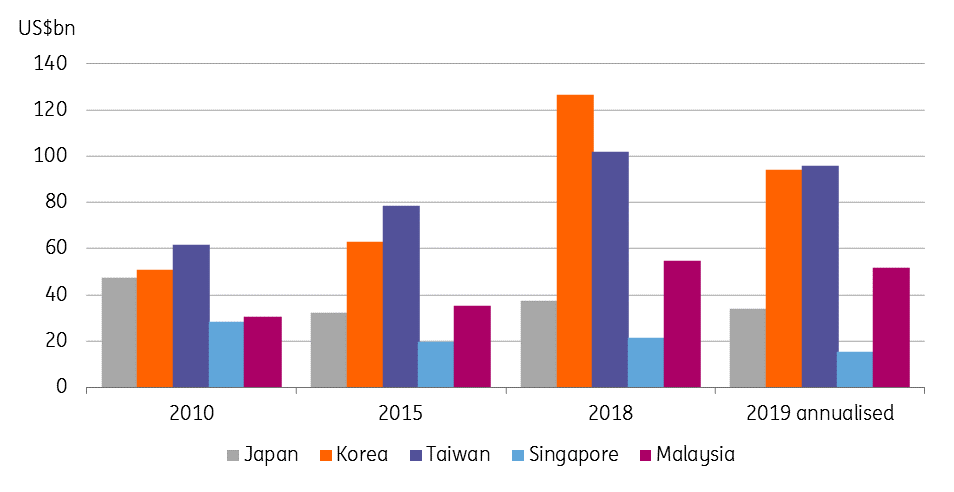

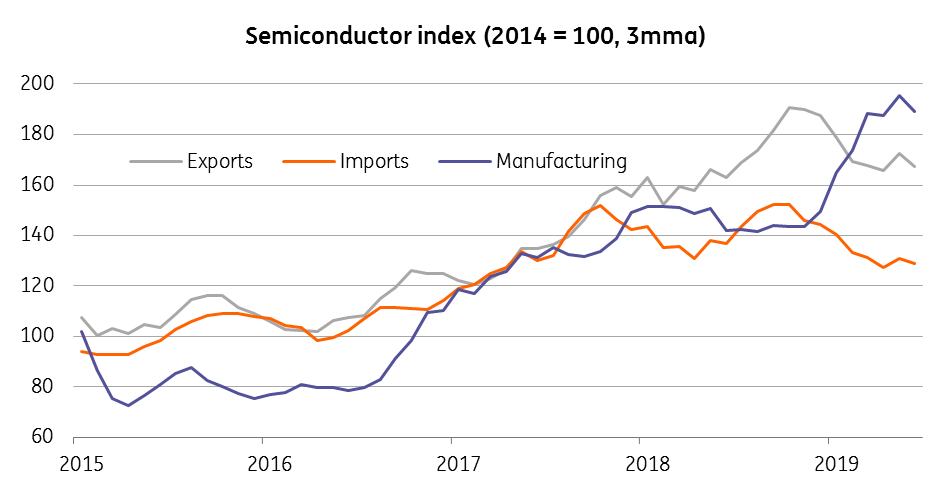

Some of the facts substantiating this view include a big surge in foreign direct investment inflow in the northwest coastal states as well as a surge in semiconductor manufacturing and exports this year. A Bloomberg story recently pointed out the state of Penang, already home to big tech companies, has attracted large FDI inflows this year, which together with a surge in semiconductor manufacturing this year (23% YoY in the first half of 2019) and in exports (up 6%) are hopeful signs that Malaysia is moving up the value chain.

Asian semiconductor exports - Is Malaysia moving up the electronics value chain?

Further exploring electronics potential

The electrical and electronics sector forms a significant part of Malaysia's economy. Exports from this sector account for about 38% of Malaysia’s total exports and were equivalent to about 26% of the country’s GDP in 2018. Virtually all of Malaysia’s trade surplus is being generated from the electrical and electronics sector, while the sector also accounts for almost a quarter of manufacturing output (GDP), employment and investment.

Despite the big weighting in trade and manufacturing, the electrical and electronic sector's contribution to overall GDP and employment has been pretty low. Although this may come across as a low-value adding nature of the sector, which also conforms to high import content of E&E exports, the fact that virtually all of Malaysia’s trade surplus is generated from the E&E trade challenges the low value-added argument.

Until recently most of the E&E imports were processed for re-export, and even the strong surge in exports in recent years (19% in 2017 and 11% in 2018) failed to stimulate Malaysia's manufacturing out of its low single-digit growth path. However, this seems to have changed since the outbreak of the trade war.

Electrical and electronics - key facts

E&E - the biggest contributor to the trade surplus

The recent outpacing of Malaysia's electrical and electronics exports over imports may well be a transitory side-effect of the global trade war exerting weakening pressure on the currency and thus depressing imports (but then that would have also benefited neighbouring economies, which it doesn't seem to have done).

Or, more likely, this may be evidence of a structural shift as part of the supply chain relocation in the intensifying US-China trade and tech war.

Malaysia's semiconductor surge

Near-term economic outlook - steady as she goes

Yet, it’s hard to imagine the economy continuing to outperform the rest of the world as global trade tensions touch new heights. Nor do we see Malaysia's electronics sector continuing to beat the global tech slump, though elsewhere in the region, some green shoots may have started to emerge in this sector.

Nevertheless, we see growth lingering close to the high end of the government’s 4.5-5.0% forecast range (revised from 4.3-4.8% following 2Q GDP report earlier this month) in the remaining two quarters of the year. We maintain our growth forecast at 4.7% for the current year and 4.9% in 2020. Any easing of trade tensions will be more positive for growth next year, though as things stand now there are no reasons to be too hopeful about the trade war. We expect sluggish global demand and subdued commodity prices to limit upside growth potential, while firmer domestic demand will limit any downside to growth from here on.

Barring any more severe trade shocks, or a commodity price shock, we see no reason for GDP growth to drift far from the 5% potential level the economy has managed in recent years. In its 2018 Annual Report, the central bank estimated a range of potential growth in the current year at 4.6-5.1%, just a tick down from 5%.

Weak public finances, healthy external payments

While talk of fiscal stimulus to boost growth has been gaining traction around the world, Malaysia’s tight public finances offer little scope for a big fiscal boost. However, a renewed boost to investment by reviving some of the key infrastructure projects stalled last year should help.

The East Coast Rail Link (ECRL) project is back on track in a significant sentiment booster for foreign investors in Malaysia. After being suspended for a year, China and Malaysia have reportedly resumed construction of the 640km rail line forming a part of China’s Belt-and-Road initiative. Meanwhile, the government has also managed to bring the project cost down by a third to about $44 billion and aims for completion by end-2026. Hopefully, this spins the wheels for another key rail project, the Kuala Lumpur-Singapore High-Speed Rail (HSR), that’s on hold currently.

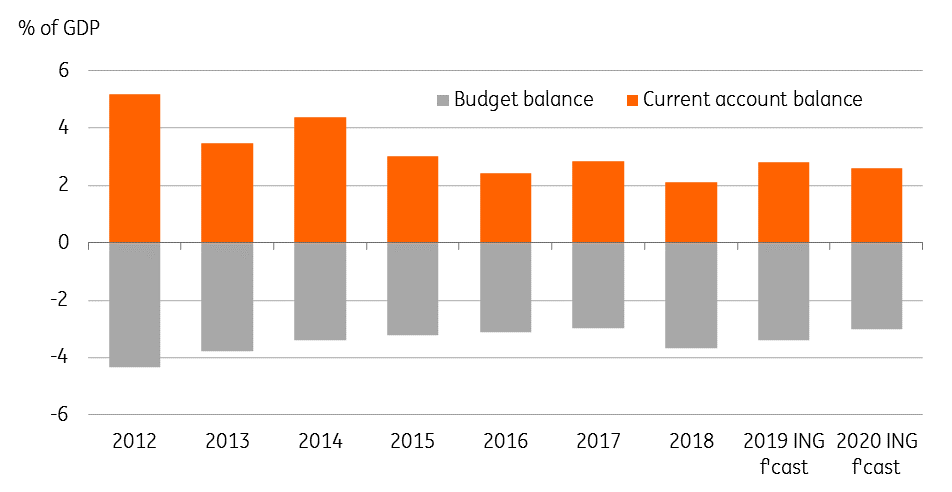

Malaysia's authorities are concerned about public finances staying on track for a target consolidation of the deficit to 3% of GDP by 2020. Their concerns are valid given growing external risks and the current high level of public sector debt, estimated at over MYR 1 trillion. In contrast, we see firmer growth creating scope for the deficit to come in below the 3.4% target this year government revenues are boosted. An 18% YoY rise in revenue in the first half of 2019 was associated with a 27% YoY reduction of the deficit for the period.

Hopefully, this improvement will be sustained over the rest of the year, though we don’t think the government will be rushing into outperforming its target given the wave of fiscal easing taking off globally. We maintain our 3.5% deficit forecast for the current year and 3.3% forecast for 2020.

Meanwhile, Malaysia's external payments position continues to be healthy with 2019 likely marking a turnaround in the trend narrowing of the current account surplus. As mentioned earlier, the MYR 30.7 billion current account surplus in the first half of 2019 was nearly double last year's surplus, prompting a big upward revision to our full-year forecast for the surplus equivalent to 2.8% of GDP from 2.0% earlier.

Budget and current account balances

Inflation isn’t an issue, nor will it be anytime soon

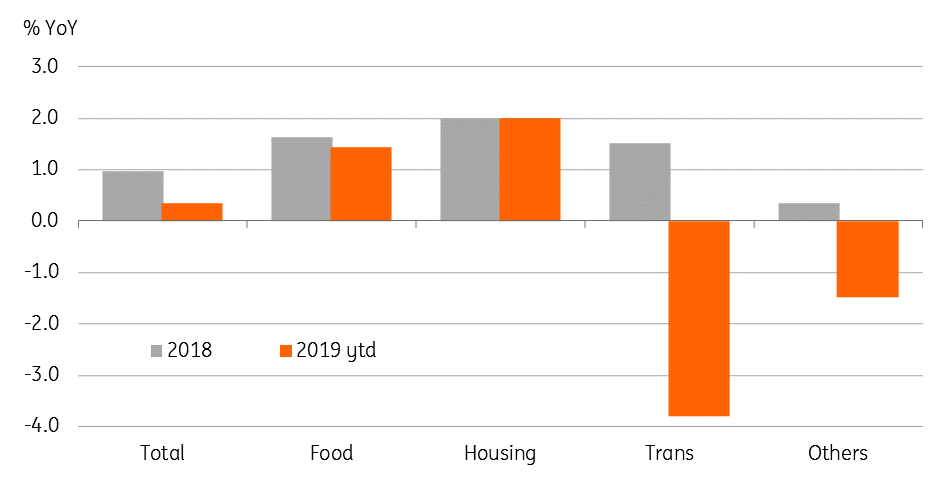

Inflation has surprised on the downside so far this year. At only 0.3% year-to-July we don’t see inflation becoming an issue for the economy anytime soon. The transmission of lower global oil price to domestic fuel prices has been a key source of lower inflation this year. And with prevailing downside risks to global demand, we don’t see oil price inflation posing any inflation threat in the near-term. Inflation in the important transport component should continue in negative territory for the foreseeable future. Among other key drivers, food inflation has risen past 2% in recent months but it’s now close to peaking, while housing inflation remains contained below 2%.

Inflation expectations also remain well-anchored, imparting a downside risk to BNM’s view of inflation this year to be broadly stable at 2018’s 1% rate. We have cut our full-year inflation forecast to 0.8% from 1.0%. Beyond that, we see it staying under 2% for the next couple of years.

Consumer price inflation

How low can BNM policy rates go?

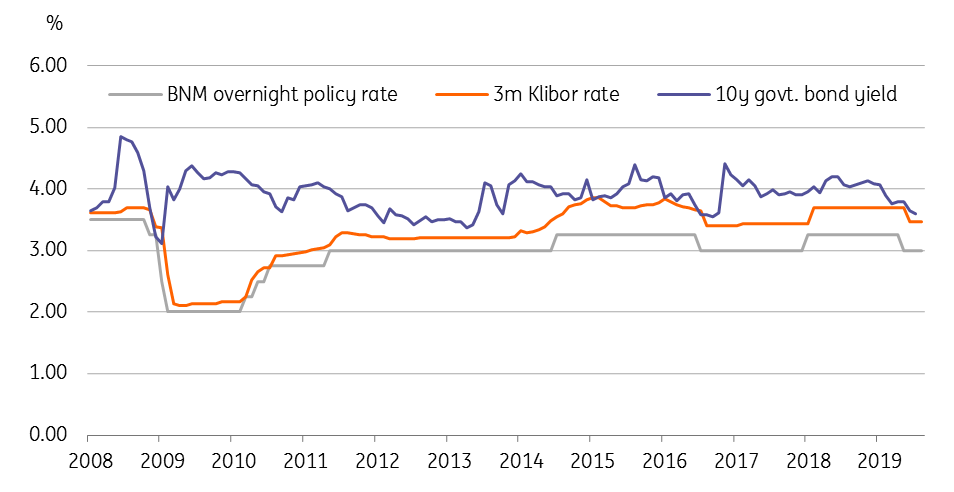

With persistently subdued inflation we don’t think the central bank (BNM) will be left behind in the easing cycle. BNM started easing in May this year with a 25bp cut in the overnight policy rate to 3.0%.

Although the current US-China trade war and tech slump don't compare to the global financial crisis, its impact is more focussed on Asia. Consequently, we believe we can draw parallels between BNM's behaviour then and in the current situation.

If so, then BNM policy rates could go as low as 2.0%. Even so, we believe the central bank will tread a cautious path and abstain from excessive easing. We now anticipate two more 25bp BNM rate cuts taking the overnight policy rate down to 2.50% by end-2019.

BNM policy and market interest rates

Bottom line

Firmer growth, low inflation, and a healthy external payments position – are all coming together in support of positive investor confidence in the economy in the current global economic turmoil. Recent affirmation by rating agency S&P's Malaysia’s ‘A-‘ long-term sovereign ratings with a stable outlook was a vote of confidence in country’s balanced economic outlook for the near-term, with monetary flexibility offsetting weaker yet relatively stable public finances.

With this, we see the Malaysian ringgit continuing to be among the most resilient Asian currencies in the period ahead with the exchange rate against the USD hovering just around 4.2.

Malaysia - Key economic indicators and ING forecasts

Download

Download article27 August 2019

What’s happening in Australia and around the world? This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).