Why is Japan’s inflation so low?

Consumer price inflation rose 3.0% YoY in August, and we look for headline inflation to stay above 3% for the rest of the year – but that's probably the highest it can go. We think a lack of demand-side pressures is a key reason for low inflation. With little sign of improvement in household income, CPI inflation will likely fall below 2% next year

Japan's inflation is low by global standards

The global economy is now at war with high prices. Although prices in major economies appear to be passing or nearing peaks, inflation remains at an elevated level in many countries. The main reasons for this are: 1) excessive liquidity was injected into the economy during the pandemic to mitigate the impact of Covid-19, and 2) the Russia-Ukraine war has triggered high commodity prices and worsened global supply bottleneck problems.

Indeed, while Japan has – despite the influence of both factors – managed to maintain relatively low inflation, its CPI inflation also rose in August to 3.0% YoY, from the recent low of -1.2% in December 2020. Services price growth has been muted while goods prices have been the dominant factor in the recent inflation rise.

Japan's CPI inflation has risen due to goods prices, but is significantly lower than other DM countries

What are the differences in CPI weights between Japan and other developed markets?

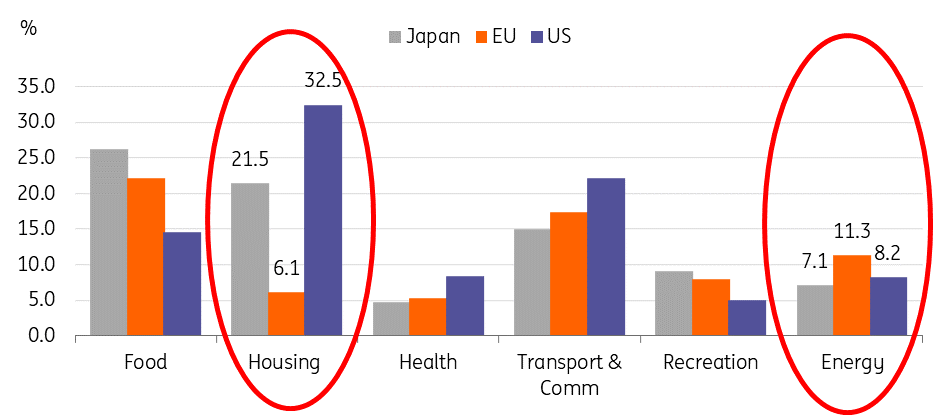

Looking at Japan’s CPI basket as of August, food is the largest category accounting for 26% of the total CPI weight, followed by housing at 21.5%. Among other major categories, energy and recreation are relatively small at 7.1% and 9.1% respectively. Comparing Japan’s weight to other developed markets, its energy share is lower than that of the US and EU, and its housing share is intermediate between the US and EU. Why is this important? Because these are the two main contributing factors that are keeping inflation in Japan low.

The different CPI weights per country could explain Japan's low inflation

Energy prices in Japan have surged, but not as much as in the US and EU

Japan, being a net energy importing country, cannot opt-out of rising global commodity price rises. However, energy inflation in Japan has grown slower than in the US and EU. In our view, long-term contracts have provided some cushioning for Japan’s liquefied natural gas (LNG) imports. According to the International Gas Union, oil-linked contracts accounted for around 67% of LNG purchases in 2018, thus Japan has received more protection from the recent strength in gas prices. In addition, and probably more importantly, Japan imports about 10% of LNG from Sakhalin, Russia under long-term contracts, but there has been no major supply problem in the channel so far.

Energy prices in Japan have surged, but not as much as in the US and EU

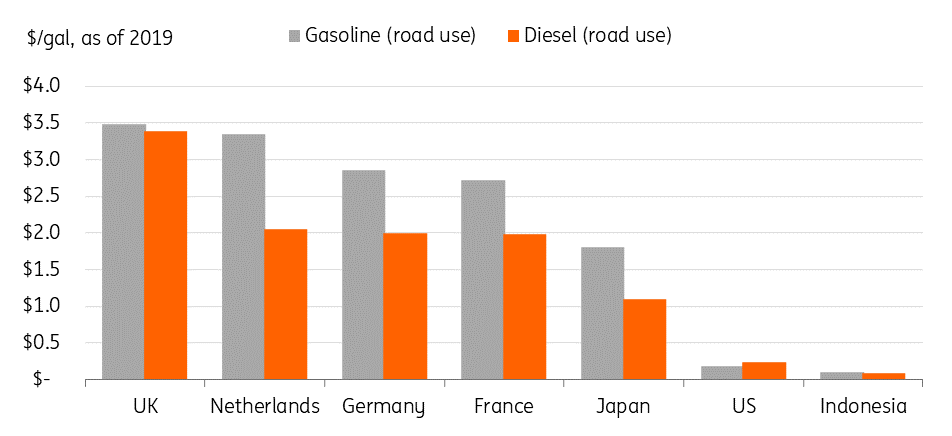

Fuel tax might be another reason for Japan’s low energy price compared to the US. While European countries tend to tax petroleum fuels at the highest level globally, Japan has also set taxes relatively high by global standards (but not as high as the EU). Higher tax rates provide some cushioning from crude energy price changes, and while in places like the US, where there are much lower taxes, the price swings come through quickly and fully. In the case of Japan, the government took the subsidy option for the first time in recent history and increased fuel subsidies to refiners and oil product importers. Ever since the temporary subsidy programme was introduced in January – with 3.4 yen per litre paid to oil distributors and importers – the ceiling on the subsidy has increased, to 37.3 yen per litre in May.

The government's efforts to cut fuel tax has also lightened the price burden

House prices in Japan have never recovered from the 1990s real estate crisis

The rental components, making up a fifth of the inflation basket, have recently risen but only negligibly compared to the US and EU. Japan suffered a real estate bubble burst in the early 1990s, and the market has never recovered from the losses. In general, there is a positive correlation between house prices and rentals with a time lag, but since there has been no increase in house prices in Japan, the rental components of the CPI have stagnated as well. The US and EU’s house prices surged during the pandemic, and lagged effects of house price gains have pushed up rents sharply to 6.3% in the US and a more modest 2.1% in the EU. Crucially, we don’t see any significant gains in the housing market in the long run with an ageing population, which will also anchor Japan’s relatively low inflation in the future.

Japan's property market hasn't fully recovered, thus rent inflation hasn't changed much

Why have house prices remained weak despite the low interest environment?

There can be a number of reasons holding back the housing market’s recovery. Looking at the supply and demand in the real estate market, it seems that there was an oversupply problem as housing supply continued for a while even after the bubble burst. From the early 1990s to the early 2010s, the number of new uncontracted apartments remained relatively high. Meanwhile, demand for real estate moved in the opposite direction as the population declined. Other than the supply and demand mismatch, there may be other reasons to explain the poor real estate markets, such as prospective buyers only wanting earthquake-resistant homes, or because the trauma of the real estate crisis has driven people away from investing in housing.

Japan oversupplied new housing even after the crisis

Household income conditions have only slightly improved

The price elasticity of demand of Japanese consumers is quite sensitive to price increases and companies’ cautious price-setting behaviour reflects this purchasing attitude of consumers. Thus, inflation remains low and creates expectations of low inflation in future. (A comparison of Japanese and US New Keynesian Phillips Curves with Bayesian VAR-GMM, March 2022, Bank of Japan Working Paper Series).

Household income growth has been near zero for the past 20 years

It is true that household income has barely increased over the past two decades. Wage growth has been fairly weak while asset prices in Japan have also struggled to recover from their previous peaks. The Japanese stock market has risen only 20% since 1987, while US and EU stocks have grown nearly ninefold and fourfold, respectively, over the same period. The stagnant stock market also suggests that companies are performing poorly, and margins are shrinking, leaving little room for companies to increase prices. An ageing population also increases consumers’ propensity to save. What all this suggests is that households’ purchasing power has not strengthened, which means consumers’ desire to consume is likely to be suppressed.

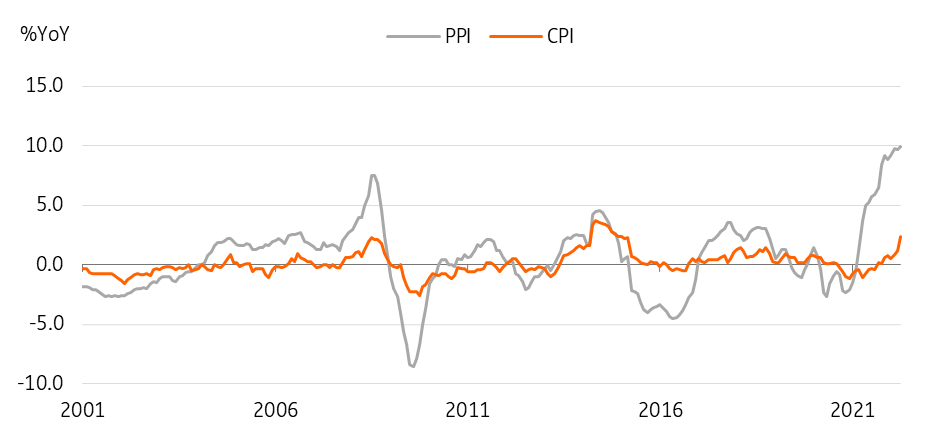

Businesses cannot effectively transfer input price hikes to consumer prices

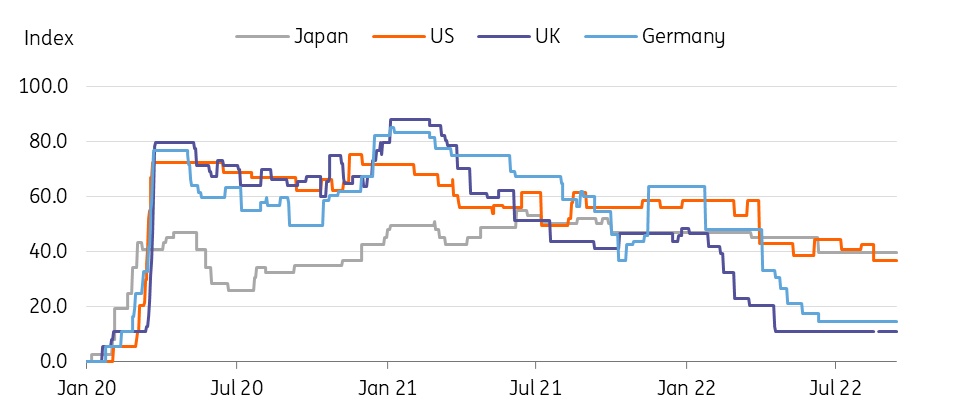

The pace of reopening in Japan has been slower than that of the US and EU

Last but not least, the pace of reopening is another reason to explain the slow inflation rise. The recent sharp rise in prices has mainly been driven by constraints on the global supply side, but a recovery in demand after mobility restrictions in many countries were lifted last year has also contributed. Japan has been one of the most conservative countries in relaxing social distancing measures and it only started easing the rules in April this year. Although the government continues to relax measures, many rules are still intact and cross-border mobility is still tightly regulated with quarantine and testing. Thus, the pressure on the demand side for energy from the reopening has been weaker than in the US and EU.

Stringency index shows that Japan’s measures have not been completely lifted

Short-term inflation outlook: pipeline prices appear to have stabilised since June

Despite the recent weakness in the Japanese yen, the drop in global oil prices has led to price stabilisation in recent months. Producer price inflation remained unchanged at 9.0% year-on-year in August (vs 9.4% in June) and import price growth continued to slow to 21.7% in August (vs 26.1% in July). With the market consensus of global oil prices falling further by the end of this year, we think pipeline prices are expected to decline accordingly.

Despite the deceleration in pipeline prices, consumer prices are expected to rise further for the duration of the year. The low base from last year would be a factor and the second-round effect from high commodity prices – manufactured food – will come into play over the next few months. According to a recent survey, the prices of 6,532 food items are expected to rise in October, compared with 2,493 items in August and 2,424 items in September. In addition, relatively healthy labour conditions combined with a reopening boost will support additional gains in prices for the time being.

The Bank of Japan outlook

Although today's CPI outcome was slightly higher than expected, we believe it is unlikely to prompt the Bank of Japan (BoJ) to change its policy on Thursday. But, it will certainly have to find more convincing messages to justify its easing policy with the relatively fast pace of inflation rise – by Japanese standards. The BoJ will also have to think about an exit plan as the Covid-19 situation is slowly turning to normal. As the first move, the bank will likely end its Covid-19 support programme as originally planned at its September meeting. If the BoJ decides to terminate the programme as scheduled, it shows its determination to take the normalisation path, but doesn’t necessarily mean that the bank will hike policy rates or change its yield curve control policy anytime soon. As mentioned earlier, the current above-2% inflation is not sustainable beyond six months so we expect the BoJ to remain unchanged for a while.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article