Where next for global central banks?

Everything you need to know about central bank policy around the world

Where next for central banks?

Federal Reserve: A steady climb

The Federal Reserve is sticking to its 'gradual' policy normalisation plan, which essentially means a rate hike every quarter. However in the near term, the balance of risks is skewed towards swifter action despite financial market pre-occupation over the potential for a tariff-led trade war.

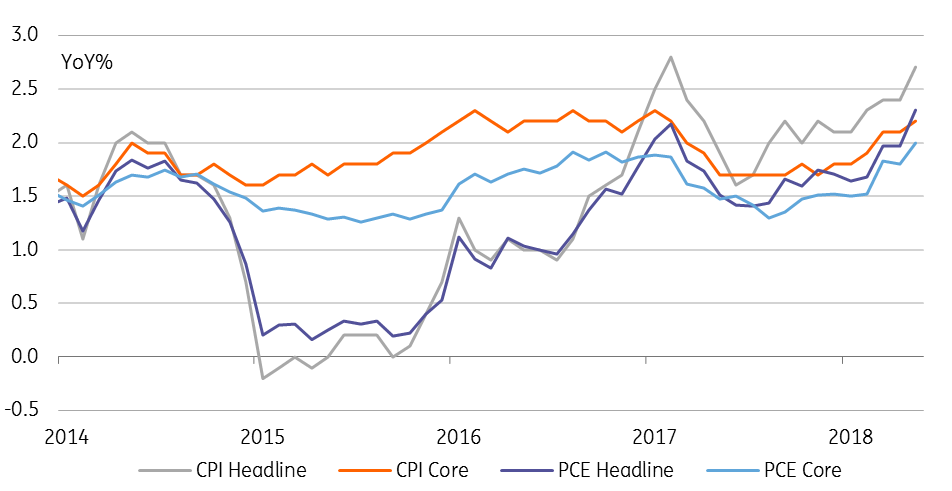

The economy looks set to grow 4% annualised in 2Q18, buoyed by tax cuts, after a 'soft' 2% in 1Q18 while inflation continues to edge higher with headline CPI set to hit 3% YoY in the next couple of months. At the same time, employment growth is averaging 207,000 per month YTD in 2018 versus the 182,000 monthly average in 2017 and you have to go all the way back to December 1969 to find a lower unemployment rate.

For now, corporate America is sanguine on the trade situation. Business surveys are strong given robust demand, but should tensions escalate and trade barriers go up, growth may moderate. This could lead to a slower pace of interest rate hikes in 2019, but the process is unlikely to stop. The tightness in the labour market and rising pay pressures will continue to support both consumer demand and inflation.

US inflation keeps the pressure on for Fed rate hikes

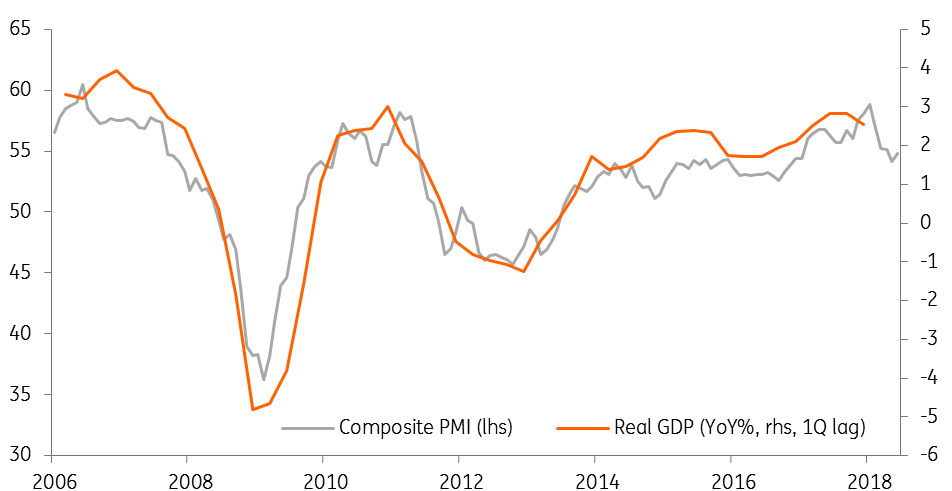

ECB: Dovish tapering

At its last meeting, the European Central Bank found a Solomon judgement to please both the doves and the hawks. A dovish tapering without creating a tantrum. The announcement that the ECB anticipates another reduction of the monthly quantitative easing purchases to €15 billion after September and an end of the net purchases by the end of the year was an elegant way to prepare markets. It would require a significant worsening of the economic situation over coming months, as well as an absence of any signs that core inflation is creeping upwards, for the ECB not to deliver.

However, the increased uncertainty on the back of trade tensions and political turbulence in the eurozone keep the door for a QE extension into 2019 slightly ajar. Once QE has ended, all eyes will be on the timing of a possible first rate hike. Here, ECB president Mario Draghi was very clear: interest rates will remain unchanged at least through the summer of 2019. This would give him two opportunities to hike rates before he leaves office: in early September and late October. In our view, he will use at least one of these two opportunities.

Eurozone data has softened

People's Bank of China: Safeguarding against trade wars

It is a tricky moment for the PBoC. On the one hand, it has to loosen monetary policy to safeguard against downside risks from trade, but it also has to tighten liquidity to fulfil its deleveraging target. The Chinese central bank (PBoC) has stopped following the Fed with rate hikes, and instead has cut the reserve requirement ratio and softened the yuan further to support SMEs through the current trade environment.

As the PBoC is now preparing to safeguard the economy from risks arising from trade and investment tensions, we don't expect the central bank to raise interest rates (7-day repo) in 2H18, but we would expect further RRR cuts at the beginning of each quarter, each of 0.5 percentage points. The RRR cuts, like previous moves, would predominantly release funds to SMEs, which are prone to export risks. As a result, we revise our USDCNY forecast to 7.0 for the end of 2018.

On the other hand, the PBoC will continue financial deleveraging reform by limiting issuance of wealth management products, and therefore restricting credit flowing into local government-related infrastructure projects. Daily liquidity management will remain tight as financial deleveraging reform continues.

China loan growth

Bank of England: Gearing up for an August hike, despite mixed data

The big question everyone is trying to answer in the UK is whether or not the economy has rebounded enough during the second quarter to justify an August rate hike. The Bank of England’s recent commentary increasingly indicates they believe the answer to be “yes”. Chief economist Andy Haldane joined two others to vote for an immediate hike at the June meeting. At face value, the latest data appears to support this. Retailers have had a better ride over recent weeks, while service sector activity has recovered somewhat. On this basis, we think policymakers are keen to hike rates if they can.

But this is not guaranteed. Looking beyond the weather, consumers remain very cautious when it comes to big-ticket purchases. This, combined with higher business rates and rising minimum wage costs, is continuing to lead large high street firms into difficulties. And while the recent overall wage growth trend has been better this year, momentum has begun to slow a little. Based on what policymakers have been saying recently, we still suspect the Bank is gearing up for an August rate hike. But the risks of a rapid succession of hikes beyond then remain low, particularly as Brexit noise ratchets up in the autumn.

UK 1Q growth was poor relative to the rest of the world

Bank of Japan: Taper plans bogged down by trade & ECB

Not a lot has changed for the BoJ since our last update. It continues to pass up on regular bond purchases on occasion, no doubt viewing this as a good way to prevent a premature exhaustion of available instruments when bond yields are behaving themselves anyway. More of this in the future seems likely, even to the point where we cease to think of the BoJ’s purchases as regular, and begin to view them more as reactive, depending on market conditions.

As such, the notion of a stealth taper remains one we like. But the cover for doing this has been reduced as the ECB has made its own taper a very drawn out and slow affair. With limited distraction from them, the BoJ’s own attempts to return to something closer to normality are getting bogged down.

On top of which, with the trade environment globally, and particularly in Asia turning more negative, China beginning to look a little more concerning, and Japan’s own data flow losing some momentum, the BoJ’s own policy intentions have most likely been postponed until later in 2019, at the earliest.

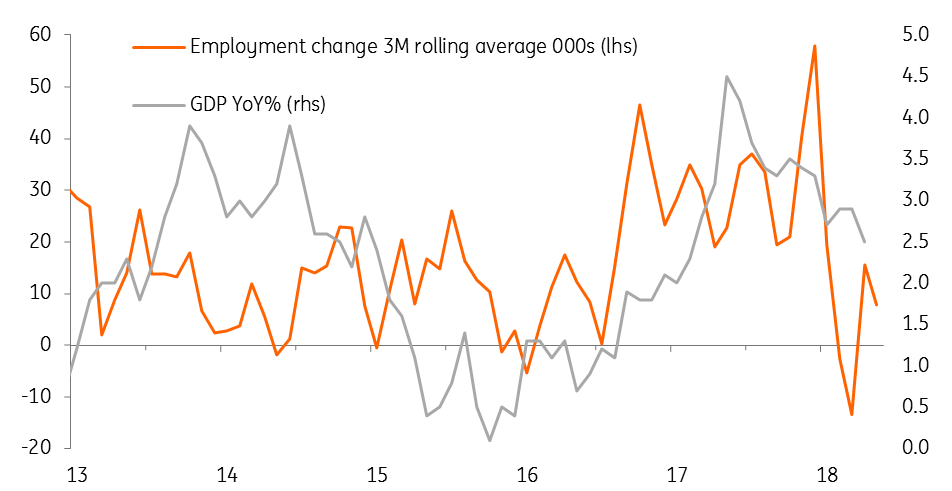

Bank of Canada: Twists and turns

The market had been all set for an 11 July rate hike from the Bank of Canada, but comments from governor Stephen Poloz have muddied the water in recent days. Poloz cited a “litany of things we simply do not know” and the uncertainty over Trump’s trade tariffs as an issue that would “figure prominently in our upcoming deliberations”. This led to markets pricing in the odds of a hike this month at just 50:50.

However, the following day he adopted a more hawkish stance saying that “we’re in a situation where the economy will warrant higher interest rates”. He added “we’re data dependent, not headline dependent. We’re not going to make policy on the basis of political rhetoric”. This suggests he felt markets may have over-interpreted his previous statement. As such, should the numbers come in OK between now and 11 July, we are probably going to get a rate rise.

The outcome hinges on Friday’s Labour report. If employment rebounds strongly after two consecutive falls we'll get a hike. Assuming the trade rhetoric calms as we predict – note Nafta talks are ongoing – then this can pave the way for a further rate rise in 4Q given inflation is broadly in line with target and the economy remains set to grow close to trend this year.

A rebound in Canadian employment could help unlock a rate hike

Riksbank: Still waiting for Godot

The outlook for the Riksbank remains challenging. While the Swedish economy continues to grow at a solid pace (3.3% YoY in 1Q) and headline inflation has reached 2%, growth momentum is slowing down and the underlying trend in inflation remains subdued.

In addition, Sweden’s export-oriented economy is highly vulnerable to escalating trade tensions driven by the US’s aggressive stance, and the domestic housing market remains under pressure.

At its policy meeting on 3 July, the Riksbank left rates and the interest rate path unchanged (indicating the first hike towards the end of 2018).

In the longer term, our view remains that weak domestic inflation pressures and the very gradual tightening of ECB policy means the Swedish central bank is unlikely to deliver its first rate hike until mid-2019. We believe the Riksbank’s policy stance will start to shift slowly in that direction as the year goes on.

Norges Bank: Getting ready to hike

At its latest meeting in June, Norges Bank confirmed its intention to raise interest rates by 25 basis points to 0.75% in September and also raised its interest rate forecast further out. With a strengthening domestic recovery and buoyant oil prices supporting the growth outlook, we think the Bank will stick to the September hike. At this point, it would take a major setback for the Norwegian economy in the next three months to force the NB to change course.

The June decision reinforces our view that the Norwegian central bank is in a more hawkish mode than its fellow central banks in western Europe. While the ECB, BoE, SNB, and the Riksbank have all pushed back rate expectations in the first half of this year, the NB has been going the other way, raising the expected path of interest rates in March and June.

So long as the recovery in the domestic economy stays on track and oil prices hold up, the NB is likely to remain in tightening mode.

Reserve Bank of Australia: On hold as trade uncertainty builds

The Reserve Bank of Australia met on 3 July and held interest rates steady at 1.5%. Although there was a subtle shift in tone to a more negative outlook, it wasn't enough to change our view that the next move for the RBA will be to tighten. We note that inflation could pick up over the coming quarters, and the main reason why policy remains unchanged – stagnant wages growth, is at odds with an improving labour market and rising GDP growth and inflation.

Perhaps the main reason for not tightening is simply an absence of necessity, though this is a bit backward looking. The lack of central bank action is also partly a reflection of the ongoing increase in Australian household debt, which at 190.1% of household incomes, means that any rate hike will have a proportionately greater dampening effect on household spending than it would have done when debt ratios were only 100%. This is becoming a bit chicken and egg though, and debt will not stop rising if rates remain low for an extended period.

The best argument for inaction now is uncertainty about the global trading environment. Although it has not yet hit the commodity space, we expect it to do so in the quarters ahead, which would likely weigh heavily on Australian terms of trade and growth.

Reserve Bank of New Zealand: Dovish rethink has pushed AUD/NZD higher

The Reserve Bank of New Zealand took a much more dovish stance at is latest policy meeting, and signalled that rates could move down as well as up. This has caused a rethink in the forecasting community, which had been assuming that rates would remain on hold for the foreseeable future, like its larger neighbour. Our base case remains that the Bank will stay on hold, eventually followed by some modest tightening. But a more damaging trade environment would provide a suitable catalyst for NZ rates to converge on Australian rates, which are currently 25 basis points lower at 1.5%.

This latest dovish swing from the RBNZ has enabled AUD/NZD to push above 1.09, but we doubt that it could move past 1.13 without a further catalyst specific to the New Zealand economy.

Swiss National Bank: Wait and see

At its June meeting, the Swiss National Bank left its main policy rates unchanged: the target range for the 3-month Libor was maintained between -1.25% and -0.25% and the interest rate on sight deposits with the SNB remained set at -0.75%. Moreover, the SNB reiterated its willingness to intervene if needed in the foreign exchange markets to prevent an appreciation of the Swiss franc. The SNB still believes the Swiss franc is “highly valued” and still believes it is considered a safe-haven asset.

Given the higher than expected inflation during the first few months of 2018, the SNB revised its conditional inflation anticipation (i.e. based on the assumption of no change in monetary policy) upwards for 2018, to 0.9% from 0.6% estimated in March. However, it didn't revise its forecast for 2019 (0.9%), recognising that higher inflation is due to temporary factors. Moreover, it revised its inflation forecast for 2020 downwards, from 1.9% to 1.6% which signals a rather dovish monetary policy over the coming years.

We believe the SNB won’t change its policy anytime soon. Given that the central bank's worst nightmare is a strong appreciation of the franc, we believe it'll wait on the ECB to start raising rates. The ECB announcement that it'll stop bond buying in December isn't enough on its own to make the SNB change its policy. Given that the ECB is not expecting to hike before the end of summer 2019, we think the SNB will hold off raising rates before December 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 July 2018

In case you missed it: Trading blows This bundle contains 5 Articles