What to expect from the July RBA meeting

The June Reserve Bank of Australia (RBA) meeting was significant only in that it punted a lot of decisions to the July meeting. Here's what we think the RBA will do in terms of asset purchases, bond yield targets, and forward guidance on cash rates, and what it means for the Aussie dollar

Decision time

With millions of Australians back in lockdown following the emergence of some Delta variant cases across the country, what ought to have been a very straightforward meeting for the RBA becomes a little trickier, but not much.

The first point to note is that we see absolutely no likelihood of a change to the current forward guidance on the timing of the first hike in cash rates. As the last minutes noted, "For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest". So although the US Federal Reserve has shifted its guidance in the dot plot to 2023 from 2024, the RBA is under no pressure to follow suit and open the door to a possible 2023 hike, at least until it sees some more evidence that Australian wage growth is responding to further employment gains.

The next set of wage data (2Q wage-price index) is not due until 18 August, and there is another RBA meeting before then (3 August).

Target change for the 3Y?

One of the decisions that we were told in June would be taken at this July meeting, was whether the 3Y target would shift from the current April 24 bond issue to the November 24 issue. This feels like a fairly trivial distinction, though at this point, the April issue is further away from a "true" 3-year bond than the November issue.

Semantics aside, the decision could indicate whether the RBA views it as likely that the Bank will still not be raising rates by November 2024, since if it is, it will involve a lot more firepower to keep a November 24 bond yield anchored to 10bp, when over the lifetime of the bond, there is a growing expectation of non-zero cash rates. The RBA has already indicated that it is not going to change the 10bp target, which makes it easier to draw this conclusion than if it had perhaps allowed this to drift higher.

As a result, we think that there is no compelling reason to shift the target issue at all. So that may be made clear.

What about asset purchases?

The next decision for the RBA to take at this July meeting is what to do when the second AUD100bn chunk of asset purchases is completed in September this year.

The available options here are more numerous and include:

- Ceasing asset purchases altogether;

- Repeating a further AUD100bn over the next six months and then reviewing;

- Conducting a smaller amount (say AUD50bbn) over the next six months and then reviewing;

- Repeating a further AUD100bn but over a longer period, say 12 months and then reviewing.

We view option one as unlikely. The simple statement "The Board continues to place a high priority on a return to full employment" that immediately followed the June policy decision strongly hints that until further progress on full employment is made, some asset purchases will persist. So this suggests a choice between options two, three and four.

Option two is our current preference. This would be the simplest choice as it avoids any hint of taper, which the Fed is still mulling, and thus prevents the RBA from looking hawkish relative to the Fed. It potentially leaves the RBA looking quite a bit more accommodative than the US Fed during early 2022, when we believe that actual tapering in the US will take place. But it also leaves open the possibility for signalling a future slowdown in the pace of asset purchases at one of the RBA meetings close to the end of the year, which could reduce the distinction.

Both options three and four could be viewed by the market as de facto "tightening", which makes them trickier to implement, especially this month. The reality, however, is that both options still represent incremental easing, just at a slower pace. Given the current Covid difficulties Australia is experiencing, and the uncertainty that this creates, we think that it is probably harder for the RBA to market such a change at this meeting. Though if we don't see option two, then our preference is for option three, as it ties the RBA's hands for a shorter period of time than option four.

AUD: We expect a contained negative reaction

After a number of central banks turned more hawkish in their policy messages – and especially after the June FOMC meeting - market expectations around a similar shift by the RBA have increased. Very strong jobs data has endorsed these increasingly hawkish expectations, but the tone among RBA officials has remained quite neutral, signalling that all policy decisions would be discussed at the July meeting.

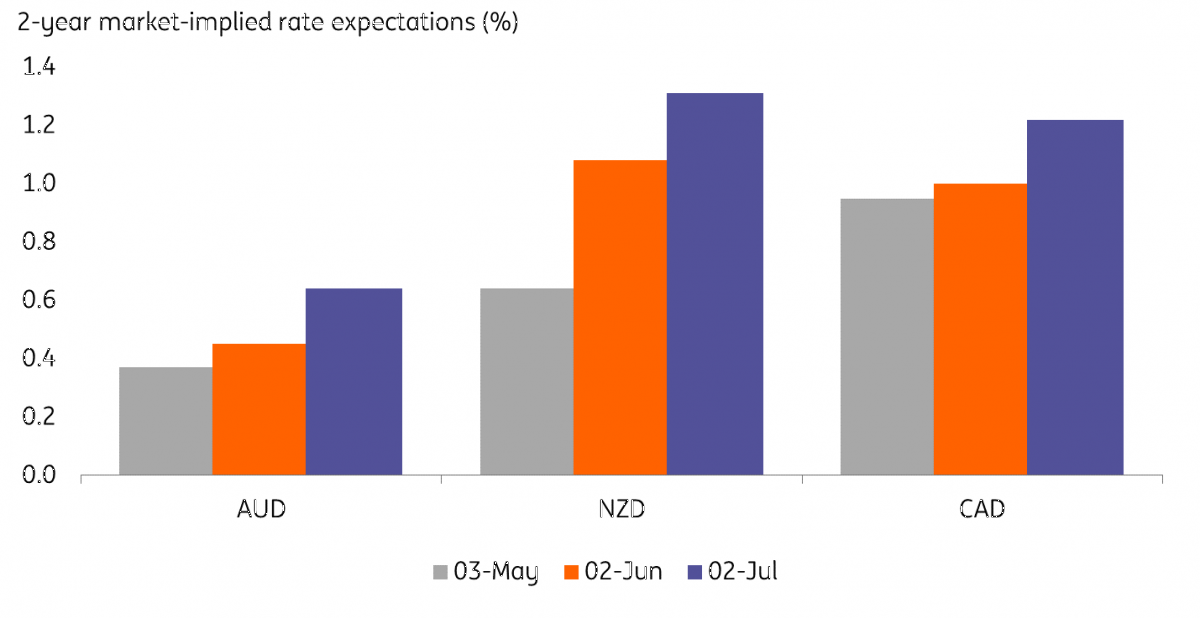

The chart below shows how rate expectations for the next two years have moved in the direction of tightening in Australia. Still, compared with AUD’s main peers in Canada and New Zealand, RBA pricing is still rather conservative, and the margin is wider than the simple difference in policy rates (0.25% in Canada and NZ, 0.10% in Australia) would warrant.

So, on a comparative basis, we can argue that the Aussie dollar has further room to benefit from a hawkish-repricing compared to the likes of NZD and CAD, that already have around 100bp of expected tightening attached by the market in the next two years. Yet, the main difference is that the Bank of Canada and the RBNZ have both explicitly signalled a first rate hike in 2022, while we do not expect the RBA to do so at this meeting.

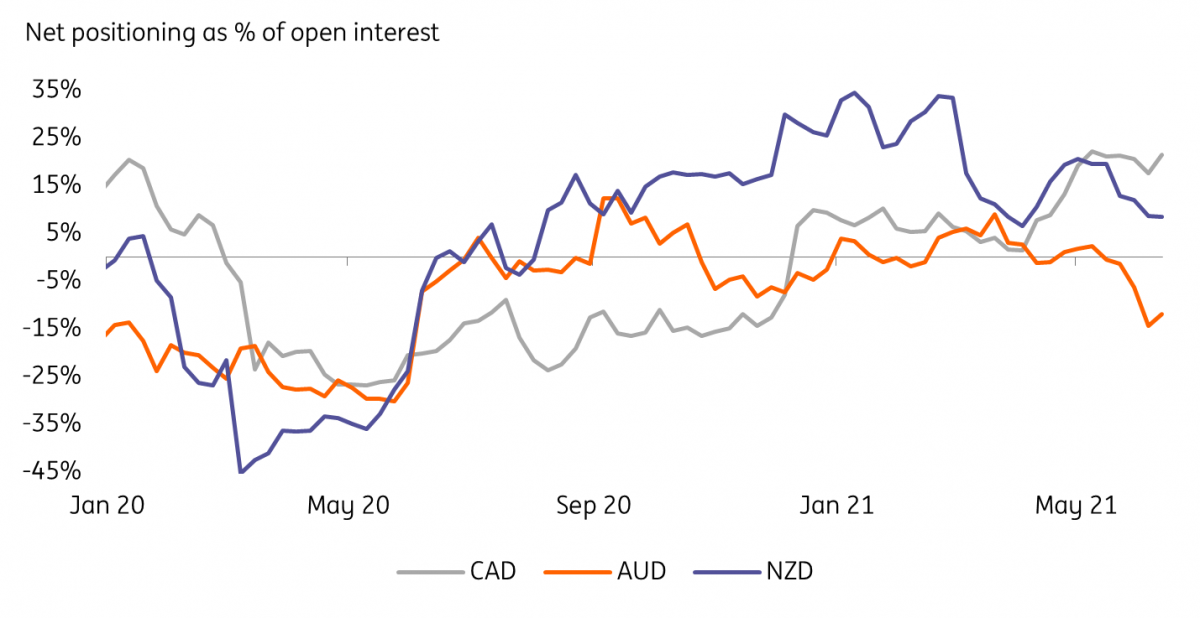

Markets are pricing more than 50bp of tightening by mid-2023 so some re-pricing may occur if the RBA does not hint at a 2022 hike. From an FX perspective, this should result in a negative response by the Aussie dollar, although the downside should be somewhat limited considering hawkish expectations are not too aggressive and AUD is still showing a speculative net-short positioning – as opposed to NZD and CAD - according to CFTC data (chart below).

It is harder to gauge where market expectations stand when it comes to tapering/re-shaping of quantitative easing. Our impression is that expectations may fall between option two (our base case, A$100bn of purchases for six months) and option three (less than A$100bn in six months) explained above. Should our projections prove correct, with the RBA opting for A$100bn of purchases, the market may read this as more dovish than expected, adding some pressure to the AUD.

In the longer run, an RBA that sticks to its dovish tone for longer is likely to be a liability for AUD, especially as we consider that a low-volatility environment could favour carry trades in the summer period, and the likes of NZD, CAD and NOK would inevitably be a more attractive option than AUD from this perspective.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more