Tapering talk and policy normalisation: What to expect from the Fed

While no Federal Reserve policy changes are expected in July's meeting, we could hear more about the tapering discussions that started in June. The volume surrounding this issue is likely to be turned up at the August Jackson Hole conference with the risks remaining skewed towards earlier policy normalisation that the Fed is currently signalling

Fed to bide its time

We are building up to the 28 July Federal Reserve meeting, but Chair Jerome Powell made it clear in his recent testimony to Congress that he continues to believe inflation pressures are largely transitory and there isn’t any pressing need to signal an imminent shift in policy. After all, employment levels remain more than 6 million lower than before the pandemic started while the latest Covid wave adds another level of uncertainty that can be used to justify inaction.

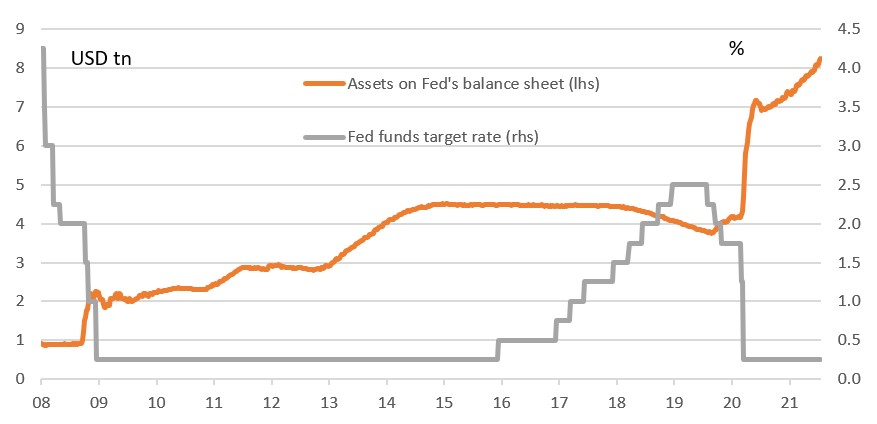

Federal Reserve balance sheet & Fed funds target rate

Remember too that the Fed’s new monetary framework places a much greater emphasis on ensuring as many people in society feel the benefits of growth. This was accompanied by a move to an “average” inflation target of 2% and a clear signal that the economy will be allowed to run hotter than in previous cycles to ensure these targets are reached.

Given this backdrop we are not expecting any change to the Fed funds target rate range of 0-0.25%, nor do we expect the Fed to lower its monthly QE asset purchases, which are currently running at $120bn per month. Moreover, Chair Powell is likely to suggest that while discussion on tapering has started, there is still plenty of time before they need to reach a conclusion on what they will do.

The tide is changing

Nonetheless, there is a growing hawkishness creeping into the viewpoints expressed by other FOMC members given the strong economy and the fact that inflation is running at more than double its 2% target. For instance, St Louis Fed President James Bullard has historically been viewed on the more dovish end of the spectrum of FOMC members, yet in recent months he is arguably one of its most hawkish by making the case for an imminent taper.

We believe that inflation will be more persistent than the Fed is forecasting

We believe that inflation will be more persistent than the Fed is forecasting with supply disruptions and labour shortages showing little sign of abating. In fact, we forecast that US headline inflation will stay above 4% until 1Q22 with core inflation unlikely to get below 3% until the summer of next year. We also expect the strong growth to story continue and with workers remaining in short supply, we see further wage pressure too.

We also have to consider financial market conditions. The fall in 10Y yields from 1.7% to 1.25% is a big additional monetary stimulus for the US economy and is only likely to add to the nervousness of the more hawkish members of the FOMC.

Taper talk is key

While the July FOMC meeting is likely to be a non-event in itself, we wouldn’t be surprised to hear Jerome Powell talk a little bit more about the discussions surrounding the path of tapering. The upcoming Jackson Hole Federal Reserve Conference in late August, we suspect, will see Fed officials starting to lay the groundwork for a QE taper with this fleshed out in more detail at the September FOMC meeting before being formally announced in December. We predict a relatively swift reduction that sees QE purchases end in the second quarter of 2022.

Risks skewed towards earlier rate hikes

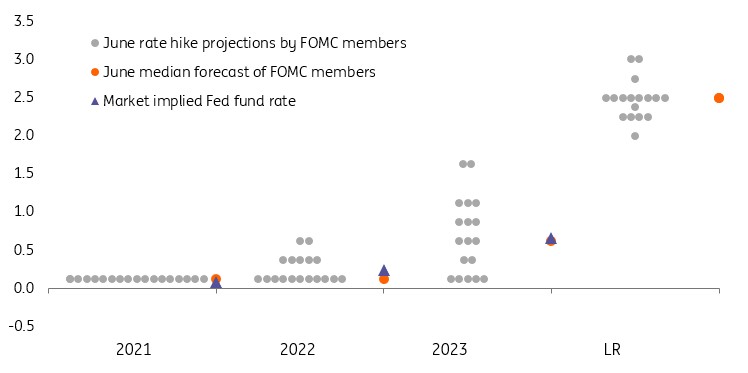

As for interest rates, the June FOMC meeting saw officials shifting their collective view to a 2023 start point for interest rate increases after having previously been adamant it would not happen before 2024. The Fed’s own 'dot plot' chart of individual members' thoughts on the outlook for interest rates only requires two of the 11 members not favouring a 2022 rate hike to switch sides to bring the medium in favour of action next year. As we have seen, things can change very quickly at the Fed.

Fed dot plot - individual FOMC member interest rate expectations (%)

With the economy continuing to grow strongly, inflation well above target and the jobs market looking strained through a lack of suitable workers we wouldn’t be surprised to see that happen at the September FOMC meeting. This would then tally with our own view that we will start to see policy tightening get underway in September 2022 with a follow-up interest rate rise in December 2022.

Implications for the dollar: We're bullish

The dollar goes into the Wednesday FOMC meeting close to the highs of the year. Assuming that the Fed continues to dangle the carrot of a September tapering and the global growth environment remains mixed at best, we suspect the dollar can retain its gains, if not edge higher.

It has been a tough summer for those bearish on the dollar. The 2021 bearish dollar outlook had been based on two key tenets:

- a patient Fed keeping US real interest rates very negative and

- a continuing recovery in the global economy as scientists and policymakers increasingly overcame their battle with Covid-19.

Both of those positions have been tested this summer. Firstly the June 16th FOMC meeting suggested the Fed might not be as patient after all and could well be swinging to rate hikes in 2022. The second has been the pick-up in Covid-19 cases driven by the Delta variant. Its impact has not been evenly spread. Developed economies in the northern hemisphere, where vaccination rates are high, are trying to ride the latest wave out without resorting to lockdowns. Developed economies in the southern hemisphere and Emerging Markets, where vaccination rates are low, as you can see in the chart below, are more likely to return to lockdowns and be hit harder.

The vaccination divide

The combination of a less dovish Fed and the Delta Variant has certainly hit portfolio flows to emerging markets, which have been negative in five out of the last six weeks. This has certainly provided support to the dollar. It is hard to see this trend turning in the immediate future.

And given that the US rates markets do not look heavily positioned for a hawkish Fed – 1m USD OIS rates priced three years forward have corrected 30bp lower from their highs in June – a Fed sounding like it is ready to start normalising should prove dollar supportive.

For EUR/USD, we had felt that it had a chance of tracing out a 1.17-1.23 range for the second half of this year. A more difficult global environment and a more dovish European Central Bank now means that 1.1700 floor will come under more pressure. A sustained break of 1.1700 would warn of 1.15 and even 1.13 in 3Q21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 July 2021

Message in a bottle This bundle contains 6 Articles