What to expect from the December Federal Reserve meeting

The economy is growing strongly and inflation pressures continue to build. The Fed is alive to the risks and is set to announce that the QE program will end in February. This then paves the way for earlier and swifter interest rate hikes, Omicron permitting, with the Fed dot plot set to point to a minimum of two moves in 2022

QE: the end is nigh

The November 3rd FOMC meeting saw the Federal Reserve call time on its $120bn/month bond-buying QE programme. It announced that asset purchases would be reduced by $15bn in November and by a further $15bn in December, which meant that if the wind-down continued at that pace, QE asset purchases would cease by the end of May.

However, they also said that they could adjust the speed in the new year “if warranted by changes in the economic outlook”. That now looks to be the case. With households, businesses, politicians and virtually all the regional Fed Presidents sounding increasingly anxious about inflation, Jerome Powell has signalled that he too thinks swifter policy “normalisation” is already required as CPI moves to within touching distance of 7%.

With no opposition raised by other Fed officials, despite the uncertainty presented by the emergence of the Omicron variant, next week’s meeting look set to see the Fed announce an acceleration in QE tapering, with a $30bn reduction for January (to $60bn of purchases) and a further $30bn reduction in February.

This would mean the Fed wrapping up the programme by the beginning of March, leaving the Federal Reserve with $8.8tn of assets on its balance sheet – more than double its pre-pandemic January 2020 level!

Assets of th Federal Reserve Balance sheet (USD tn)

'Transitory' inflation fades away with further forecast revisions

Even with the end of QE buying, the Fed’s policy stance will remain highly stimulative and in an environment of strong growth, decent jobs momentum and elevated inflation pressures, the case for withdrawing some of the stimuli, appears strong. Admittedly, the emergence of the Omicron Covid variant is a cause for concern. Based on figures for restaurant dining and air passenger numbers, it appears that some consumer caution does appear to have kicked in, but so far the early signs are that it is doesn’t look set to prompt major new movement restrictions that will severely impact the economic outlook, at least in the US.

This uncertainty will be acknowledged in the statement, but with Jerome Powell having suggested that the “transitory” description of inflation should be “retired”, there are also going to be additional changes to the accompanying statement. They will acknowledge the upside surprises for inflation and the tighter jobs market but are set to keep the line “longer‑term inflation expectations remain well-anchored at 2 percent” even if the consumer survey evidence and break-even inflation rates on Treasuries, are less categorical.

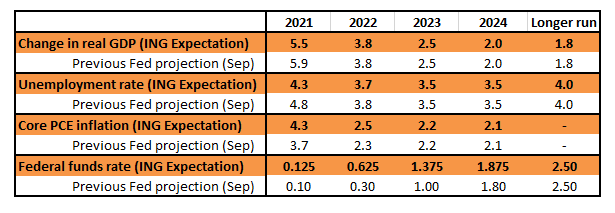

We also expect to see some changes on the Fed’s economic forecasts, with growth revised modestly lower for 2021 on the impact from the Delta Covid wave in 3Q and some caution related to Omicron. Inflation will be revised higher, given the consistent overshoot caused by production bottlenecks and labour shortages amid decent demand. The unemployment rate should also be cut, given that the labour supply hasn’t come back as rapidly as expected.

Previous Fed forecasts and ING's expectations for th New Fed predictions

Rates rising faster

We then get onto the Fed’s guidance on interest rates. The Fed’s position on the outlook for monetary policy has shifted a long way over the past nine months. As recently as March the FOMC dot plot of individual member forecasts, suggested that interest rates were unlikely to increase until 2024. The June update moved this to 2023 and then in September the median expectation was for a 2022 move. Next week’s update from the Fed is set to show them shifting to a two-hike view for next year.

In our 2022 Economic Outlook that was published last week, we suggested that were it not for the emergence of the Omicron variant, we would have shifted from a two-rate hike view to a three-rate hike view for 2022. After all, we are forecasting real growth of 4.4% and inflation of 4.5%, which few would argue is compatible with the idea of keeping interest rates at close to zero. So far, the evidence suggests that Omicron won’t derail the global recovery story, but there is still uncertainty. Nonetheless, that three hike call looks increasingly likely.

The Fed "dot plot" of individual FOMC member interest rate forecasts

Will the Fed directly address the spectre of liquidity contraction? They should.

A significant nuance here is the change from the current situation where the Fed is adding to bank reserves, to one where the Fed will get to the point where they take reserves out of the system. This will largely be unseen, but ends up putting upward pressure on the price of liquidity. That will be the precursor to a first hike, and the combination should have an overall tightening effect that will tempt market rates generally higher, and this should be echoed right out the curve.

Fed bond buying has stretched bank reserves to the max, and the consequence has been a liquidity overflow into the Fed’s reverse repo window. This is also reflective of an excess of liquidity over collateral, which has pushed market repo rates down to the low single digits. In consequence, the Fed's 5bp on offer at the reverse repo window looks as good as any market alternative.

The elevation of the debt ceiling at least allows the US Treasury to push some more collateral back into the system. As the Fed tapers to zero in the coming months, we will also get to the point where the Fed’s bond-buying is no longer generating additional excesses of (potential) liquidity. By the end of the first quarter, it’s likely that the Fed will be near to concluding its taper. After that, the next big focus will be on the delivery of the first hikes in the cycle.

That will push the risk-free rate up from mid-2022, similarly impacting repo. The Fed may or may not address this directly, but it certainly should be raised at the Q&A session. For us, it’s a key change, as it will give 2022 a very different feel relative to 2020/21 where the system was awash with ever-growing liquidity.

FX: Dollar poised to move higher post Fed

The balance of risks from next week’s FOMC meeting look dollar positive. As above, any downside risks to the dollar from lower US growth forecasts should be more than offset by the Fed’s shorter tapering cycle and the introduction of an extra 2022 hike into its median Dot Plot. Indeed, the Fed’s Dot Plots have been a key catalyst for a stronger dollar both in June and September this year.

The narrative of the Fed pushing ahead with policy normalization even as Omicron uncertainty continues warns of the dollar strengthening against the traditional high-beta community of currencies such as the Mexican Peso and the Norwegian Krone. Yet at least the central banks in Mexico and Norway are also responding to inflation with rate hikes, suggesting losses against the dollar prove more limited.

More in harm’s way are the low-yielders of the Euro and the Japanese Yen. Having traded a 1.1180-1.1380 range so far in December, the Fed meeting certainly could prove the catalyst for EUR/USD to break down to 1.10. Though investors may prefer to wait from the ECB the next day before chasing the move. USD/JPY could also be pressing 115 post Fed.

We are also interested in the performance of USD/CNY. Back in June, the PBOC raised the FX reserve requirements of local financial institutions to take downside pressure off USD/CNY. Backed up by a hawkish Fed in June, USD/CNY duly reversed higher. This week the PBOC has again raised FX reserve requirements shortly before a Fed meeting. A hawkish Fed could certainly push USD/CNY back inside of its 6.35-6.50 range – seemingly the PBOC’s comfort zone to match Chinese importer and exporter interests.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more