US recovery to support metals demand

An improved US household balance sheet and robust income growth supports consumer demand, while historically low inventories should keep order books very firm. This suggests the restocking cycle could be a prolonged one. US stock replenishment will continue supporting metals demand together with imports of metals products and consumer goods

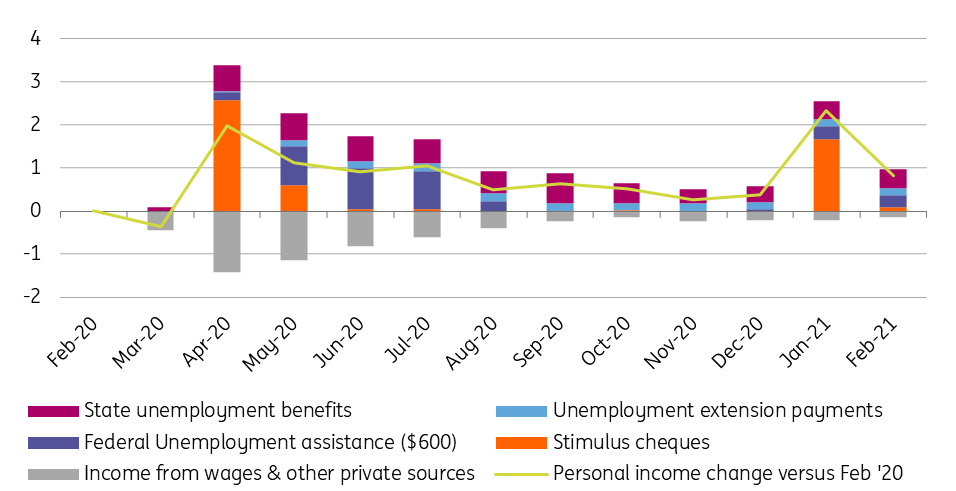

Household income growth has fueled the recovery

The way the US government supported the household sector during the pandemic was very different to how Europe reacted.

Rather than protect employment through government-funded furloughing schemes, the US let the labour market clear. However, they strengthened the safety net for the millions of people who lost their job through expanded and uprated unemployment benefits.

Consequently, Europe had less unemployment than the US, but wages fell as governments only paid a portion and not the full salary (typically 60-80%). In the US case, unemployment rose sharply, yet incomes also rose!

The US is in a remarkable position whereby household incomes continue to run well above their pre-pandemic levels

The University of Chicago estimated that 68% of Americans who lost their jobs earned more money by being unemployed versus working, thanks primarily to the new additional $600 weekly federal payment.

With individual stimulus payments ($1200 in April 2020, $600 in January 2021 and $1400 in March 2021) coming on top of this, the US is in a remarkable position whereby household incomes continue to run well above their pre-pandemic levels.

Contributions to change in personal income levels versus February 2020 ($trn)

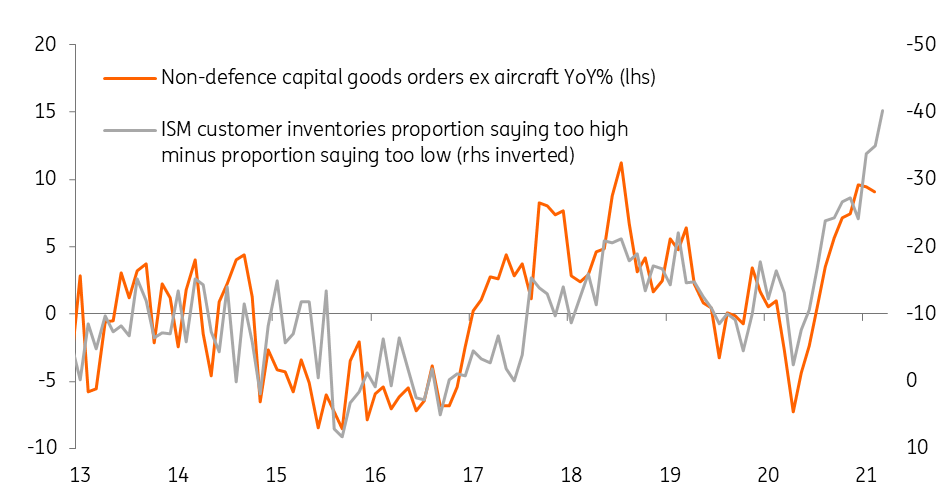

With incomes so well supported, this has allowed US consumer demand for physical goods to remain strong. However, lockdowns and social distancing have hurt domestic production capabilities, resulting in a run-down in inventory levels. We are now at a point where the institute for Supply Management reports that a net 40% of manufacturers state their end customers have inventory levels that are “too low”.

With the US domestic re-opening gathering momentum as the vaccination program progresses, this allows a ramping up of manufacturing output and replenishing of inventories. However, as the re-opening process continues, a more significant proportion of consumer spending is likely to be directed towards services (such as leisure and travel) rather than concentrate on goods.

That is not to say we should be fearful of dropping off in American demand for products, materials and components. Household cash, checking, and savings deposits have increased $3tn since 3Q19 due to surging incomes and a lack of options to spend money. This strengthening of the household balance sheet means that consumers will have the cash ammunition to continue to buy products in significant amounts. Remember, too, that household credit card balances are at four-year lows for similar reasons.

Moreover, with inventories at such historically low levels, this suggests order books will remain robust, with the restocking cycle likely to last well into late 2021/early 2022. President Joe Biden’s $2tn infrastructure spending plan is working its way through Congress, and this could yet extend the process given the heavy focus on transport and electricity grid infrastructure spending. We also have to acknowledge that the pandemic has led to a pullback on capital expenditure by the private sector. A catch up in investment spending here could further prolong the cycle.

Record low inventory levels will continue to support capital goods orders

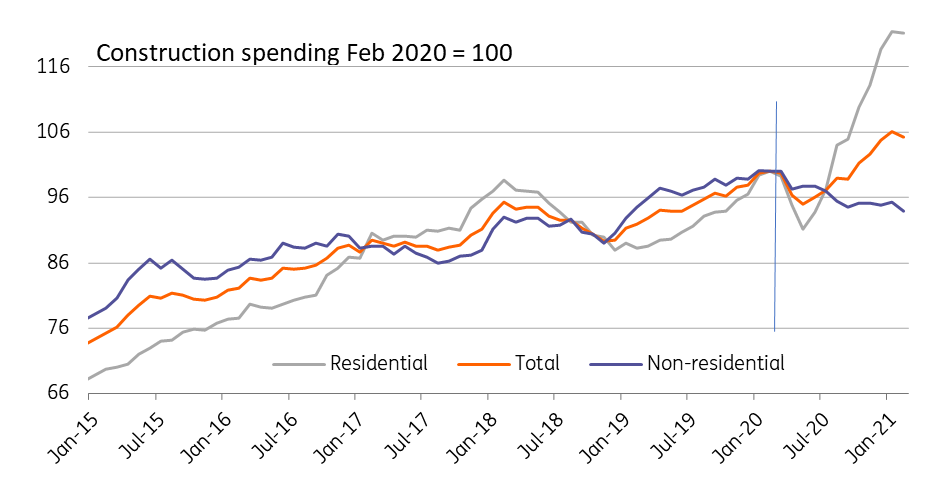

The housing boom is another prop for commodity demand

Another critical area of demand for imported metal products is the US residential construction market. Record low mortgage rates have stimulated a more robust demand for homes. Amidst a shortage of supply, house prices are recording double-digit YoY gains. The total amount of property for sale right now in the United States is equivalent to just two months of sales, a record low.

This is spurring a construction boom, as we can see in the chart below, with Home Builder sentiment remaining close to all-time highs. Building permits and housing starts are on a par with the housing boom seen 2005-06, and this should mean the residential construction sector can continue to more than offset weakness in the commercial construction market.

US construction spending

What does it mean for metals demand?

Inventory replenishment seen in developed economies has been driving the recovery in metals demand in the pandemic aftermath. Strong spending on consumer goods and the construction boom in the US have been constructive for commodities demand.

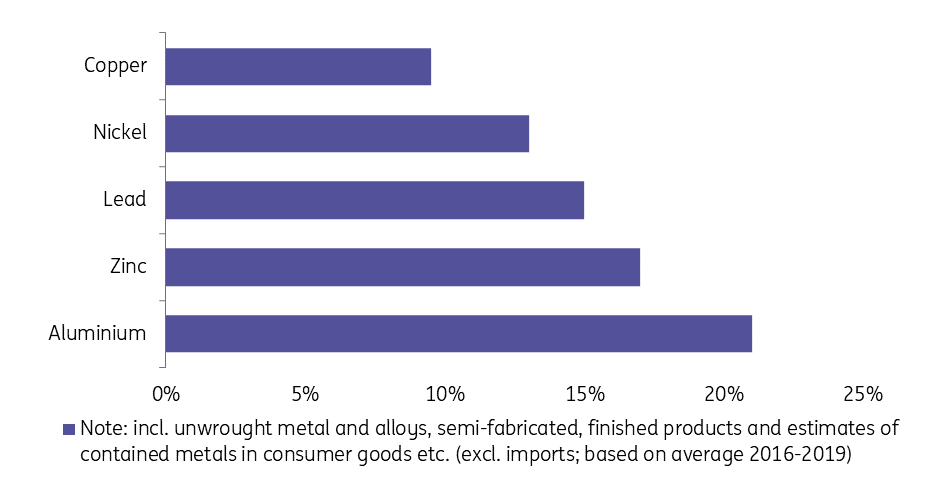

Among base metals, aluminium has the most considerable exposure (over 20%) to exports in the form of unwrought metals and alloys, semi-fabricated products, finished products, and aluminium within consumer goods

As the US imports a large share of products from China, there has been strong export growth from China in metal finished products (such as aluminium structures, windows, door frames) and consumer goods (such as air conditioning) that have a high metal content. On average, China makes up around half of global base metals consumption, but a large share of this ‘consumption’ is exported in the form of products. The firm exports of metal in products played an important role in China’s metals demand recovery.

Among base metals, aluminium has the most considerable exposure (over 20%) to exports in the form of unwrought metals and alloys, semi-fabricated products, finished products, and aluminium within consumer goods, followed by zinc with approximately 16%.

Export exposures as percentage of metals consumption in China

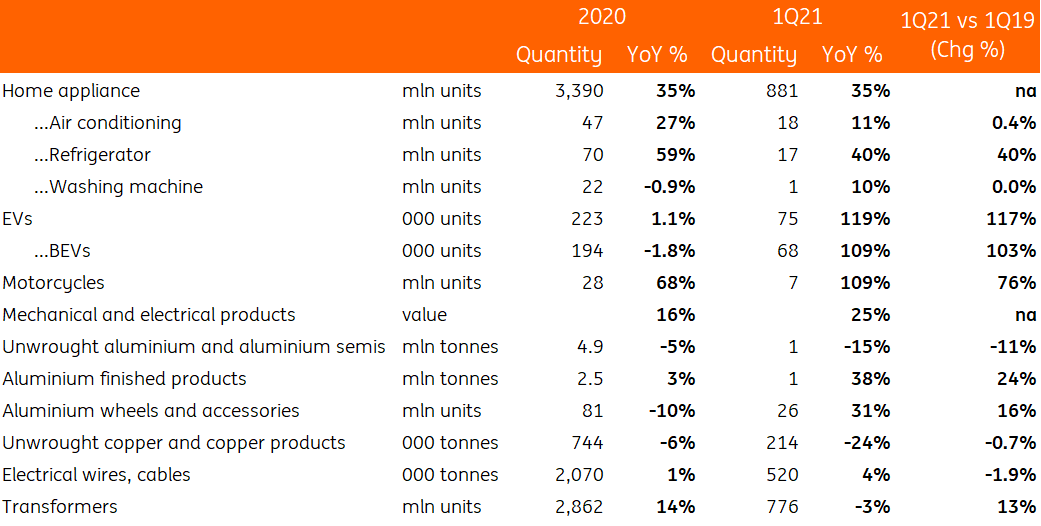

Total aluminium finished product exports grew by 3% YoY in 2020, despite the collapse in activity over 1Q20 when China was in lockdown. Looking at major categories of Chinese aluminium finished products and consumer goods exports, around 40% of these products made their way to the US.

The combined export volume of aluminium household products (such as kitchen related products) jumped by 10% YoY during 2020, growing by another 98% in 1Q21 compared to 1Q19 to avoid distortion of last year’s activity collapse. Meanwhile, strong exports of aluminium structure products (such as windows and doorframes) seem to result from the US construction boom as they soared by 23% YoY in 1Q21 (+33% vs 1Q19). Restocking from automakers has also spurred demand for products like wheels, with Chinese exports of the product during the first quarter of this year growing by 16% against the same period of 2019 (or 31% YoY), and the top three destinations are the US, Japan, and Mexico.

Among other sectors, strong exports in home appliances (e.g. air conditioning and refrigerators) and electric vehicles is stoking the usage of copper (tubes, pipe, wire, etc.) along with other base metals. Besides imports from China, the strong metals demand recovery in the US is also evident in the US aluminium premium (P1020 Midwest), which soared to a six-year high. However, some supply issues, especially freight rates, may have also played a role in this.

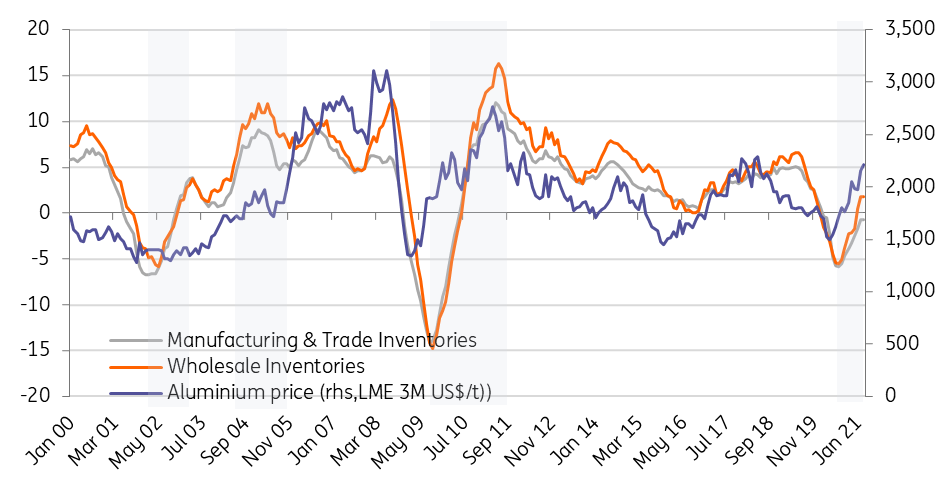

US inventories change vs aluminium price

Chinese exports of metals products and end-use products

As order books from the US will remain robust with the restocking cycle unlikely to top out until late 2021/early 2022, this should continue to support metals demand. This reinforces our view that the demand recovery from markets outside of China will be a key theme this year.

Given that the ongoing US stock replenishment cycle highly correlates with China’s exports of some metal products, this could see the export market continuing to offer support to the primary metals consumption in China.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article