USD/JPY: Bracing for the second half US recession

FX markets currently price a 30% chance that USD/JPY trades at 120 at, or even before, the end of the year. 120 is our year-end forecast and is premised on the US going into recession and the Fed cutting rates by 100 basis points later this year

Calls for US hard landing grow louder

As our global macro team discusses in our latest monthly update: ‘Everything, everywhere, almost all at once’, the tighter credit conditions created by US bank failures means that the Fed has to do less tightening. We look for one more 25bp hike on May 3rd but feel that the Federal Reserve will be in a position to cut rates later this year.

Do not expect the Fed to acknowledge the need for easier policy yet; it's still battling inflation. But into the second half, our house call is that clear signs of disinflation will be showing through and that the Fed will be able to respond to that slow-down. We look for three whole quarters of US GDP contraction, stretching from 3Q23 to 1Q24.

We note with interest yesterday’s readings from the NFIB small business sentiment, where loan availability was seen as the worst in a decade. Certainly, declining profit growth and tighter credit conditions stand to weigh heavily on business investment trends this year.

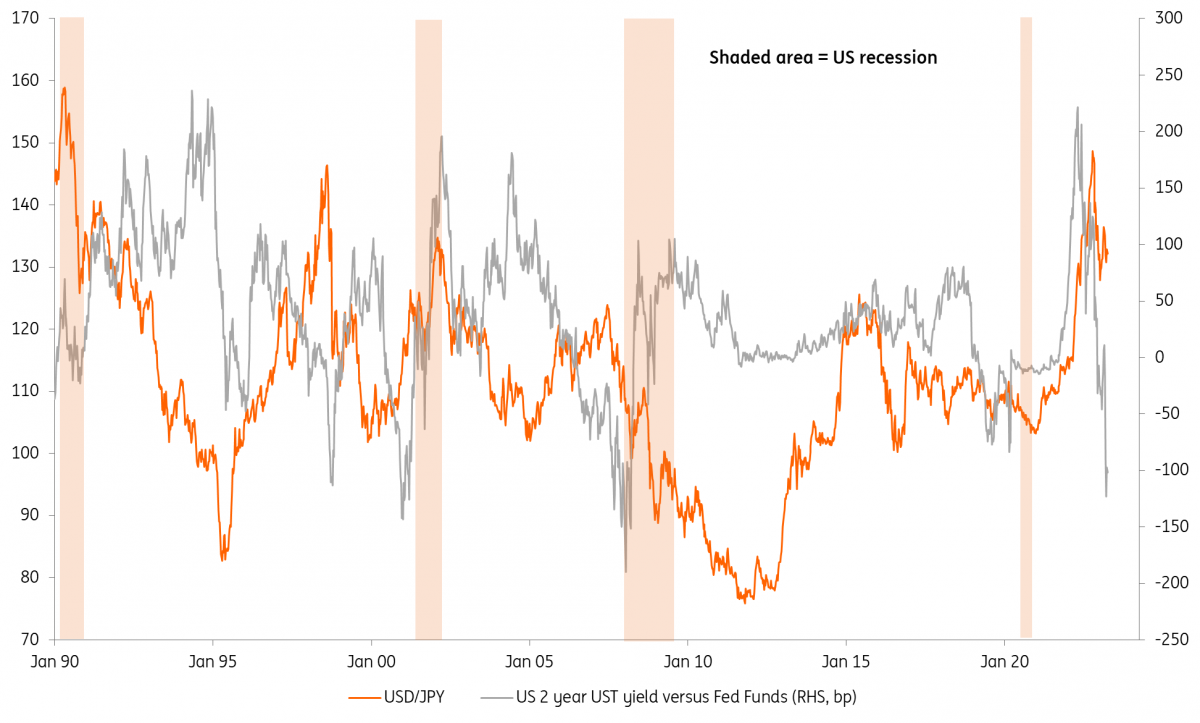

In response to last month’s US bank failures, the market is now close to pricing one final Fed hike in May before a 60bp easing cycle by the end of the year. Equally, US two-year Treasury yields are now trading around 100bp below the upper end of the Fed funds target – that is a historically deep discount and is typically seen before the US enters a recession. That discount can correct when the Fed brings the policy rate lower.

USD/JPY versus US 2 year Treasury yield discount to Fed Funds

USD/JPY: The key vehicle.

As our chart shows, you might have expected USD/JPY to be trading even weaker, given the strong expectations of a Fed easing cycle. The reason it still trades above 130 is probably because of the expensive overnight dollar rates of 4.80% and a reluctance amongst investors to be substantially short dollars into another potential US banking crisis.

Yet USD/JPY should again prove the key FX vehicle to express views on a US recession. Here Japan’s large net foreign asset position after decades of current account surpluses leaves the yen well insulated in an environment of deleveraging – a likely outcome were financial stability risks to re-materialise.

Equally, we think the market underprices the risk of the Bank of Japan shortening its Yield Curve Control policy to the five-year part of the JGB curve when it meets in June. The forward market still prices 10-year JGB yields at 0.50/55% over the next six months, and presumably, these would trade much higher and the yen much stronger should the BoJ stop targeting the 10-year JGB maturity.

The FX options market currently prices a 31% chance that USD/JPY trades at 120 at or before the end of this year. We think the chances are higher (120 is our year-end forecast) and that USD/JPY will again prove the best vehicle to hedge a US recession.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article