USD-EUR rates divergence: More in the tank

Europe's Covid-19 and vaccination trouble may be temporary, but the US recovery is powering ahead. Economic and cash flow divergences are likely to bring wider USD-EUR rates differentials, with the risk of a spike this quarter

The EU is missing a bridge

It is well documented that Eurozone fundamentals do not support the type of reflation trade that is gripping US markets. When asked, most of us would instinctively mention slow vaccine rollout and the third wave as key reasons for Eurozone gloom, but something more fundamental is also at play in the diverging growth trajectories: fiscal policy.

The Eurozone is struggling to ratify and implement the EU recovery fund (NGeu) agreed in July 2020

While the US economy is experiencing its fourth and fifth fiscal support packages, the Eurozone struggles to ratify and implement the Next Generation (NGEU) EU fund agreed in July 2020. In truth, SURE disbursements related to unemployment insurance have already started in late 2020, and we remain optimistic that the first NGEU-related payments will start in the second half of 2021.

The Biden administration’s infrastructure plan unveiled last week is more akin to NGEU: its benefit will accrue to the economy over many years. What the EU is missing, arguably, is a near-term palliative to slow growth to bridge the gap between the pandemic-induced slump in economic activity and the time when longer-term fiscal policy kicks off.

Doves all around, but growth is forcing the Fed’s hand

We think this is what USD-EUR rates divergence is currently reflecting.

While it may be tempting to dismiss the shortfall in near-term fiscal support, and the delay in reopening due to slow vaccination/third Covid-19 wave, as merely a timing factor, it means the Eurozone is unlikely to achieve a high-pressure economy that could affect inflation dynamics beyond this year’s spike.

The Eurozone is unlikely to achieve a high pressure economy that could affect inflation dynamics beyond this year’s spike

As one might expect, economic divergence breeds monetary policy divergence. It is in part due to the above factors that the ECB has felt the need to accelerate the pace of its purchases in 2Q21, and has been battling expectations that a further increase in quantitative easing envelope is around the corner. Compare this to a Fed that is at pains to dismiss expectations of tapering this year and of hikes in 2022, due to accelerating job creation and risk of higher inflationary dynamics.

USD-EUR swap rates differentials are set to widen further

A divergence is also evident in supply dynamics

The differing fiscal policies are also the main reason why the US and the Eurozone government bond markets face materially different backdrops in terms of net issuance.

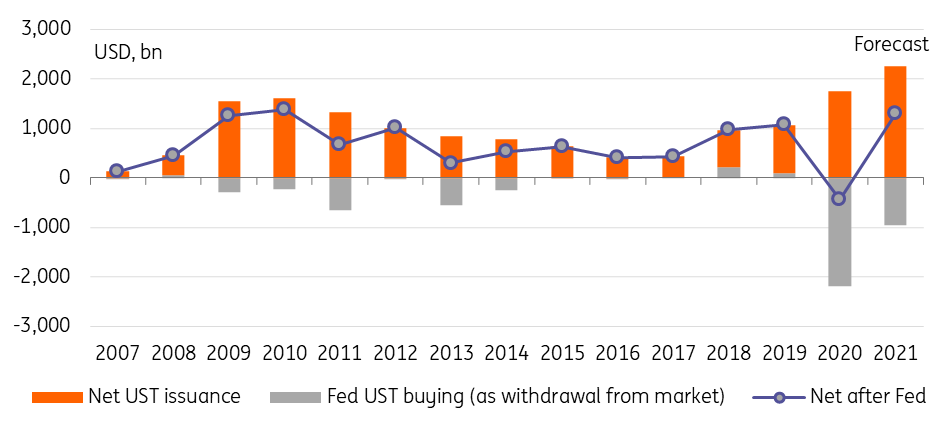

Both the Fed and the ECB continue to buy governments bonds. In the US, however, the Fed purchases of US$80bn per month do not change the fact that the US Treasury market sees a record net supply this year. US$960bn of Fed buying faces an estimated US Treasury net supply of US$2.25tn in 2021. This means private investors would still have to absorb more than US$1.3tn of US Treasuries, although numbers could still change depending on the degree the Treasury will rely on T-Bill funding and still high cash reserves in its accounts at the Fed.

US and the Eurozone government bond markets are facing materially different backdrops in terms of net issuance

In the Eurozone, the less forceful fiscal response has kept government bond issuance from rising to the same degree after a spike in 2020. And in part, also to make up for that lack of fiscal generosity, the ECB has stepped up its bonds purchase to the degree that will see this year’s net government bond issuance more than entirely absorbed by the central bank. For German bunds specifically, we estimate that the ECB buying could surpass the German net bond supply by more than €100bn in 2021.

Of course, these different dynamics are well flagged and on their own are probably not enough to drive yields differentials wider. The increased buying by the ECB over the current quarter should still provide a supportive backdrop for further divergence.

US Treasury net supply could climb new highs this year

200bp in the bag, another 25bp in the tank

On that basis, we forecast the yield differential between 10-year US treasuries and 10-year German Bund to reach 225bp by the end of the year, up from 200bp currently.

The US growth story is a medium-term dynamic in our view, with 3% US yields a distinct possibility next year as our economics team forecasts inflation to average 2.9% in both 2021 and 2022.

This being said, the risk of a near-term spike in USD rates is significant, as markets are forward-looking and the steady drumbeat of strong US data should help solidify growth and inflation expectation not only for the coming quarters but for the years to come.

| 190bp |

Differential between 10-year USD and EUR swap ratesBy the end of the year |

As a result, we see a non-negligible chance of the US-Germany spread spiking well above 225bp in 2Q21, even if this could well prove a one-off spike. In 10-year swaps, this should equate to roughly a 190bp differential from just under 170bp currently.

Q2 represents a sweet spot of sorts for wideners because the effect of faster ECB purchases are still being felt, while US growth is powering ahead. Fast forward to the second half of the year, the acceleration in the EU vaccination campaign will be visible, and the prospect of NGEU kicking in should allow more optimism to be baked in EUR rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RatesDownload

Download article