US: What to expect from this week’s Fed meeting

While no policy changes are likely we will get an update from Jerome Powell on how the Fed sees the outlook for the economy in the wake of new fiscal stimulus and the vaccine roll-out. A more positive assessment could bring forward expectations of QE tapering and eventual rate hikes

A cautious Fed

At the last FOMC meeting on December 16th, two days after Covid vaccinations started in the US, the Fed remained cautious on the economic outlook. They stated that the pandemic “poses considerable risks to the economic outlook over the medium term” and their updated forecasts continued to suggest that interest rates wouldn’t likely rise until 2024.

Just 5 of 17 FOMC members expected a move in 2023 or sooner and all they agreed that QE would continue “until substantial further progress” has been made towards hitting the Fed’s inflation and employment goals. Despite this caution they did revise up their growth and inflation forecasts for 2021 and 2022.

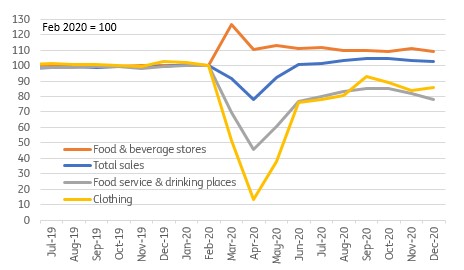

Retail sales feel the squeeze

But the outlook is brightening

The newsflow since that meeting has been positive on the medium to longer term, but undoubtedly more negative in the very near-term given clear signs of a loss of economic momentum. For instance, we have had confirmation of three consecutive monthly falls in retail sales while the December jobs report showed a fall in employment as Covid containment measures were stepped up in several parts of the country. These constraints will continue to depress activity in the near-term.

The medium-term outlook has improved though with the Democratic Party winning both Senate seats in the Georgia run-off elections, emboldening President Biden to go big with a proposed $1.9tn fiscal support package following hot on the heels of the $900bn December deal.

The medium-term outlook has improved with fiscal support and the vaccination program

Meanwhile, the vaccination program is making progress with, as of January 22nd, nearly 5% of the population having received at least one dose of the Covid-19 vaccine. With more resources and better planning this will be stepped up with a realistic possibility of a re-opening getting underway in the second quarter.

At the same time the housing market is in fantastic shape with transactions and house price inflation growing strongly, supported by record low borrowing costs. Equity markets too are at all-time highs so physical and financial asset markets continue to provide support for the outlook.

Inflation is also becoming a more significant theme with both market and consumer inflation expectations having pushed higher in recent months. The implied break-even inflation rates on index linked bonds is rising for all maturities with the 2Y rising from to 1.2% in mid-November to 2.5% currently and the 10Y rising to 2.1% from 1.65% over the same period.

In this regard the Fed will have been focusing on the pick-up in longer dated borrowing costs, which has seen the 10Y yield break convincingly above 1%. On the one hand, this is a positive in that a steeper yield suggests growing confidence in the idea of “reflation”. On the other hand, it has been a fairly large move over a short period of time. A sense that if things move too far too fast it could be detrimental for the recovery through higher borrowing costs has probably contributed to the Fed dampening talk of possible QE tapering later this year.

Inflation expectations moving higher (break even inflation rate using 10Y index linked bonds %)

Fed on hold

Given this backdrop we believe the Fed will leave monetary policy unchanged on Wednesday with the Fed funds target rate range staying at 0-0.25% with the Quantitative Easing program maintained at $80bn of Treasuries and $40bn of Mortgage-Backed Securities. However, it will be interesting to see how the Fed interprets the outlook.

A greater probability of substantial fiscal stimulus and robust asset markets and clear progress with more resources being devoted to the Covid-19 vaccination program should be taken positively. Then throw in the increase in inflation expectations and the Fed will be encouraged that perceptions of the economic outlook are improving.

However, they will be wary of markets potentially getting ahead of themselves. The containment measures are going to keep the economy weak in the near-term with the risks that the labour market continues to lose jobs until there is a meaningful relaxation of Covid controls.

The fiscal stimulus may also take time to materialise with the Senate filibuster a potential sticking point that could result in the plan being watered down. Then there are uncertainties about the long-term efficacy of the vaccine – is it one and done or will it need to be modified each year? Will we need ongoing testing. These factors could weigh on sentiment and corporate investment plans.

But the risks are skewed towards earlier action

We suspect the Fed will retain a cautiously optimistic tone at the press conference while seeking to downplay the prospect of any meaningful change in Fed policy anytime soon.

Nonetheless, we are increasingly confident that the US economy can grow 5% this year despite near-term softness and that significant progress will be made on job creation. That is before we even consider the prospect of Joe Biden’s $3 trillion plus Build Back Better energy and infrastructure plan.

We also suspect there will be more near-term inflation pressures with headline CPI likely to push above 3% in 2Q/3Q 2021 as price levels in a re-opening economy that has some supply constraints (airlines cutting flights, restaurants having gone out of business, etc) are compared with those of twelve months ago when the economy was in dire straights and companies were slashing prices to generate cash flow.

The Fed is likely to 'look through' an increase in headline inflation

The Fed will likely say this is a temporary phenomenon and we should “look through” it, but we suspect it could be a little stickier as companies try to improve profit margins in an environment of vigorous demand.

If we are right and we see a period of booming growth, elevated inflation and ongoing fiscal stimulus the Fed may feel compelled to act somewhat sooner than they are currently indicating. We could conceivably see the Fed start to taper at the end of this year with a rate hike likely to be on the agenda for 2023.

4Q GDP to highlight near-term loss of momentum

This week’s key data release is Thursday’s 4Q20 GDP report and it should confirm the slower growth story seen over the last three months. As already mentioned, retail sales fell in October, November and December while employment has also softened as tighter Covid restrictions dampened sentiment, people movement and spending. Factory output though has been very robust and government spending is also likely to have contributed positively to growth. Then there is residential investment, which should contribute significantly given the strength in housing starts with demand boosted by record-low mortgage rates. Consequently, we expect to see growth of 4.2% annualised, which is pretty much in the middle of the consensus range of the latest Bloomberg survey of 3-6.2%.

1Q21 is likely to be even weaker with little reason to expect a sudden upswing in activity until Covid restrictions are meaningfully eased. Yes, the recent $600 stimulus cheques will support incomes, but we suspect most of that will be saved while the latest stimulus proposal may not get approval until well into March given the near-term focus on Donald Trump’s second impeachment trial, which gets under way the week of February 8th.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article