What to expect for American growth in the third quarter and beyond

Thursday’s 3Q GDP report will show the US expanded at a record rate over the July-September period as pent-up demand and huge government transfer payments fuelled demand. However, weaker income growth and rising Covid-19 cases suggests 4Q growth will be substantially slower and the economy will end 2020 still more than 2% smaller than 2019

Breaking new records

The human and economic cost of the pandemic has been beyond painful with more than 200,000 dead and more than 10 million people yet to find and return to work. The hit to output was equally huge with the economy contracting by more than 10% through the first half of the year. However, Thursday’s 3Q GDP data should provide positive headlines with a record 30%+ annualised expansion widely anticipated.

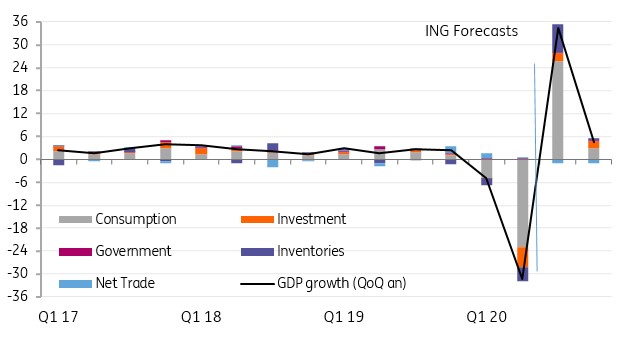

In fact, the consensus forecast amongst analysts is for annualised growth of 32% after a 1Q contraction of 5% and a 2Q annualised decline of 31.7%. We are even more upbeat, looking for 34.5% annualised growth, thanks primarily to a 38% surge in consumer spending.

Contribution to QoQ% annualised growth

Consumers lead the charge

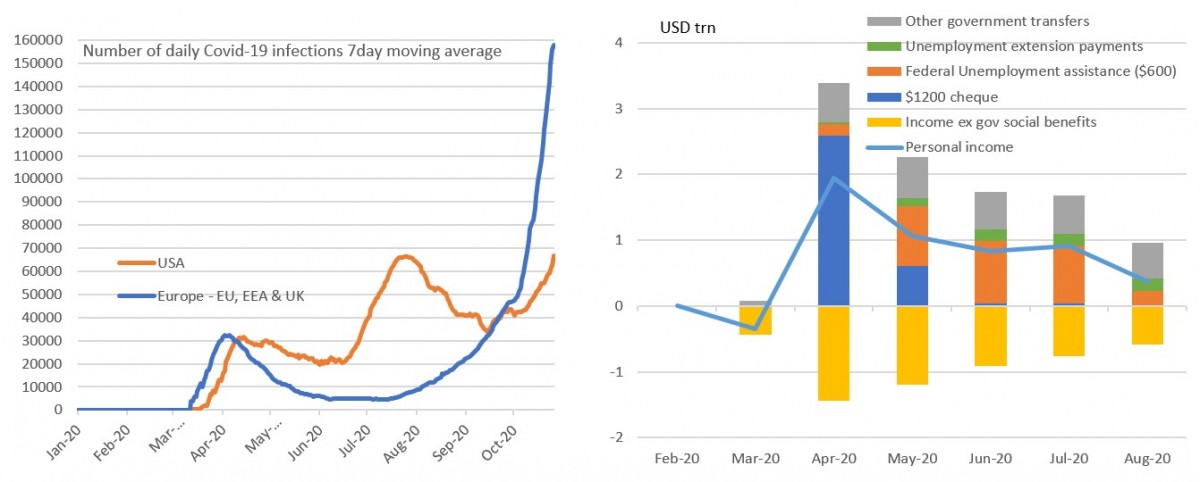

Pent-up demand after we were finally able to escape the confines of our homes is the overwhelming reason, but we cannot understate the importance of the government support for household incomes. The $1,200 cheques and the expansion of unemployment benefits that included an additional $600 per week Federal payment meant nearly 70% of recipients received higher incomes than when they were actually working[1].

Goods demand is the key story with retail sales having surged above pre-Covid levels and car sales rebounding strongly. The service sector is still heavily constrained by social distancing – for example restaurants and bars, travel and accommodation away from home will continue to struggle until there is a vaccine.

Residential fixed investment has also been a big growth driver with housing transactions, on some metrics, above the levels seen during the housing boom in the mid-2000s. Record low mortgage rates and a sense that home working could be a long-term structural change for the economy have helped drive demand at the expense of rental leases in the big cities.

Inventories have also been rebuilt as factories restocked to meet rising demand although business investment is likely to provide more muted upside given plenty of spare capacity. Rounding out the contributions, net trade will be a drag given demand for imported consumer goods has been so strong while government spending could also be a modest drag given the CARES Act focused payments in 2Q20.

[1] https://bfi.uchicago.edu/wp-content/uploads/BFI_WP_202062-1.pdf

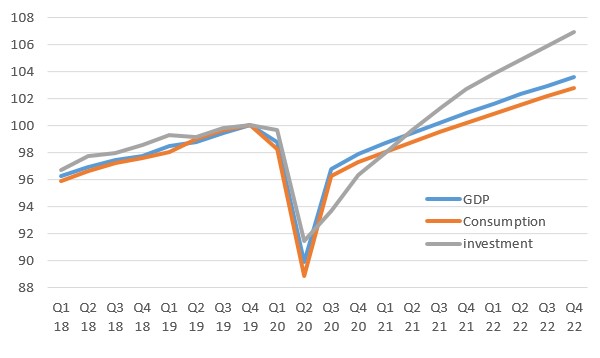

The level of real economic activity 4Q19 = 100

4Q: Constrained by Covid?

Even if we are right and the economy has indeed expanded 34.5% in 3Q, we should remember that output will still be 3.2% below that of the end of 4Q19. There is a long way to go before the economy is fully healed and unfortunately the challenges are mounting.

The number of new Covid-19 cases is rising sharply once again and although they are currently not of the scale of what is happening in Europe (see left hand chart below), the prospect of widespread social gatherings around Halloween and Thanksgiving suggest that they soon could be. Should healthcare systems start to struggle this may necessitate the return of containment measures that would be economically damaging and result in more job losses.

In any case we would likely see consumers and businesses react more cautiously, particularly if the numbers of deaths start to climb. This would result in consumer spending inevitably slowing.

Daily Covid-19 cases and the the changes in household incomes since February

Fading fiscal support adds to growth worries

Our other major concern is that while the fourth quarter seems to have started well, fiscal support is fading with the very real prospect that income growth moves into negative territory in November and December.

Income from employment and assets remains below the levels of February while the support from incomes from the $1,200 government cheque has passed and the $600/week Federal payment has been tapered to $400 (and to $300 in many instances). We also need to remember that millions more have now exhausted their 26 weeks of state unemployment benefits. With politicians so far failing to agree a new stimulus there is the risk that uprated benefits soon no longer fully offset to the decline in employment incomes.

With weekly initial jobless claims still coming in well above anything experienced during the Global Financial Crisis there are clearly significant strains in the jobs market and should Covid containment measures need to be reintroduced, job losses would mount. As such a vaccine can’t come quickly enough.

That said, even if we do get a vaccine in December, the time taken to roll out the vaccination program means a return to pre-Covid consumer behavior norms is a long way off.

Currently we are forecasting 4Q GDP annualised growth of 4.5%, which if it comes to fruition would still leave the level of real GDP more than 2 percentage points below that of 4Q19. Given the potential health and economic impact of a European style spike in Covid and the prospect of weaker income growth, the risks seem increasingly skewed to the downside.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article