US: What now for the President’s plan?

The US economy remains very strong, but the prospect of additional fiscal stimulus will be limited if the Democrats win control of the House of Representatives curtailing the President's legislative agenda, with the risk that he steps up attacks on trade partners

The US economy continues to boom, outperforming other major developed markets thanks to the support from the massive fiscal stimulus. This has lifted consumer spending and investment but has also meant that President Trump’s second policy thrust on the economy – trade protectionism – has got less traction than he perhaps hoped.

The trade balance on goods widened out to its largest deficit ever in September. Significant tariffs on imported goods have been introduced this year, but when you hand households an average $900 tax cut, it shouldn’t come as a surprise that a large proportion of this being spent on cheap imported consumer goods.

The midterms will be critical for trade and fiscal policy

President Trump would clearly like to turn the screw tighter on China to extract concessions that would make the trade relationship “fairer” while protecting US intellectual property rights. He is also keen to make further progress on tax reform and deliver on his promise on improving US infrastructure. Whether he can do this will significantly depend on the outcome of the 6 November mid-term elections.

Our base case remains one where the Democrats win control of the House while the Republicans hold onto the Senate with a wafer-thin majority.

US election scenarios and potential implications

Our base case is a split Congress

Our base case is “Trump tapered” and the key implication is that a split Congress makes it more challenging for President Trump to pass major legislation. He will need to get Democrats in the House to support his initiatives, and in the polarised world of Washington politics, this won't be easy. That is not to say deals can’t be done, but given entrenched political positions, getting both sides to compromise enough will be difficult.

As such, any further fiscal stimulus is likely to be modest, and there is the real possibility of government shutdowns as issues over the budget arise. Faced with this, we suspect President Trump is likely to focus the bulk of his attention on his executive powers, which includes trade policy.

China will remain in the spotlight with further tariffs likely

China will remain firmly in focus with the 10% tariff on $200bn of imports into the US set to be hiked to 25% in the New Year. China shows no sign of cracking on US demands for enacting policies that will slash the bi-lateral deficit and sufficiently protect intellectual property in the US Administration’s eyes.

Officials are already signalling those tariffs may well be expanded to all Chinese imports later in 2019. Democrats may support President Trump on this initiative, but would likely be reluctant to back sanctions against key allies such as the EU. Moreover, we suspect the US administration would prefer to get the EU “onside” to provide a united front that would stand a better chance of getting concessions from China.

If Republicans spring a surprise, global trade tensions could quickly escalate

However, if we are wrong and the Republicans actually retain control of both the House and the Senate, President Trump could see this as a vindication of his trade policies and actually double down. This would risk a rapid escalation of global trade tensions with sanctions spreading to Japanese and EU products and a heightened risk that the US pulls out of the World Trade Organisation.

China still has ammunition

President Trump may feel that because the Chines-US bilateral trade relationship is one-sided, the Chinese will eventually crack, but we have to remember that the Chinese are not without options to fight back.

The US fiscal position is poor with the Congressional Budget Office suggesting the Federal deficit could rise to 5% of GDP in coming years. At the same time, the Federal Reserve is running down its balance sheet holdings of US Treasuries.

China remains a key buyer of Treasuries, so one option is not to turn up to some Treasury auctions

Failed government bond auctions could see bond yields spike, putting up borrowing costs across the country and adding to volatility and uncertainty. Admittedly it wouldn’t be great for the Chinese either given it holds close to 20% of the US debt but used in moderation; it could be an effective tool to send a warning shot across the bow of President Trump.

Moreover, if compromises are not forthcoming and the trade war intensifies this would risk impacting supply chains, raising prices, hurting growth and could lead to equity market price falls, which President Trump often views as a key barometer of his performance. A weaker economy and falling US household wealth would not stand him in good stead for a defence of his presidency in 2020.

Investment slowdown ahead?

Trade tensions will continue to bubble

Overall, our view remains that trade tensions will remain a slow burn, creating concern but not causing enough damage to the US economy to see the US administration throw in the towel and reverse course in the near-term.

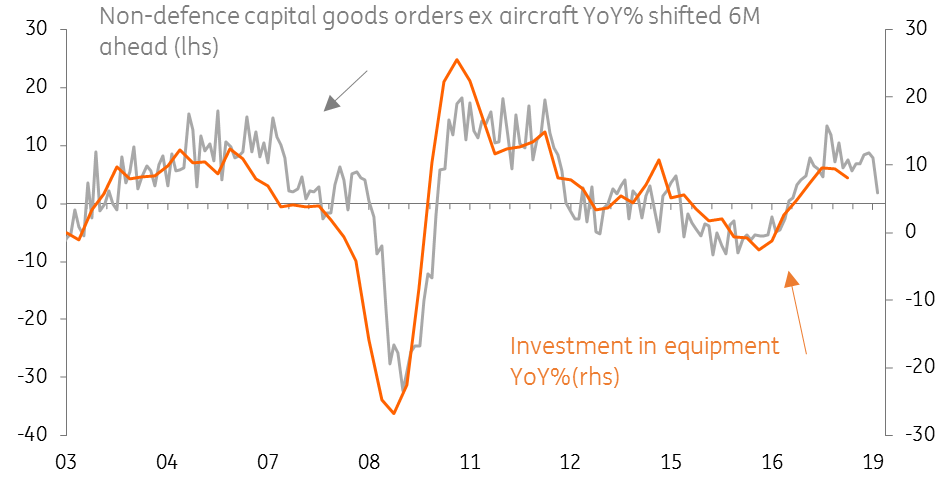

This view is consistent with our forecast of a slowdown in US growth over 2019 and 2020. Trade uncertainty is creating a headwind for activity and as the support from the fiscal stimulus fades, and the lagged effects of higher US interest rates and a stronger dollar are felt increasingly, the US will lose some momentum. Significantly we are also seeing some signs of a slowdown in durable goods orders, which is not encouraging for investment spending (as seen in the chart above).

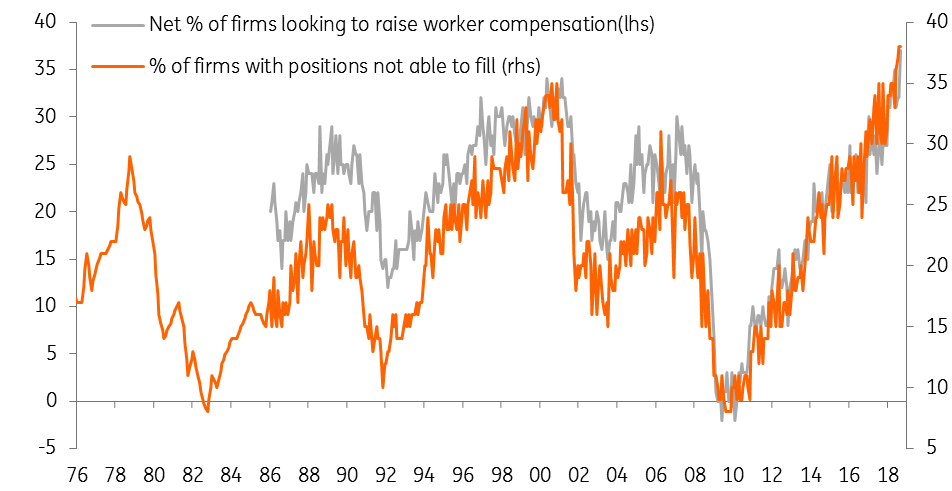

National Federation of Independent Business survey on labour market 1976-2018

Fed to remain in tightening mode given rising inflation pressures

However, there continue to be some positives, most notably in the jobs market. The chart above shows that the proportion of companies that can’t fill their job vacancies and the proportion of companies looking to raise pay are at a record high. This should be supportive of consumer spending, but it also suggests there are clear pipeline price pressures.

Given inflation is already above the Federal Reserve’s 2% target on all the main measures this suggests that the Fed will remain in tightening mode for much of 2019. We continue to forecast a 25bp rate rise in December with three more rate hikes in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 November 2018

November economic update: A changing of the guard This bundle contains 8 Articles