US: Vibrant manufacturing heaps more pressure on the Fed

With manufacturing and construction activity surging ahead and inflation pressures becoming more evident the Federal Reserve's relaxed attitude to allowing the economy to run hot is going to be increasingly questioned

Manufacturing produces the goods

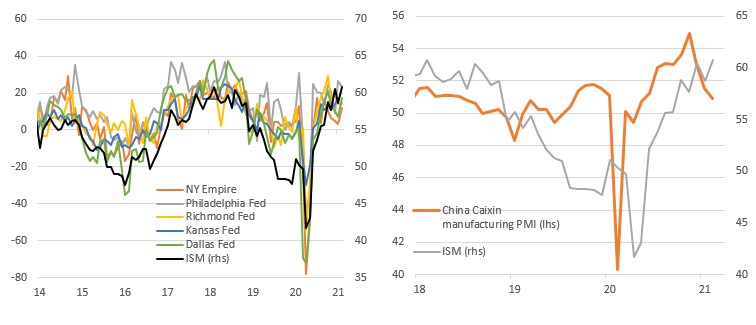

The February ISM headline manufacturing index has risen to a 3-year high of 60.8 from 58.7 in January. This was ahead of the 58.9 consensus, although is broadly consistent with the regional manufacturing surveys. Interestingly, the US manufacturing sector is now outperforming China’s and with more stimulus on its way plus the potential for a $3tn+ Build Back Better program, the outlook for growth and jobs is very positive.

ISM & regional surveys and versus the Chinese PMI

Momentum is strong

Both new orders and output improved and are running at rates in excess of their 6M average, indicating the momentum is good. At the same time customer inventories have weakened to match their all-time low. Given a strengthening economy we would expect to see companies ideally wanting to rebuild their inventory levels back towards historical norms. This would indicate that both the orders and output components will continue to perform robustly in the months ahead.

Business optimism was also underlined by the fact that the employment component rose to 54.4, the best reading since March 2019. It looks as though the manufacturing sector will be contributing positively to Friday’s jobs report – we forecast a 230k rise in payrolls with the California re-opening providing a lift after January’s disappointing 49k outcome.

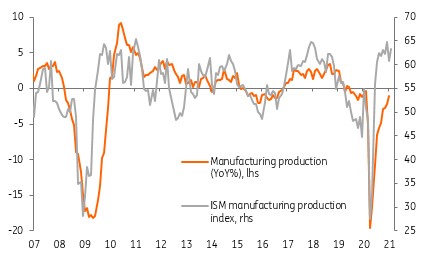

ISM points to further output gains

Inflation pressures becoming much more apparent

Inflation pressures continue to rise with the prices paid component rising to its highest level since July 2008. This reflects input costs, particularly commodity and energy, which have been pushing higher for several months now. This is likely to lead to broader price pressures given supplier delivery times posted the second highest reading since 1979! This indicates some major supply chain issues will push costs even higher and in a strong demand environment, those cost increases can more easily be passed onto consumers

We expect inflation to rise above 3.5% in the second quarter and today’s figures only make that look more likely. The Federal Reserve continues to believe that this won’t be sustainable and we think they are probably right. However, there is a growing risk inflation could end up being a little stickier around the 3% mark given the prospect of vibrant, stimulus fueled demand coming up against a supply constrained economy and businesses taking advantage to rebuild margins.

For now, the Federal Reserve tells us that they don’t think they will raise interest rates before 2024, but we feel that this will be increasingly difficult to reconcile with the data. Mid-2023 looks increasingly likely to be the starting point for higher US interest rates.

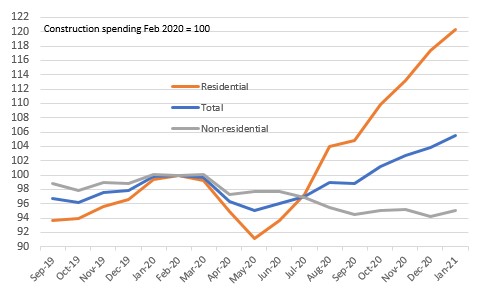

US construction output led by residential

Construction is booming

Meanwhile, construction surged 1.7% month-on-month in January while December’s reading was revised up to show 1.1% MoM growth. Once again residential construction is primarily responsible, increasing 2.5%, given the booming housing market. With so little inventory on the market we expect this important sector to make a major contribution to both GDP and employment growth in 2021

Residential home construction is now up 20.3% on the previous peak seen in February 2020 and is up 31.9% from the low in May. It is mainly being driven by single home construction with seven consecutive MoM increases in excess of 3%! Apartment construction is making much more modest gains, but is at least positive. Meanwhile, non-residential construction is down 5% from the February peak and will remain lackluster given working from home’s impact on office construction plans. Government construction is under pressure given state and local government budgets, but with more stimulus proposed that could turn around far more quickly than the office sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article