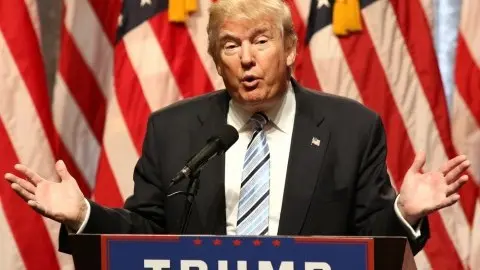

Dethroning the King: Five ways Trump could weaken the dollar

Can President Trump instruct the US Treasury to intervene in FX markets and weaken the dollar? Twelve months ago, we wouldn't have even considered this question. But under this new mercantilist US regime, who knows? We identify five ways in which Washington could try to engineer a weaker dollar

Key messages: Time to consider how Trump could weaken the dollar

- President Trump’s ramped up verbal jawboning in recent weeks suggests that current USD strength may be the upper bound of the White House's tolerance level

- We identify five policies that the White House could employ to weaken the dollar: (1) US FX intervention and building out US FX reserves; (2) Changing the rules of the game for the Fed; (3) Ongoing jawboning and talking down the dollar; (4) Pressuring major trading partners to strengthen their currencies; (5) Creating a US sovereign wealth fund.

- We don’t think any small-scale unilateral intervention by US authorities will have a sustained impact on weakening the dollar. The best historical precedent – the Bush FX interventions in 1989-1990 – shows that this approach had a limited impact in driving the USD materially lower.

- Given that the current loose fiscal, tight monetary US policy mix is inconsistent with a weaker USD, we think that the US administration may find greater success by addressing one of the root causes of recent USD strength – higher US rates. Constant Fed criticism may keep a downside skew in US rates markets when it comes to pricing in Fed policy tightening – and on the margin, help to keep USD strength at bay.

- In a normal market environment, we think Trump jawboning could weigh on the dollar via a clearout of speculative long USD positions, weakening the power of interest rate differentials in influencing USD crosses and reducing the incentive for overseas investors to take on unhedged USD exposure. If the short-term fundamental USD factors were to wane as well, then we think a clearout of long USD positioning could be worth a 5-7% decline in the trade-weighted USD index.

- Alternative ways in which the Trump administration could weaken the US dollar – pressuring major trading partners to strengthen their currencies or even the creation of a US sovereign wealth fund – would be more slow-burning and medium-term in nature.

- Overall, more active steps from the White House to weaken the dollar could serve to knock the top off of an emerging dollar bull trend. Indeed, such active steps send a strong signal about the White House’s current dollar policy. We think the US administration's implicit desire for a weaker USD that is consistent with its mercantilist US trade policy will inevitably be self-fulfilling over the medium-term – and is one of the reasons why we remain strategically bearish on the US dollar.

White House needs a weak dollar for US trade policy consistency

While the first sentence of the above Larry Summers quote is certainly true, the second sentence is up for major debate. It may be difficult for investors to reconcile (i) a White House adamant in narrowing its trade deficit by boosting US competitiveness and (ii) broad-based USD strength. In theory, the two cannot coincide simultaneously.

The exchange rate is the purview of the Treasury. The United States is in favour of a strong dollar - Former US Treasury Secretary Larry Summers (2011)

Yet, whilst the White House has enforced sizeable tariffs on major trading partners in 2018, the dollar has broadly strengthened since April – with fundamental flows outweighing the uncertainty factor over Trump's dollar policy (see our note USD: Trade War Trap). We suspect the USD's recent strength – in particular against the Chinese yuan (CNY) – will have grabbed the US administration's attention, not least as it is incompatible with their current mercantilist policy agenda (see chart showing FX performance since Trump's inauguration). As we have seen in recent weeks, the President has ramped up verbal jawboning over a strong dollar and higher US rates as the currency has strengthened – suggesting that current USD strength may be at the upper bound of the White House's tolerance level.

Dollar strength starting to move into White House jawboning territory

Dethroning the King: President Trump's toolkit to weaken dollar

Given Washington's desire to address the US trade deficit and boost domestic competitiveness, we think it now makes sense to consider the tools that President Trump has at his disposal to keep a lid on dollar strength. We identify five policies that the White House could employ to weaken the dollar:

- US FX intervention and building out US FX reserves

- Changing the rules of the game for the Fed

- Ongoing jawboning and talking down of the dollar

- Pressuring major trading partners to strengthen the currency

- Creating a US Sovereign Wealth Fund

US Treasury FX Intervention | Likelihood: Very Low | Impact: Limited

The most direct way in which the Trump administration could seek to weaken the dollar would be to order the US Treasury (via the New York Fed) to conduct FX interventions. This would involve selling dollars and buying foreign currency most likely via the Exchange Stabilization Fund (ESF) – which permits the Treasury Secretary, with the approval of the President, to "deal in gold, foreign exchange, and other instruments of credit and securities" (see Footnote 1). So in theory, the ESF gives the Trump administration the power to buy and sell foreign currencies – without needing any prior approval from Congress.

Would it be this easy for President Trump to intervene in FX markets? Unilateral FX intervention by US authorities would be politically contentious – not only at home but also abroad. US FX interventions have been sparse since the early 1990s (see Figure 1 below) – with the last two occasions in 1998 and 2000 having been coordinated interventions with major central banks to support relatively weaker foreign currencies in disorderly markets (see Footnote 2). The last time US officials unilaterally intervened to weaken the dollar was in the early 1990s.

The main obstacle to effective US FX intervention via this channel is the size and the mechanics of the ESF. For ESF interventions that involve buying FX assets – which have historically largely been in EUR and JPY – USD assets on the ESF balance sheet need to be sold. As of 31 July 2018, there are just over $22.27 billion dollar-denominated assets held on the ESF balance sheet (all in US government debt). Even if the Treasury Secretary instructed all of these to be used to purchase FX assets, the direct impact on a USD market that has a $4 trillion daily turnover would be fairly muted.

While we will save the technicalities of US FX intervention for a later note, it is worth noting that there are some out-of-the-box ways for the US administration to bypass the ESF technical constraints – as well as any FOMC approval – to increase the pool of funds available to buy FX assets:

- While the Treasury can instruct the Fed to intervene on behalf of the ESF, it is unable to force the central bank to intervene under the Fed’s own account (SOMA). One exception would be if FX intervention was deemed a national emergency. While in the current environment this would seem absurd, it is not something we can completely rule out given that the current US administration is seeking to enforce tariffs on the grounds of national security.

- The other way would be for the administration to officially adopt a policy that seeks to build up US FX reserves buffers. While this makes little sense in the current environment – with the USD a reserve currency and the US running a trade deficit, the White House may see the need for a bigger US FX reserves buffer under its strategic plan to boost the US's role as an exporting nation. While again this sounds absurd, the Trump administration may be able to 'sell it' to Congress by simply pointing to other major trading partners which have bigger reserves buffers – and justifying a similar US policy on the grounds of national security.

Prior US Treasury FX interventions have marked distinct shifts in dollar policy

Would unilateral US FX intervention be effective?

Even if we engage in this thought exercise, we don’t think any small-scale unilateral intervention by US authorities will have a sustained impact on weakening the dollar. Over time, economic fundamentals will prevail – and the administration will find it difficult to fight these forces.

And right now, US officials have an incoherent policy mix to achieve a weaker USD – loose fiscal and tight monetary policy is typically fundamentally positive for any currency in the short-term. Add on top of this the White House's own trade policy that has seen the imposition of tariffs on major trading partners and fuelled flight-to-safety flows into USD-assets – and one could easily argue that any 'leaning against the wind' US FX intervention to weaken the dollar would be futile.

Therefore, in the current US policy environment, we think unilateral FX intervention by the Treasury would at best keep a lid on USD strength. Indeed, the best historical precedent – the Bush FX interventions in 1989-1990 – shows that this approach had a limited impact in driving the USD materially lower (with the trade-weighted USD flat over this period).

Altering the Fed's mandate | Likelihood: Very Low | Impact: High

Given that the current loose fiscal, tight monetary US policy mix is inconsistent with a weaker USD, we think that the US administration may find greater success by addressing one of the root causes of recent USD strength – higher US rates. Indeed, a more effective way to weaken the USD in the current environment would be to alter the rules of the game for the Fed in a way that would force them to adopt a slower tightening path.

This again provides legislative hurdles; it’s difficult to see Congress passing any change in the Fed’s mandate that would effectively force the central bank to adopt a higher inflation target (note that it is the FOMC that holds the mandate to set the explicit level for the inflation target). However, further criticism from the White House over the Fed's tightening approach – as we have seen in recent months – could have two indirect consequences: (1) it could in the short-term force the Fed to more likely than not err on the side of caution whenever the decision to raise interest rates is close and (2) it may get the FOMC re-thinking its long-run monetary framework (a debate that is taking place behind the scenes in the academic world).

The first factor could keep a downside skew in US rates markets over Fed policy tightening – and on the margin, keep USD strength at bay. But in the absence of forcibly changing the rules of the game for the Fed, interest rate differentials will be one of the main drivers for the USD – and like we've seen in recent months, can be quite a powerful positive driver for the currency.

White House dollar jawboning | Likelihood: High | Impact: Negligible

Given the legislative difficulties in enforcing an active policy to weaken the USD, the most likely thing that we will see from President Trump is ongoing talking down of the dollar and US interest rates. The effectiveness of this has been mixed (see the timeline of Trump dollar talk table below) – and we think the prevailing market conditions matter for whether the impact is sustained. For example, in a fully-fledged risk-off market, negative Trump comments on the USD would have a negligible – and potentially non-existent – short-term impact.

In a normal market environment, we identify the following channels through which any Trump jawboning could weigh on the dollar:

- A clear out of speculative long USD positions

- Reduced power of interest rate differentials in influencing USD crosses

- Less incentive for overseas investors to take on unhedged USD exposure

- A small uncertainty premium over White House dollar policy

However, these channels would only have a sustained impact if the short-term fundamental factors were also pointing to a weaker US dollar. If US leading activity indicators continue to come off the boil as they have been in recent weeks (we've seen a sharp drop in the ISM, Philly Fed index and Michigan consumer confidence) – then we think the USD could be vulnerable to a sharp positioning adjustment fuelled by weaker cyclical macro dynamics and Trump jawboning. Indeed, similar long USD positioning clearouts in 1H16 and 2H17 have been worth around a 5-7% decline in the trade-weighted USD (BBDXY) index.

Extreme long spec positioning makes USD vulnerable to Trump jawboning

White House jawboning would be more potent and effective in the short-term if President Trump – via Treasury Secretary Steven Mnuchin – were to formally end the long-standing 'strong dollar' policy. We see the risks of this as being low ahead of the US midterm elections given that it could cause some backlash within Congress and the Republican party. However, the White House officially ending the 'strong dollar' policy could mark a distinct shift in USD dynamics – that could have medium-term repercussions, marginally reducing the incentive of real-money investors (central bank reserve managers) to hold excess USD reserves.

A timeline of Trump administration dollar talk

Pressure major trading partners to strengthen their currencies | Likelihood: High | Impact: Medium

A simple, yet effective, policy approach that the Trump administration could take to weaken the dollar is by actively encouraging major trading partners to strengthen their domestic currencies. We have already seen the White House tie currency clauses to any new trade deals – with the updated US-South Korea trade agreement (KORUS) a good example.

Indeed, this may also be a tactic that President Trump is currently employing with China on any forthcoming trade deal – with headlines crossing the newswires last Friday that Washington will put pressure on Beijing to "lift" the yuan as part of upcoming talks. The effectiveness here shouldn't be underestimated; as we've argued, a more stable – and even higher – CNY would be transmitted across other closely-linked currencies.

A US Sovereign Wealth Fund | Likelihood: Very Low | Impact: Medium

One final and very left-field idea to weaken the dollar – or at least put a lid on dollar strength – would be for President Trump to establish the United States’ very own Sovereign Wealth Fund (SWF). Critics could argue that China was only able to establish its own SWF in 2007 – the China Investment Corporation (CIC) – with an undervalued renminbi and proceeds from its burgeoning FX reserves during that period. The CIC was capitalised with $200 billion of China’s FX reserves in 2007 and now has close to $1 trillion in assets under management.

Typically SWFs have been created by those nations running huge current account surpluses – largely on the back of natural resource exports – and have chosen to save those export proceeds for future generations. Thus the likes of Norway and the Middle East have some of the largest SWFs in the world and conduct regular FX buying operations to prevent those export proceeds driving the domestic currency a lot higher.

Its typical position of a net debtor on the current account would not make the US a conventional candidate for an SWF. But these are unconventional times and were President Trump to instruct the US Treasury to build up FX reserves for the purpose of capitalising an SWF at some future date, the move could serve to knock the top off of an emerging dollar bull trend.

Bottom line: Weak dollar policy will be self-fullfilling

Overall, more active steps from the White House to weaken the dollar could serve to knock the top off of an emerging dollar bull trend. Indeed, such active steps send a strong signal about the White House’s current dollar policy. We think the US administration's implicit desire for a weaker USD that is consistent with its mercantilist US trade policy will inevitably be self-fulfilling over the medium-term – and is one of the reasons why we remain strategically bearish on the US dollar.

Footnotes

1. Strictly speaking, the 1976 amendment to the Gold Reserve Act – which forms the legislative basis for the ESF – states that it must be used in a manner that is "consistent with the obligations of the Government in the International Monetary Fund". The IMF would be unambiguously opposed to any unilateral FX intervention by the US for competitive devaluation purposes – given that this would be a violation of international exchange rate commitments.

2. The Fed's coordinated intervention with the Bank of Japan in 2002-2003 to weaken the yen was not recorded as US intervention given that US officials were selling yen (and buying dollars) on the behalf of Japanese authorities (MoF/BoJ). Therefore no 'money' of US authorities was involved. The New York Fed's website has more on how it acts as an agent for foreign central banks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 August 2018

In case you missed it: De-throning the king This bundle contains 8 Articles