US: The Fed’s dose of reality?

The Federal Reserve’s Financial Stability Report underlines the point that even with a vaccine on the horizon the economy is still facing tough immediate challenges. The central bank stands ready to provide more support and may well need to

A shot across the bow?

A red headline on the newswires stating “Fed warns assets may have big declines if virus isn’t contained” offered something of a reality check to markets that were buoyed by news earlier in the day surrounding the effectiveness of a vaccine. It is important to point out that this came from the Federal Reserve’s November Financial Stability Report, which has been compiled over recent weeks and wasn’t a Fed assertion tied to any specific news event.

As the title of the report suggests, it is a document on the risks and is always going to take a cautious position regarding the economy and events that could impact it. The report's purpose is to “promote public understanding and increase transparency and accountability for the Federal Reserve’s views”.

The offending paragraphs...

The key passages in today’s report are on page 57 and states:

“If the pandemic persists for longer than anticipated—especially if there are extended delays in the production or distribution of a successful vaccine—downward pressure on the U.S. economy could derail the nascent recovery and strain financial markets and financial institutions, particularly if many businesses are shuttered again and many workers are laid off and left without a normal income for a long period.”

“Investor risk appetite and asset prices have increased in recent months but could suffer significant declines should the pandemic take an unexpected course or the economic recovery prove less sustainable. Given the generally high level of leverage in the nonfinancial business sector, prolonged weak profits could trigger financial stress and defaults.”

Covid-19 cases are on the rise

Obviously, this report was written well in advance of today’s positive news on a vaccine, but the concerns about the vaccine rollout amidst a surge in Covid-19 cases is clearly still valid. It is unlikely to be widely available until 2021, meaning a vulnerable few months for the US population and the economy.

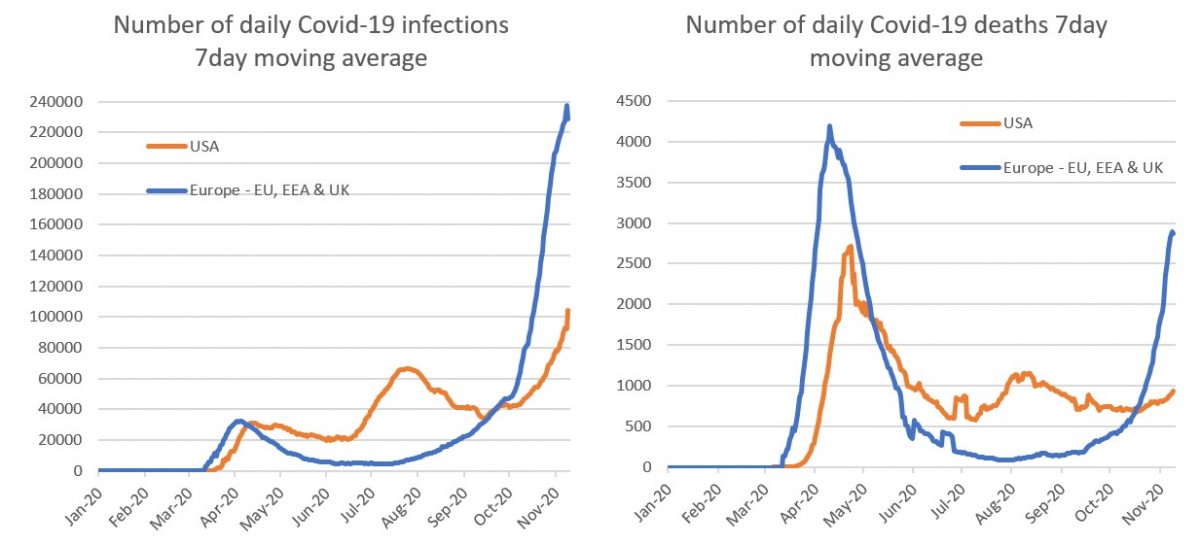

The number of cases in the US is moving sharply higher and appears to be following the path in Europe. There, accelerating transmission has prompted rising hospitalisations with governments taking the tough decision to reintroduce containment measures to protect the integrity of their healthcare systems. This, we think, will lead to Eurozone economic activity contracting at an 8% annualized rate in 4Q20.

Covid-19 cases are rising rapidly

Near term macro risks are mounting

Such action in the US would inevitably bring economic damage. While the construction and manufacturing sectors may escape the scale of lockdown experienced earlier in the year, the service sector is unlikely to be as fortunate. Even if we see only limited action, health fears could mean consumers vote with their feet and not go to shops, restaurants and gyms.

Right now we are forecasting sub-2% growth in 4Q20 and negative GDP in 1Q21

Activity would weaken in any case, not helped by the fact that unemployment benefits are currently being tapered, meaning incomes are increasingly under pressure. Right now, we are forecasting sub-2% growth in 4Q20 and an actual negative GDP reading for the first quarter of 2021. The more severe the restrictions, the more severe the contraction.

The fact that Fed Chair Jerome Powell stated last week that rising Covid-19 cases were “particularly concerning” underscores their nervousness at the central bank. The current political backdrop with legal challenges surrounding the election may not be the best environment for politicians to swiftly agree a package of support measures. Consequently, the Fed may well feel that they have to take a lead to calm nerves and smooth market functioning.

Given this situation we feel that the balance of risks are increasingly moving the direction of the Fed choosing to ramp up its asset purchases and/or liquidity rather than scaling them back.

Outlook for Treasuries

The impact effect of the vaccine announcement was to take the 10yr US yield from 80bp to 90bp. It then trended up to the 95bp area and seemed to have an attack on 1% as a target. This Fed release has helped to take the 10yr lower to the low 90’s bp. It is still a significant net up-move in the yield on the day.

Our vision ahead see a move towards a 1-handle for the 10yr yield as a viable structural 2021 theme. For the remaining weeks of 2020 it is not implausible that the 1% area could be tested. But it feels at the some time that it will prove tough to stay up there given the immediate headwinds from a macro and Covid-19 perspective coming.

This warning shot across the bows for risk assets from the Fed this afternoon reminds market participants that a vaccine is all well and good (great in fact), but we need to get through some “heavy stuff” first, and in consequence the Fed it still very much on a rescue mission for the economy. Market participants should react accordingly – don’t get too carried away (just yet).

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more