US: The bounce-back gains momentum

US GDP grew an annualised 6.4% in the first quarter with the re-opening process and ongoing stimulus set to result in double-digit growth in the second quarter. This leads us to the remarkable conclusion that the level of US GDP will be higher at the end of the year than would have been the case had the pandemic not occured

| 6.4% |

US 1Q21 annualised GDP growth |

Growth accelerates thanks to stimulus fueled consumers

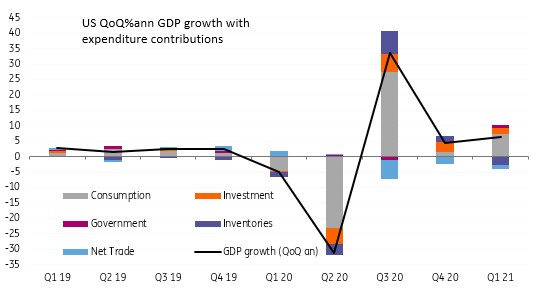

US 1Q GDP growth came in at 6.4% annualized, a little weaker than we had been looking for (7.4%) and just a touch softer than the 6.7% consensus. Consumer spending rose 10.7%, which was actually above what we had been factoring in, while non-residential fixed investment rose 9.9% and residential investment posted a 10.8% increase with government spending up 6.3%. However, a run down in inventories subtracted a hefty 2.6 percentage points from GDP growth and net exports subtracted 0.9 percentage points as strong consumer demand sucked in imports while exports fell due to economic weakness overseas.

Contributions to GDP growth

The outlook keeps getting better

Looking towards 2Q GDP, it is clear than consumer spending in March was very strong, supported by the latest $1,400 stimulus check and this provides a strong base for growth in the current quarter. Encouragingly, restaurant booking data, security check numbers at airports and daily debit and credit card transaction numbers suggest that momentum has carried through into April. With 142 million Americans also now having at least one dose of the Covid vaccine and the economy opening up more and more each day we are penciling in a double-digit GDP growth figure of around 12.5% annualized.

The US economy has already experienced $5tn of stimulus through measures enacted by Presidents Trump and Biden and is set to be boosted by an additional $4tn of spending, partially offset by some tax rises, from Joe Biden’s latest infrastructure and social spending plans. That is equivalent to around 40% of GDP all in and with household balance sheets in great shape and the US economy opening up more and more we should be expecting very strong growth for several quarters to come.

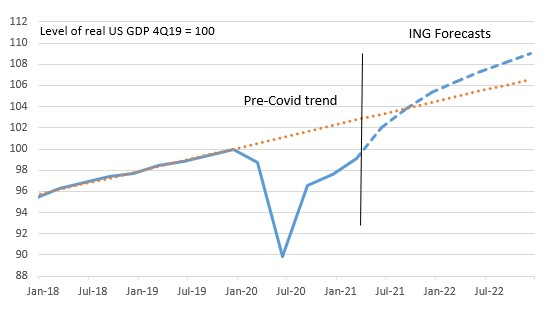

GDP to move above trend

In fact we strongly suspect that the level of real GDP in the US will be higher in 4Q 2021 than it would have been of there had been no pandemic and the US economy had instead continued growing at its 2014-19 trend – see chart below.

Inflation pressures are mounting and the Fed will respond

By mid-2022 we think the level of output will be 2 percentage points above where it would have been absent the pandemic. With scarring from the pandemic hitting the US' supply capacity, this underlines our sense that inflation pressures could be more sustained than the Fed is publicly admitting. With strong growth set to boost job opportunities through the summer we expect to see a substantial shift in Fed language at the August Jackson Hole Conference that would pave the way for a December QE taper announcement. We continue to expect a rate hike in 1H23 versus the Fed’s current guidance that nothing will happen before 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 April 2021

World in motion This bundle contains 6 Articles