US: Strong jobs momentum will only build

A very strong jobs report for February is just the start. Construction is set to rebound next month after winter storms and with more state Governors relaxing Covid containment measures we expect to see even better numbers in March and April. With vaccines ramped up, we could see a broad 2Q re-opening that fuels a surge in job creation thereafter

| 379,000 |

The number of jobs the US economy added in February |

Jobs looking more plentiful

The February jobs report shows that 379,000 jobs were created in February, significantly above the consensus forecast of 200,000. There were also decent upward revisions to the past two months of data, amounting to an extra 38,000 jobs. This has resulted in the unemployment rate dropping back to 6.2% while wage growth has held at 5.3%.

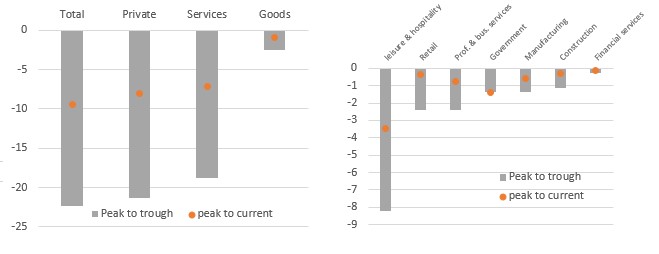

The private sector led the charge with a 465,000 gain despite construction employment falling 61,000, with bad winter weather likely the cause of this. Manufacturing rose 21,000 while private sector services jumped 513k. Leisure and hospitality rose 355k with retail up 41k and business services gaining 63k. We were expecting a good number on the basis of the California re-opening and several other cities expanding or re-opening dine in eating, but this is considerably stronger and reinforces the message that the US economy has started 2021 on a very strong footing.

The government sector lost 86,000 jobs, but with more support coming as part of the $1.9tn fiscal support program we expect to soon start to see some stabilization.

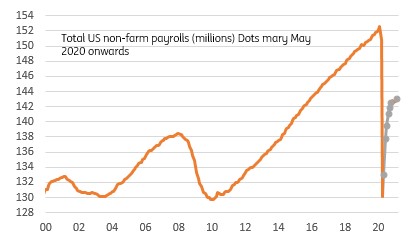

Level of US employment (millions)

Don’t read too much into the unemployment rate or wages

Wages growth of 5.3% YoY looks fantastic, but we should continue to ignore it due to the way it is calculated. Given that most of the jobs lost in the pandemic were low wage consumer services roles, such as retail, restaurant and bar work, the fact that these jobs no longer exist structurally lifts the "average" hourly pay rate of the people who are still working. It will be many more months before we get a clean wage growth figure.

Likewise, the unemployment rate doesn’t tell us much about the state of the jobs market given very low worker participation rates. We prefer to look at employment as a proportion of working age population, which at 57.6% remains woefully low. Remember it was up at nearly 65% 20 years ago, so there is clearly a lot of slack in the US economy.

Change in employment levels since February 2020

Many more jobs are coming

The ongoing positive effects of the rescinding of the California stay at home order, the re-opening and expansion of dine-in eating in many cities and a likely pick-up in hiring post the recent winter storms (particularly construction) should boost the jobs figures in March. Jobs growth will then accelerate from April onwards as more and more state Governors follow the lead of Gregg Abbot in Texas and Tate Reeves in Mississippi and re-open their states on the back of rising vaccination rates and falling hospitalization numbers. This doesn’t come without risks given the prevalence of more dangerous mutant strains and the fact we are a long way from herd immunity, but it is clearly the direction of travel for the economy.

The year to date total for job creation is 545,000, meaning that employment is still 9.475mn down on pre-pandemic levels. But given we expect the economy to grow 6.5% this year we think substantial progress will be made on the jobs front with at least 4.5mn jobs forecast to be created in 2021. There could be even more job creation next year if the $3tn+ Build Back Better program gets approved.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article