US stagflation fears on the rise

A surprise GDP contraction at a time when inflation is running at 40-year highs will inevitably lead to more talk of stagflation, particularly with the Fed set to hike interest rates aggressively. However, major trade and inventory swings masked decent underlying domestic demand with 2Q activity set to be much better

| -1.4% |

Annualised growth in 1Q |

GDP falls, but details offer reasons for optimism

Well that will get all the stagflation worriers out in force! US GDP contracted 1.4% annualised in the first quarter versus expectations of a 1% increase. However, we wouldn’t get too carried away since the details are not as bad as the headline figure suggests. Domestic demand actually held up pretty strongly, especially when we take into account the hit to economic momentum caused by the Omicron wave late last year. In fact consumer spending grew 2.7%, while non-residential investment expanded 9.2% and residential investment posted a 2.1% gain.

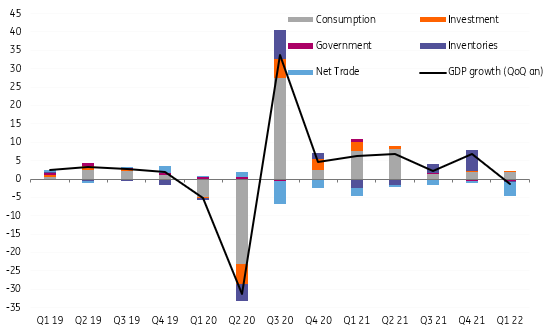

Contributions to annualised GDP growth (%)

The negative GDP number is caused by a drop in exports (weak foreign demand due to Covid restrictions) and a surge in imports that meant net trade subtracted a full 3.2 percentage points from headline GDP growth. Inventories run downs amid ongoing supply chain disruptions subtracted a further 0.8% while government spending fell in consecutive quarters and subtracted 0.5pp.

2Q growth should rebound

Looking to 2Q, we are confident the growth number will be better despite fiscal and monetary policy becoming less supportive. While inflation is hurting spending power, nominal incomes are rising strongly and there are decent employment gains that in combination can keep spending firm. On top of that there is the legacy of higher savings accrued through the pandemic and large wealth gains caused by rising asset values that can additionally be used to keep consumer spending growing nicely.

Residential construction continues to perform well with rising housing starts and building permits, while robust durable goods orders point to a positive corporate investment backdrop. We are also expecting to see less of a drag from net trade, although it still will be a drag given strong domestic demand relative to elsewhere, while companies will continue to seek to rebuild inventory levels.

GDP levels versus pre-Covid trend

Fed still set to hike by 50bp in May

We are looking for 2Q annualized growth to come in at 2.0-2.5% and with inflation pressures remaining elevated and the labour market looking so tight, today’s disappointing GDP outcome shouldn’t alter the outlook for a 50bp Federal Reserve interest rate increase next week.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article