US: Slower GDP growth, but the tide will turn

US GDP grew at an annualised 4.0% rate in 4Q20. There was undoubtedly a loss of momentum as Covid restrictions tightened, but early signs suggest 2021 is starting well with the latest $600 fiscal stimulus payment boosting spending, California starting to re-open and the vaccination program gaining momentum. 5%+ growth looks achievable this year

| 4.0% |

US 4Q annualised GDP growth |

Covid containment bites

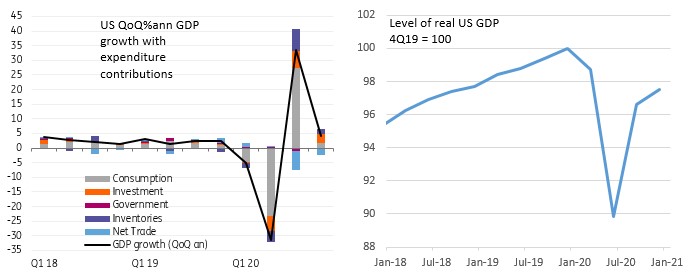

US 4Q GDP growth slowed to a 4% annualized rate from 33.4% in 3Q, broadly in line with the 4.2% consensus forecast. The details show consumer spending grew 2.5% with reintroduced Covid containment measures in several areas clearly having an impact on consumers willingness and ability to spend.

Residential investment leapt 33.5% after a 63% gain in 2Q thanks to the surge in transactions resulting from the plunge in mortgage rates. Corporate investment was also firm with non-residential fixed investment rising 13.8%. Government consumption fell 0.5%, led by an 8.4% decline in non-defence spending while inventory rebuilding added 1% to the headline GDP figure and net exports subtracted 1.5 percentage points from headline growth.

The net result is that GDP fell 3.5% year-on-year for full year 2020, but the economy is now only 2.5% below pre-pandemic levels, which in light of what has happened is a remarkable outcome.

Contributions to US GDP growth and the level of economic activity versus pre-pandemic period

2021 starts in decent shape

The early signs are that 2021 has started in decent shape. Evidence from www.tracktherecovery.org suggests that the $600 stimulus cheque, which was distributed at the beginning of January, is being spent. The buoyant housing market is likely to keep residential construction activity robust too while the ending of California’s stay-at-home order opens the door for restaurants and personal service, such as hair salons.

At the same time the US is getting close to averaging 1 million Covid vaccination doses a day with President Biden promising more resources to ramp up the process to 1.5 million and possibly even 2 million per day. With the warmer weather of spring approaching and hospitalization numbers already falling, there is hope that a 2Q re-opening of the economy is possible and this can help keep sentiment strong.

Household incomes are above pre-pandemic levels, which have led to a surge in cash and bank savings

On course for 5% growth in 2021

Once the re-opening gets underway we expect to see consumer spending leading the charge with pent-up demand focused on the leisure, travel and entertainment sectors. Households are cash rich with government support programs (extended unemployment benefits and individual cheques) boosting lower income households.

At the same time the inability to travel and spend money on “experiences” has led to involuntary saving by higher income groups. The result is that savings in cash, checking and time deposits have surged $2.4tn between 3Q19 and 3Q20. The fact that credit card balances are at four-year lows means there is a huge amount of cash ammunition with which to propel spending higher. Add in the prospect of significant employment gains as the downtrodden service sector finds its feet and 2021 looks set to be the strongest year for economic growth in decades.

More support is proposed with a $1.9tn fiscal plan set to make its way through Congress although some dilution and modifications will likely be required to get it passed.

Elsewhere, capital expenditure by US corporates is likely to recover after 12 months of flat lining and a pick-up in global trade and a more internationally competitive US dollar following its recent declines will also support activity.

While we acknowledge there are obvious risks that virus mutations deliver setbacks or problems arise with the vaccination program, we think the positives outweigh the negative risks. Consequently 5% growth looks achievable this year and this is before we consider the potential boost from President Biden's $3tn+ Build Back Better infrastructure and energy plan.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article