US: Retail sales slide, but they’ll come back stronger

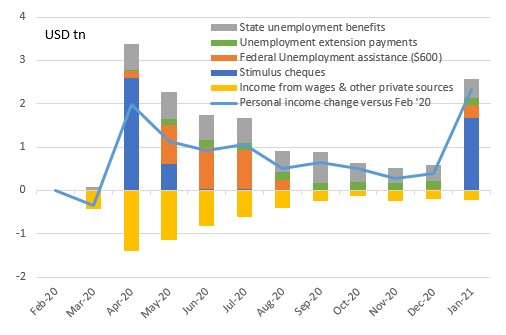

Retail sales fell more than expected in February, but this shouldn't be alarming. January's stimulus-payment-induced surge was revised even higher and with another stimulus cheque hitting bank accounts and the weather situation having improved, the numbers for March and April will surge

Sales fall, but don't worry

Retail sales fell 3% month-on-month in February, which was weaker than the -0.5% MoM consensus figure, but it is important to point out that the $600 stimulus-payment-induced surge in January retail sales was revised higher to 7.6% from 5.3%. Therefore, looking at the dollar level of sales it is broadly in line with expectations.

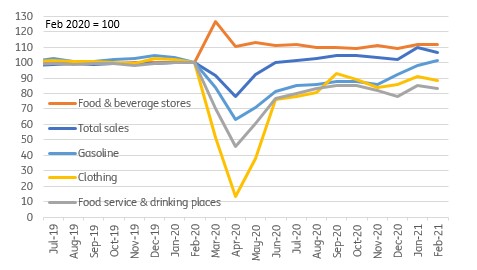

February was always going to struggle against that stellar set of figures for January. Incomes obviously dropped back while bad winter weather in many states depressed activity. We had already seen unit auto sales numbers fall 5.8% MoM to an annualised 15.67mn and this translated into a 4.2% drop in the value of auto sales. The only category to see a rise was gasoline station sales, which rose 3.6% on the back of higher prices while food sales were flat. The other categories all fell heftily with department store sales down 8.4%, sporting goods down 7.5% while non-store (internet) fell 5.4%. Surprisingly eating and drinking fell 2.5% despite the broader relaxation of restrictions in many states.

Retail sales levels - February 2020=100

March and April sales will surge

Overall, the report remains consistent with a strong 1Q GDP reading with the level of total sales still 6.3% higher than a year ago – before the pandemic really hit. The “control group” which excludes more volatile components such as food service, autos and building materials, is a better match with broader consumer spending trends and while it dipped 3.5% MoM, this followed an 8.7% jump in January. We know that retail sales in March and April are going to be very strong, boosted by the latest $1,400 stimulus payment while the ongoing relaxation of Covid containment measures across many states will increase the opportunities to spend. More normal weather will also help to reverse some of the February decline.

Change in annualised US household income versus February 2020

Jobs and ongoing fiscal support will maintain the momentum

Looking further ahead the story remains very positive with job opportunities set to improve on the re-opening of the economy and in any case the NFIB small business survey reports that 40% of small firms already have job openings they cannot fill. Consumer sentiment surveys suggest that people expect jobs to become more plentiful and this should heighten the chances that households use some of their accrued savings for spending over coming months, especially with more options such as travel and leisure being made available. In terms of savings, the Federal Reserve Flow of Funds report showed the amount of money households have in cash, checking and time depsosit accounts has increased by more than $3tn since late 2019.

Significantly, with the extended Federal unemployment benefits continuing through to September as part of the $1.9tn stimulus, the unemployed also have the guarantee of robust financial support in addition to state benefits to fall back on should they fail to find work.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article