US: Regime change?

Tomorrow's US Presidential election may be the most pivotal in decades. We bring you three potential scenarios for the US economy and markets

Decision time

The Covid-19 pandemic has made this a very different election campaign to “normal” and it will continue to be the dominant influence over the economy until a vaccine has been approved and rolled out. Nonetheless, the situation hasn’t stopped the two candidates from spending billions of dollars and travelling tens of thousands of miles on the campaign trail. Early indications suggest that the electorate is engaged and fired up with early voting pointing to the highest turnout in decades.

We will soon find out whether President Donald Trump has done enough to convince enough people that he deserves a second term or whether his response to the pandemic and Joe Biden’s vision for moving the country in a different direction will result in a new President of the United States. Then again, we might not. Court cases over the date when mail-in ballots can be counted up to, combined with the prospect of legal challenges in the case of close state elections means there is a very real chance we don’t have a clear picture for several days or possibly even weeks.

We have extensively outlined our views surrounding the potential scenarios (see here, here and here), but below you will find a brief summary of our macro and market views.

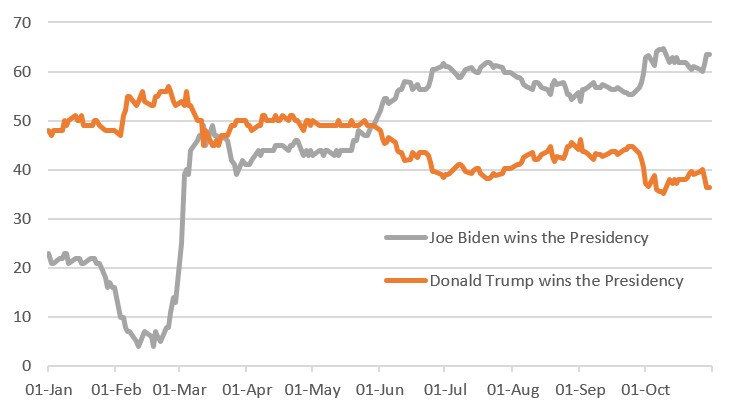

Implied probability of victory from PredictIt quotes

The Blue wave

Assuming the opinion polls are correct and Joe Biden wins a convincing victory with the Democrats retaining the House of Representatives and gaining control of the Senate this is likely to be the scenario that delivers the swiftest, most aggressive fiscal stimulus.

This is based on the $3.4 trillion stimulus proposed by House Democrats over the summer that would front-load support for household incomes and deliver relief for state and local government. The proposed massive green energy investment projects would then help maintain economic momentum. This scenario would also likely lead to a more predictable trade policy with improved relationships with allies/trade partners relative to what corporate America has been faced with in recent years.

The re-appointment of Federal Reserve Chairman Jerome Powell would be supportive for financial market sentiment, and the likely nomination of current Federal Reserve board member Lael Brainard for Treasury Secretary would ease market concerns of a more radical, progressive agenda with regards to economic policy.

Aggressive fiscal stimulus expected with tax hikes likely to be delayed and the Fed continuing its loose monetary policy

Tax hikes for corporates and high-income households will, of course, be implemented and specific industries will come under regulatory focus, but given the hugely disruptive nature of the pandemic, they would likely be eased in, rather than rapidly and aggressively enacted. Given 2021 will see a focus on growth and regaining all the lost jobs we suspect tax hikes may be delayed until 2022/23. With the Fed assuring us of ongoing loose monetary policy, a more benign trade backdrop and the prospect of a vaccine we could see very vigorous economic activity next year.

While there is a sense that equities may be initially vulnerable on the fear of higher taxes and tougher regulations, such an economic environment would likely be a positive backdrop for corporate profitability, risk appetite and US equities.

We would also expect to see the dollar continue to drift lower, from what are still comparatively high levels looking over the past 15 years. Our FX team suggesting NOK and AUD would be the main winners, but EUR and GBP should perform too. This would make the US, at the margin, more economically competitive on the international stage.

In the bond market, this reflationary environment should result in a steepening of the yield curve, with a higher endpoint for yields compared with other scenarios on the back of initially higher borrowing to fund the bigger stimulus and an implied higher growth and inflation environment.

That said, the significant investment programmes, employment strength and higher taxes for corporates and the wealthy over the medium to longer-term could result in structurally healthier performance of the US fiscal position in subsequent years. Should better-balanced growth emerge, and the budgetary position improves as it did under Bill Clinton in the late 1990s, Biden could ultimately prove to be a dollar positive.

Biden wins but faces challenges

This outcome sees Joe Biden win the Presidency and the Democrats retain the House, but fail to overturn the Republican majority in the Senate.

As with the previous scenario, the initial reaction from equities and the dollar are likely to be negative on the fear of higher taxes and more regulation. That said, if there is a sense that it will be watered down due to the lack of support in Congress, market moves may be more muted.

There is also less prospect of a major (and swift) fiscal stimulus, with Democrats having to work with Republicans on a quid pro basis. This will dilute some of Biden’s plans, but an effective legislative agenda is still possible, working with moderate Republicans. This would fit with the narrative that the focus would be on infrastructure investment first, rather than full steam ahead with the green energy project.

Less fiscal stimulus expected but better relations with allies

As in the previous scenario a return to multilateralism and preparedness to work more cordially with allies and trade partners could provide more certainty for multinational businesses. Overall, the backdrop should be modestly supportive for growth given a still sizeable fiscal stimulus and a more certain trade environment while President Biden will be constrained from implementing radical regulatory and tax changes.

This should not impede the equity market meaningfully and could facilitate a period of benign dollar decline with cyclical currencies such as NOK and AUD outperforming, but to a lesser degree than under a Blue Wave with JPY the laggard.

Given that the fiscal deficit won’t widen as rapidly in the near term as under the first scenario and the threat of gridlock on so many issues, the growth story may not be as vigorous and yield curve steepening will be more muted. However, on balance, we are less likely to see the improvement in the fiscal position we are anticipating over the longer term in the Democrat clean sweep scenario.

Trump - the comeback King

This would be a remarkable outcome given the current state of polling but is certainly not impossible given the structure of the electoral college voting system and the uncertain impact of so many mail-in ballots. The Democrats would still likely retain the House, while Trump’s Presidential victory would probably be tied up with the Republicans retaining the Senate.

Trump’s promises of low taxes and less regulation would be music to investors' ears, the question is how deliverable is it? It is difficult to imagine the Democrats setting aside differences with President Trump and the Republican party and be willing to sit down and quietly wave through his policy proposals. Instead, it is likely to be an even more divisive and brutal period that could see much of Trump’s domestic agenda stifled.

There is certainly room for a deal on fiscal stimulus. However, the Republican party’s reticence to back a package of the magnitude proposed by the House Democrats in recent months means it is likely to be more modest than under both Biden scenarios outlined. Consequently, the growth outlook and corporate profits may not be as vigorous as hoped.

Domestic policy could be limited and trade issues likely to continue

If his domestic policy thrust is limited, President Trump may well double down on his international trade policies that involve making “deals” with the threat of tariffs. We will likely see the trade, intellectual property, security and technology battles with China continue and potentially be expanded, with Europe increasingly in the line of fire.

The long-term aspiration is for production to be re-shored to the US, but this will take time and the immediate impact would be to put up costs for American businesses and consumers. This would be unsettling for equities with the dollar rising on the back of geopolitical anxiety and the prospect of a weaker global growth outlook.

If President Trump seeks to replace Jerome Powell as Federal Reserve Chair with someone more compliant, more willing to bend to his demands on negative interest rates, for example, this could undermine investor confidence. But that person would first have to get approval through Congress and we suspect that many Republicans would refuse to countenance such a blatant attack on the Fed’s independence. After all, they have rejected less controversial potential candidates for positions at the Fed.

In combination with a return of the trade war, a less reflationary fiscal environment and no real substantive tax cuts, interest rates are likely to remain pinned to the floor. This would mean a slow re-steepening of the US yield curve – the slowest of all three scenarios – as the recovery continues more gradually.

Contested result

Should the election fail to deliver a clear result and recounts and legal challenges mean that there is a longer period of uncertainty, market angst would likely rise, particularly given sharply rising Covid-19 hospitalisations and the potential for more containment measures. It would also end up heightening animosity between the two parties and could make getting legislation through Congress more challenging if grudges are allowed to fester.

Risk sentiment would be diminished with the dollar rallying and the Treasury yield curve flattening at lower levels.

Our FX team expect the JPY, USD and CHF to benefit on such an outcome.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

US electionsDownload

Download article