US recovery has challenges to overcome

The US economy is having to deal with a number of challenges that will weigh on growth in the near-term while keeping inflation elevated. Nonetheless, there are clear reasons for optimism and this should allow the Federal Reserve to “dial back” on its policy stimulus later this year and start to raise interest rates in 2022

Consumer caution weighs on growth

The US economy has fully regained all the output lost to the pandemic, but while prospects remain good, there are near-term headwinds that have resulted in us lowering our growth forecasts.

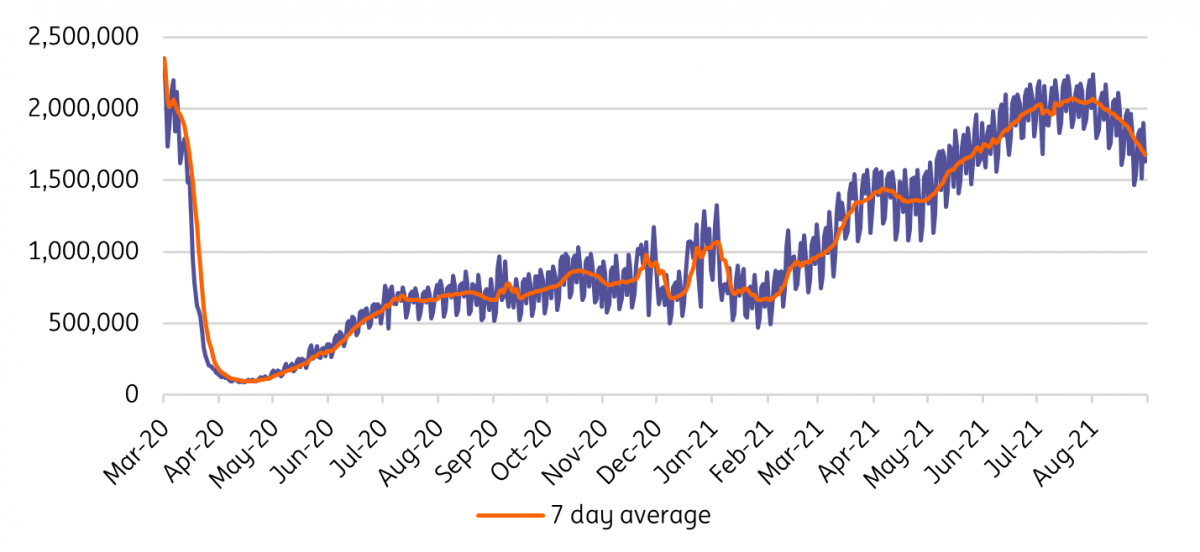

The resurgence of Covid has contributed to the seventh steepest fall of all time in the University of Michigan sentiment index. Consumer caution has translated into a reduction in the movement of people with high frequency data showing a notable softening in air passenger numbers and restaurant bookings. This suggests weakness more broadly in the travel, leisure and hospitality sectors.

Part of the decline in confidence can also be attributed to consumer anxiety over the rising cost of living with households increasingly aware of higher prices, be it food, gasoline, houses or cars. Home, car and appliance buying intentions have all dropped in response. Coming after the stimulus cheque fuelled spending surge in the second quarter, the third quarter was always going to experience slower consumer spending growth. Unfortunately, given these developments we now expect to see a small outright contraction.

The corporate sector also remains under pressure with supply chain issues and labour market shortages showing little sign of easing. This is limiting growth potential with inventory levels being run down to record levels. The construction sector is also starting to see activity moderate, but strong business investment, better net trade numbers and a positive government contribution should mean we still get a respectable third quarter GDP growth figure of around 4.5%.

As a result of our 3Q downward revisions, combined with 2Q GDP growth disappointing expectations (due to supply chain strains holding back economic activity which has led to another major run down in inventories) we have lowered our full year growth forecast to 5.9% from 6.7%.

Daily TSA security check numbers at US airports

2022 to see a durable recovery

The economic disruption from Hurricane Ida could additionally knock off a couple of tenths from 3Q GDP growth, but what we expect to find is that the clean-up operation and rebuilding and replacement of buildings, equipment and cars will actually contribute positively to growth in the fourth quarter.

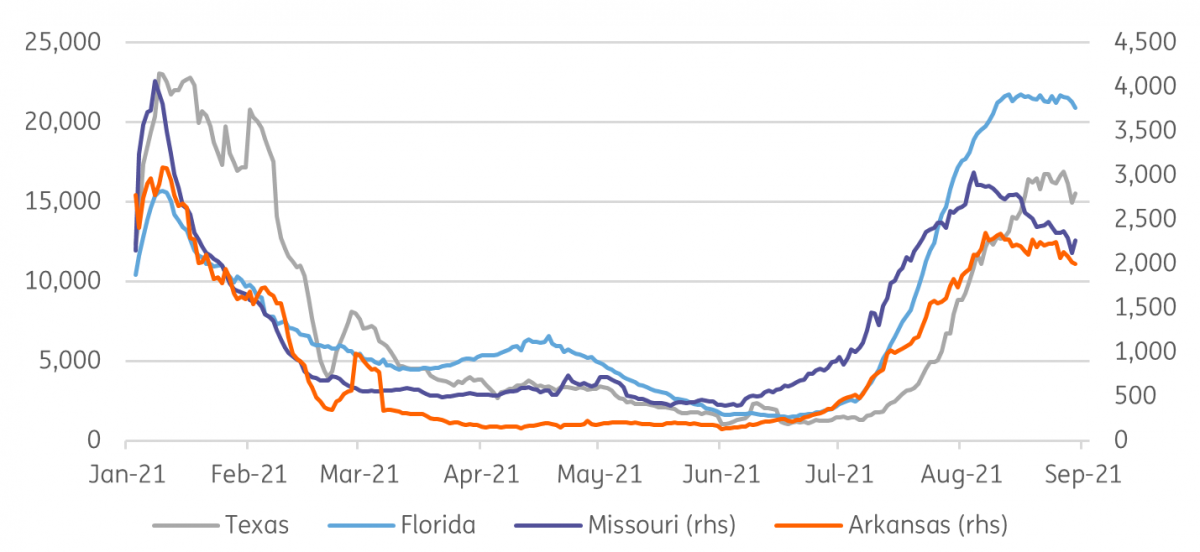

Moreover, there is already evidence that Covid case numbers are topping out and are actually falling in some of the “hot spots” such as Missouri and Texas, which should help sentiment to gradually recover. We are also seeing private income growth rise as the competition for workers pushes up wages while employment gains continue to be made. Corporate investment looks set to continue contributing strongly while stronger growth overseas will help exports. As such, we still expect to see full year growth of around 6% for 2021.

We assume that supply chain strains will ease in the quarters ahead and this will allow a major rebuilding of inventories next year. With the government infrastructure plan and an additional $3.5tn of social spending set to feed into the economy, plus ongoing job creation and solid income gains, we continue to forecast growth of close to 5% for 2022.

Covid case numbers in selected states

QE taper is on its way

Inflation is showing little sign of easing given the supply strains within the economy. Surveys suggest companies are confident that they can pass much of their higher costs onto consumers while rising housing costs will be a factor that we think will keep headline inflation above 5% for the rest of this year and core inflation above 3.5% through to next summer.

Unsurprisingly, we are hearing more and more Federal Reserve officials suggest it is time to “dial back” on the policy stimulus and end quantitative easing asset purchases soon.

St. Louis Fed President James Bullard has been the most vocal, stating that, “It’s not clear to me that we’re really doing anything useful here” while Dallas Fed President Robert Kaplan argued that “these purchases are not well suited to the environment we’re in now”.

Jerome Powell not fully on board

Fed Chair Jerome Powell is not convinced though. During his Jackson Hole symposium speech he merely acknowledged that it “could” be appropriate to taper this year. His comment that an “ill-timed policy move” could be “particularly harmful” suggests the resurgence of Covid is weighing heavily on his thinking.

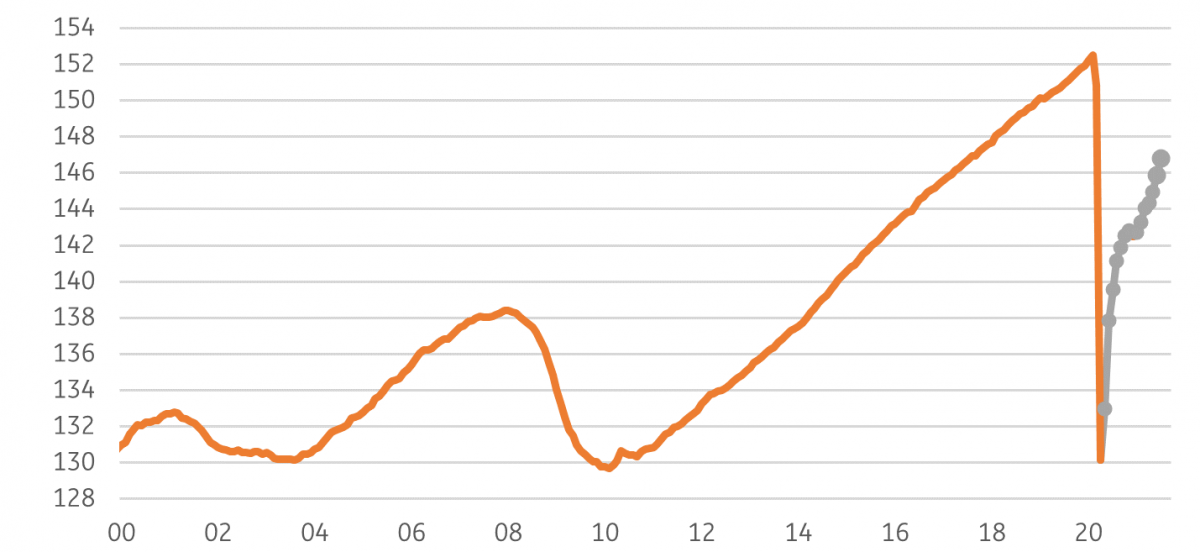

He also wants to see the economy create more jobs. Given there are still 5.7mn fewer people in work than in February 2020, there is “much ground to cover to reach maximum employment,” according to Powell.

US employment levels (m) - still well down on pre-pandemic highs

On course for higher interest rates

We doubt the August jobs report will be strong enough to convince him to back a taper announcement at the 22 September FOMC meeting with the odds favouring a November decision, and purchases being reduced from December onwards. We suspect that it will be implemented proportionally between agency Mortgage-Backed Securities and Treasuries, and that it will be concluded over a six-month period.

Jerome Powell has made it clear that the decision on QE tapering is completely separate from any discussion on raising interest rates. Nonetheless, there are already 7 out of 18 FOMC members who think they will be raising interest rates next year. It would only take a couple of members to switch their views to bring the median forecast to a 2022 rate rise. Given our growth and inflation forecasts and ongoing supportive fiscal policy this is our baseline view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 September 2021

ING Monthly: Back from the beach, into the breach This bundle contains 11 Articles