US pipeline price pressures ease, giving another excuse for a Fed pause

US data shows soft producer price inflation and retail sales, which gives the market further excuse to push in the direction of a no change Fed decision next week. Coupled with an inevitable tighting of lending conditions given recent events the need for extra hikes is doubtful

Disinflation theme remains in place

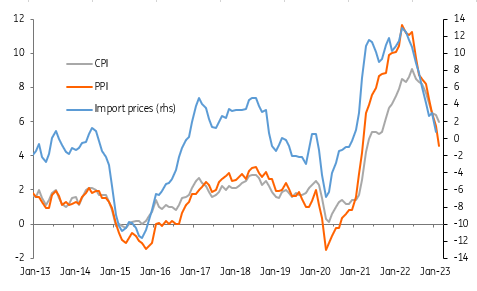

Headline producer prices fell 0.1% month-on-month in February versus expectations of a 0.3% rise, while prices were flat on the month for ex food and energy versus a consensus forecast of 0.4%. This means the year-on-year rates drop to 4.6% from 5.7% for headline and 4.4% from 5% for core. This means we have more evidence of pipeline price pressures easing, which should help keep the disinflationary trend in place regarding the consumer prices story, as the chart below shows.

Inflation rates are slowing across all areas

Within the details, the key story is the 0.8% MoM drop in 'trade services', following a 1.1% MoM decline in January. This picks up supply chain strains and can be taken as a proxy for the direction of travel on profit margins. With competitive pressures intensifying as the growth outlook darkens this component is going to be a key story that contributes to a rapid slowdown in consumer price inflation through the second half of this year and into 2024.

Mixed retail sales picture after weather boosted January

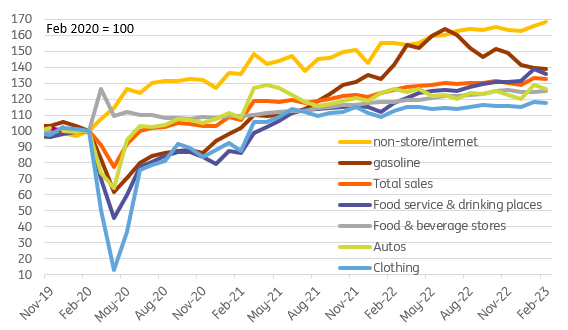

Meanwhile, retail sales fell 0.4% as expected, dragged lower by a 1.8% drop in auto sales, a 2.5% decline in furniture, 4% drop in department store sales and a 2.2% fall in eating/drinking out. Nonetheless, this follows from a very strong January – remember that January was lifted by really warm weather after wintery conditions depressed activity in December – which was revised up to show headline growth of 3.2% MoM.

Interestingly, the core 'control' measure that excludes volatile components such as building materials, gasoline, autos and food service was actually up 0.5% MoM. This is important seeing as it typically better matches movements in broader consumer spending. It is almost entirely down to a 1.6% rise in non-store sales.

Retail sales levels

The case for rate hikes keeps weakening

The PPI story is quite rightly attracting most of the attention so the market pricing for a potential Federal reserve rate hike next week has slipped to 11bp. We are of the view that there is no need to hike – the Fed can easily say it is pausing and looking to potentially restart once markets have calmed – but there are plenty of inflation hawks on the Federal Open Market Committee, which is why they opened the door to 50bp in Chair Powell's testimony to Congress last week. Tomorrow’s European Central Bank meeting will play an important role in this. If the ECB hikes and markets react badly then the no change Fed outcome will gain greater momentum. Likewise if markets take it in their stride, then a Fed 25bp move will look more likely.

US lending conditions remain our major concern with banks already pulling back on lending before last week as highlighted by the Fed's Senior Loan Officer survey. Lending conditions are only going to get worse given recent events as banks and regulators become far more cautious. Therefore, the combination of higher borrowing costs and reduced access to credit are going to weigh heavily, which we argue removes the need for further hikes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article