US: Not quite so exuberant…

A sharp fall in consumer sentiment is a surprise and may reflect recent equity market volatility and a spike in gasoline prices. A strong jobs market and rising pay will underpin sentiment and spending to a certain extent, but we shouldn't take it for granted. Today’s figures support the case for further precautionary Fed policy easing

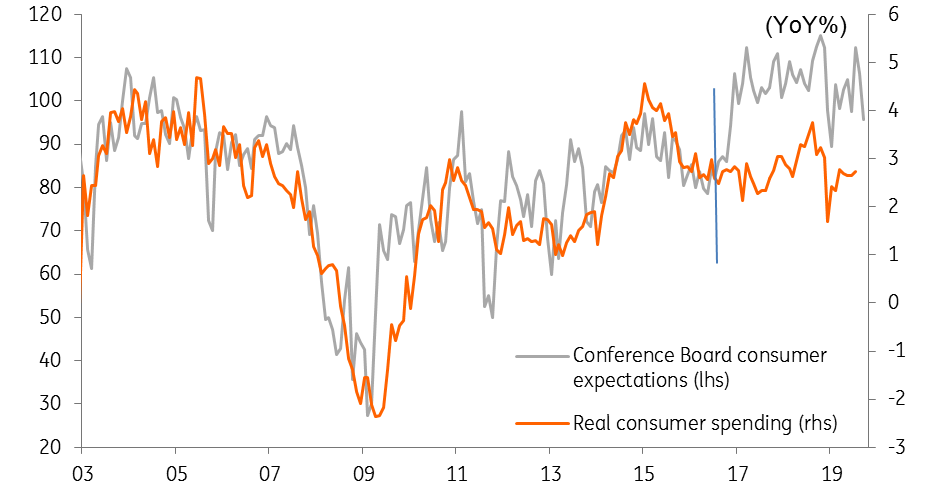

Confidence slide hints at a slowdown in spending

The Conference Board measure of consumer confidence has reported a sharper-than-expected fall in September with the index coming in at 125.1 versus 134.2 in August. This was weaker than the 133.0 consensus figure and suggests that the recent bout of equity market weakness may have generated a sense of nervousness about the economy. This has perhaps been compounded by the ten cent jump in the cost of a gallon of gasoline in response to Middle-East tensions.

The expectations component saw most of the damage, which is a little concerning. It posted its lowest reading since January when the US was in the midst of the last government shutdown. That said, the relationship between confidence and spending hasn’t been fantastic since President Trump won the 2016 election. Explaining this breakdown in the relationship is tricky. Indeed, we see less of a divergence between sentiment and spending when looking at the University of Michigan sentiment index.

US consumer confidence and consumer spending

But a strong jobs market suggests no imminent risk of a collapse

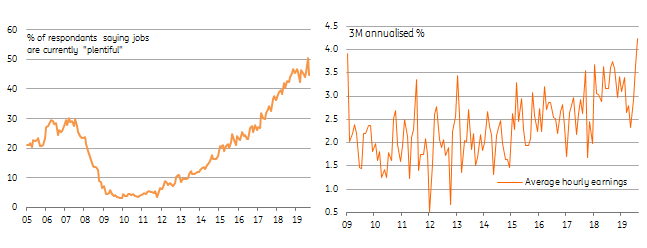

There are still reasons to be positive on the US consumer spending outlook. Unemployment is at multi-decade lows while today’s Conference Board report showed more than 40% of respondents feel that there are plenty of jobs available. This gives a sense that there are opportunities for career progression or higher pay both inside and outside of your current employer. Pay rates are certainly accelerating while equities have recovered all their losses seen in August and mortgage rates have fallen by more than 100bp over the past year. This doesn’t point to an imminent downturn in spending.

A strong jobs market provides near-term support

The case for more Fed "insurance" grows

With the US manufacturing sector seemingly in recession (note another large fall in the Richmond Fed index this morning) and weaker global growth and trade headwinds unlikely to dissipate anytime soon, the Fed will be understanding that the real source of strength in the US economy – the consumer – needs protecting. While the Fed hasn't signalled any clear appetite to cut rates further, evidence like we have seen today suggests further “insurance” policy easing will come. We continue to look for a 25bp rate cut in December with another 25bp cut in 1Q20.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article