US manufacturing: Too hot to handle

Supply disruptions and labour shortages means both US manufacturing and construction sectors are struggling to keep pace with demand. Corporate pricing power is on the rise and the case for earlier Federal Reserve rate hikes is building

Demand outpacing supply capacity

The June ISM manufacturing index dipped marginally to 60.6 from 61.2 (consensus 60.9), but make no mistake, this is an incredibly strong report where anything above 50 is in expansion territory.

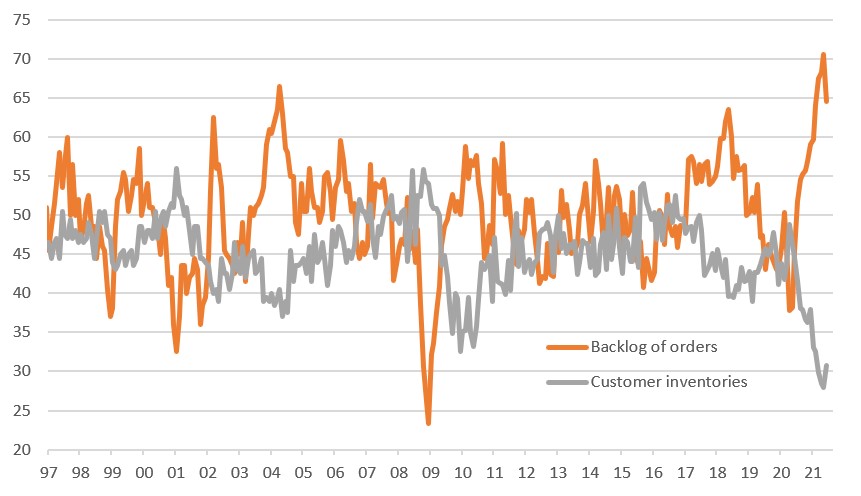

The production index actually rose to 60.8 from 58.5, which was a surprise given the well publicised supply chain issues hitting the sector. However, the fact is the manufacturing sector is struggling to keep pace with the scale of demand. New orders continue to flood as indicated by a 66.0 reading while the backlog of orders continues to surge, although at a slower pace than in May. This means supplier delivery times continue to lengthen with customers increasingly desperate for stock as indicated by another steep contraction in their inventories.

Record demand and desperate customers mean improved pricing power in the manufacturing sector

Above 50 = expansion, below 50 = contraction

Where are the workers?

A surprise was the fact that despite all this demand, employment actually fell into contraction territory (49.9). This suggests that manufacturers can’t find workers to fill vacancies and they themselves are having staff be poached by other firms. Consequently, if you want to hire and retain workers it looks increasingly likely that companies will have to pay more. Either way, today’s report supports our call for a sub-consensus payrolls growth figure tomorrow.

Companies are already paying more for everything else with the prices paid component hitting its highest level since 1979 and at least in the near-term, labour is likely to add to those cost increases.

We think labour shortages may become less of a constraint from September as childcare issues ease and expanded unemployment benefits conclude fully, but there is no guarantee given evidence to suggest potentially more than 2 million people have taken early retirement in the past year. Consequently we see the risks being skewed towards a longer period of elevated costs for employers as they hunt for suitable employees.

In any case, with such a backlog of orders and the knowledge that customers are getting desperate given such low inventory numbers, manufacturers increasingly know they have pricing power and can pass higher costs on. This all adds to our sense that inflation is likely to be more persistent than the majority at the Federal Reserve acknowledge with the case building for a 2022 first interest rate hike.

Construction levels by sector

Residential construction facing similar pressures

Meanwhile, construction spending surprisingly fell 0.3% month-on-month in May versus the 0.4% gain the consensus forecast. Residential construction rose 0.2% while non-residential contracted 0.7% – the 15th fall in the past 16 months – given the uncertainty over the need for office space and constraints on local government spending.

Residential remains very strong though, with output up 28.2% year-on-year. Similar to the manufacturing sector there are supply constraints – the cost of materials and the ongoing problem of finding workers – so we wouldn’t be surprised to see the rate of activity slow. Amid robust demand for new homes (note the surprise sharp increase in pending home sales yesterday), this means house prices are likely to keep rising at double-digit annual rates through the rest of the year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more