US manufacturing lull looks temporary

The fall in the ISM manufacturing index is disappointing, but seems driven by customers running down inventories. Given sound economic fundamentals there is scope for a rebound in 2Q19

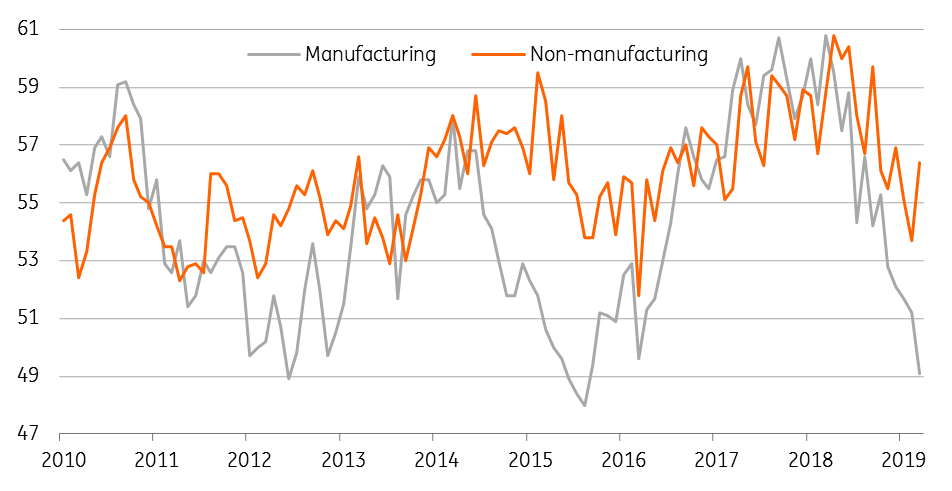

The US ISM manufacturing survey is weaker than expected with the headline index dropping to 54.2 from 56.6, relative to a consensus forecast of 55.8. This is the softest reading since November 2016 with the report showing all of the major components moving lower. However, it is important to point out that all of the key sub-indices remain above the key break-even level of 50. This means that there is expansion, just at a slower rate.

The US ISM manufacturing survey reading is the softest reading since November 2016

Nonetheless, this is quite a comedown from the 14-year high seen just six months ago and offers further support for the Federal Reserve’s decision to adopt a more cautious stance towards monetary policy. The ongoing concerns about trade protectionism and the impact on supply chains and costs probably aren’t helping.

However, worries about weaker Eurozone and China activity are seemingly affecting sentiment more than actual orders since export orders was one of the few components to actually see an improvement.

Weak customer inventories offer hope for growth

Concluding on a bit of positive news, the report shows that customer inventory levels plummeted to an eight-year low. This would explain the soft new orders figures and weaker production growth. Given the robust jobs market and strong consumer demand coupled with rebounding equities and encouraging news on a potential US-China trade deal, we think the US economy remains in decent shape.

As such we would expect customer inventories to be gradually rebuilt in the months ahead, which could be the catalyst for stronger manufacturing activity in 2Q19. This, in turn, could pave the way for a Federal Reserve rate hike in Q3 as suggested by former NY Fed President William Dudley in comments today.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article