US JOLTS data confirms job weakness is down to supply

With job openings back above 11 million there is clearly no weakness in demand for workers. Instead, the reluctance of potential staff to return to the workforce is holding back growth, with the competition to recruit set to keep labour market inflation pressures bubbling

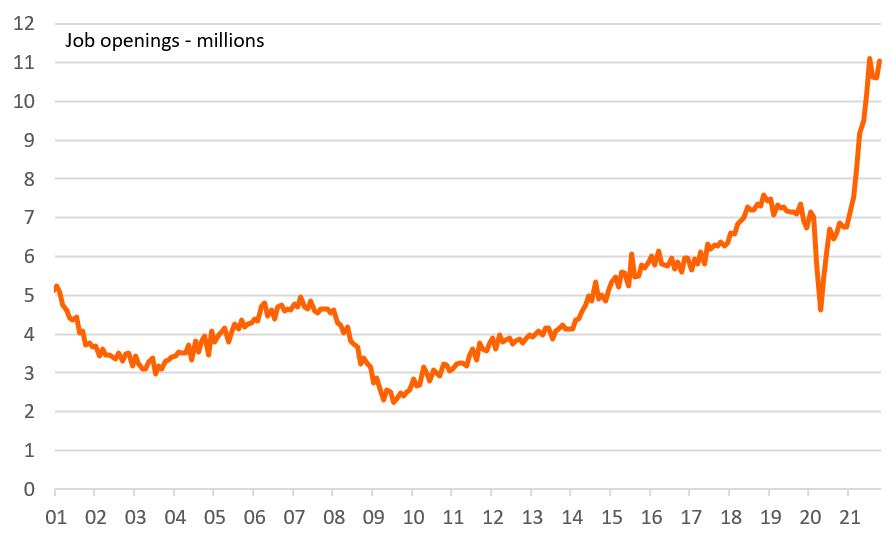

Job vacancies back above 11 million

Last Friday’s November US jobs number was disappointing, with the 210,000 outcome being less than half of what was expected. This means that employment is still 3.9 million below its pre-pandemic peak despite the economy being 1.4% larger.

Our take was that this was yet another example of supply constraints – the disappearance of millions of potential workers - rather than any weakness in demand. After all, just a few hours earlier the National Federation of Independent Businesses reported that a net +48% of small businesses have job openings they have been unable to fill.

This assessment has received further backing from today’s Job Opening and Labour Turnover Statistics (JOLTS data). It showed the number of vacancies rising to 11m – a multiple of 50 times the number of jobs created in November! Firms are desperate to recruit and are willing to pay more for staff, with the December Federal Reserve Beige Book stating “hiring struggles and elevated turnover rates led businesses to raise wages and offer other incentives, such as bonuses and more flexible working arrangements”.

US job openings (millions)

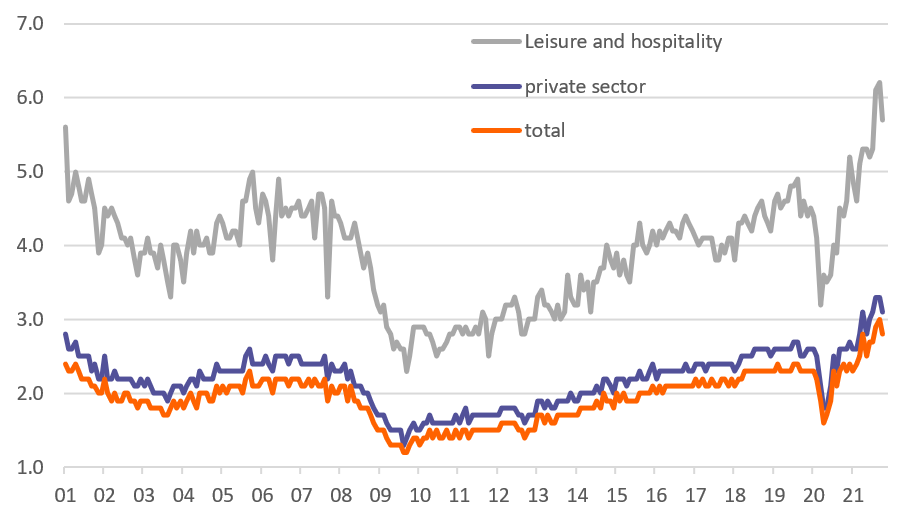

But quit rate drops back. For now...

The surprise was the decline in the number of people quitting their job from a record 4.36m in September to 4.157m in October – the first dip since May. This meant that the quit rate – the proportion of workers quitting their job – declined to 2.8% from 3%. We see this as a temporary response to the concern about the Delta Covid spike with consumer caution extending to wanting to keep the security of their current job. We expect to see the quit rate moving higher again in coming months, which would not only indicate that firms are paying up to recruit new workers, but they are also having to consider raising worker compensation to retain the staff they currently have.

Quit rate - proportion of workers quitting their job to go elsewhere (%)

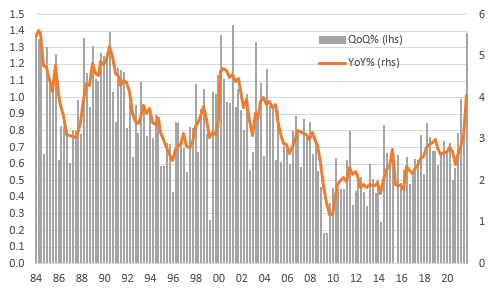

Labour costs are accelerating

This assessment is also reflected in last Thursday’s NFIB survey which showed a net 44% of companies raised worker compensation over the past three months, with a net +32% expecting to raise compensation over the next three months – both are record highs for a survey that started in the mid 1970s. The Conference Board has subsequently announced that its Salary Increase Budget Survey shows 2022 salary increase budgets are estimated at 3.9%, which is the highest since 2008.

Barring a sudden return of millions of potential workers, this paints a picture that inflation pressures are broadening out and are likely to last longer. The employment cost index was one of former Fed Chair Alan Greenspan’s favourite economic indicators and it is increasingly coming back into vogue. It highlights the potential inflation threat coming from the labour market by including broader costs than wages alone, such as health benefits and pension costs.

Employment Cost index

Fed's hawkish shift continues

The Federal Reserve is now acknowledging this by Jerome Powell dropping the “transitory” description of inflation and clearly signalling that QE tapering will be accelerated at next week’s FOMC meeting and concluded in March. Officials have also been hinting at the prospect of having two 25bp rate hikes in their updated “dot plot” forecasts.

In our 2022 Economic Outlook published last week, we suggested that were it not for the emergence of the Omicron variant we would have shifted from a two-rate hike view to a three-rate hike view for 2022. So far, the evidence suggests that Omicron won’t derail the global recovery story, but there is still some uncertainty. Nonetheless, that three hike call looks increasingly likely.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article