US jobs report underlines the case for rate hikes

Strong jobs growth continues at a time when the economy is growing 4%, and inflation is about to break 3%. Interest rates will continue to rise despite trade fears

| 213,000 |

Number of US jobs created in June |

| Better than expected | |

According to the latest jobs report, US employment rose 213,000 in June while there was a 37,000 upward revisions to the jobs numbers for April and May. As such, job creation was well ahead of the 195,000 consensus forecast, so the report really underlines the strength of the US economy right now.

Interestingly, around 600,000 new workers entered the labour force last month, but bear in mind this report is a survey and tends to be very volatile month to month. Given the flood of new workers, not all who got jobs pushed the unemployment rate up to 4% from 3.8%. This extra labour supply has seemingly helped keep wage growth in check. Average hourly earnings growth remained 2.7% against hopes of a slight pick-up to 2.8%.

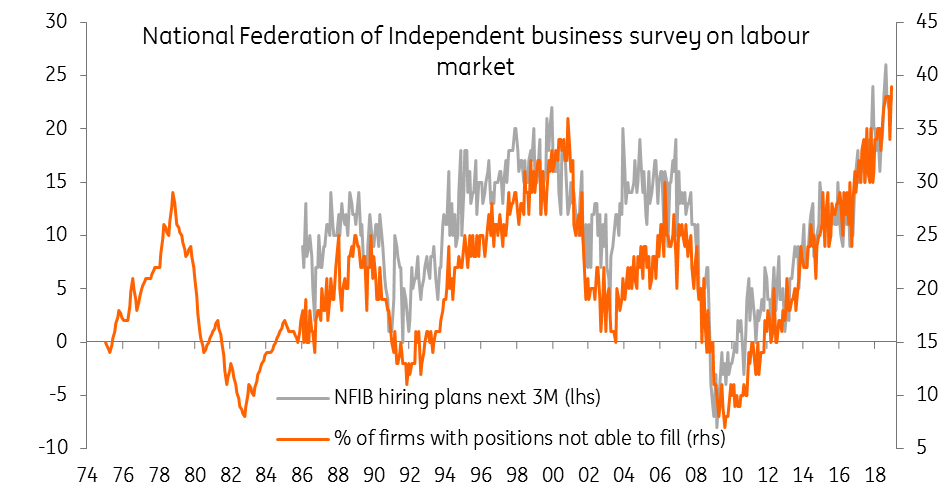

Nonetheless, the US jobs market is incredibly hot right now with yesterday’s NFIB jobs survey suggesting that in the small business sector, the proportion of firms looking to hire workers has been higher on only three occasions in the past 45 years. In fact, the proportion of firms with current vacancies that are unable to fill is at an all-time high with 21% of firms saying finding qualified labour is the biggest problem their business is facing.

Firms are struggling to fill vacancies

This suggests that these 600,000 newly available workers can quickly find work if they have the right skills and that the unemployment rate will very swiftly fall back. It also suggests that wage pressure will continue to build as companies bid for skilled labour. So, taking this all together we have a US economy growing at around 4% in the current quarter, that has an incredibly tight labour market with headline consumer price inflation potentially rising to 3% next week. This suggests the Federal Reserve needs to keep raising interest rates with at least two more rate hikes likely this year.

Nonetheless, an escalating trade war poses a clear threat. The latest ISM suggested, “respondents are overwhelmingly concerned about how tariff related activity is and will continue to affect their business”. Meanwhile, yesterday’s minutes of the June FOMC meeting reported “some” contacts said, “plans for capital spending had been scaled back or postponed as a result of uncertainty over trade policy”. The concern is that a tit-for-tat escalation of tariffs will be increasingly damaging for activity, hurting sentiment and leading to a slower pace of growth in capital expenditure and job creation. This is likely to result in a slower pace of rate hikes next year.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more