US jobs report provides more cheer

After disappointment in February, job creation bounced back nicely in March. With pay set to continue grinding higher consumer fundamentals are in decent shape

| 196,000 |

US jobs created in Marchconsensus was 177,000 |

| Better than expected | |

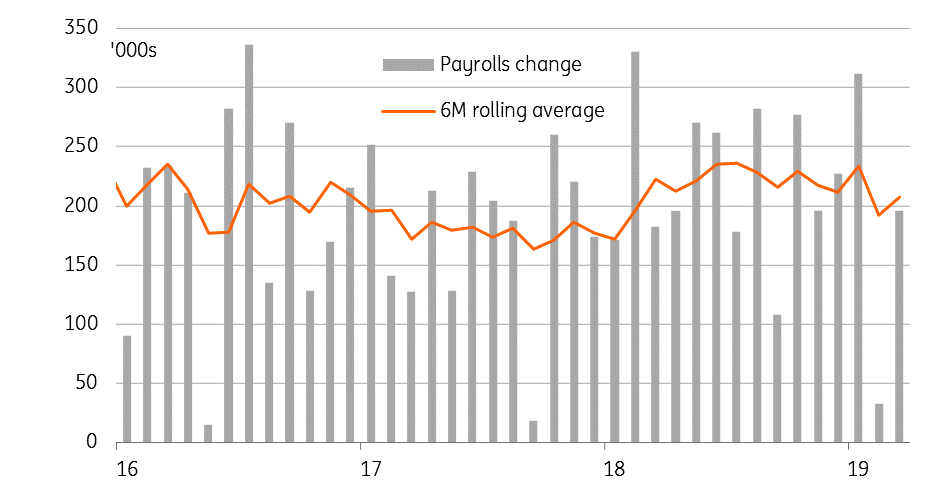

Payrolls back on track

After a poor start to the year, some better news has started to come through including today’s US jobs report. Payrolls growth has been very choppy recently, possibly due to the government shutdown and weather, with January’s 311,000 increase followed by a poor (but upwardly revised) February figure of 33,000. We seem to be back on track with a 196,000 gain for March, above the 177,000 consensus. Separately, wage growth slipped a little to 3.2% YoY from 3.4% but the unemployment remains close to 50-year lows at 3.8%.

The details on payrolls show that manufacturing employment fell 6,000 which is the first fall for this component since July 2017. Unfortunately for President Trump it doesn’t fit with his narrative that talking tough on trade and offering corporate tax cuts leads to re-shoring of jobs. Construction employment rose 16,000 while private sector services saw employment rise 170,000 and government was up 14,000. All these latter components are broadly in line with recent trends.

The household survey, which is used to calculate the unemployment rate was not so positive – but it is important to remember there tends to be much more volatility within this survey. It reported that employment fell 201,000 but with worker participation falling (it had been steadily rising over the past 12 months) it helped keep the unemployment rate unchanged at 3.8%

US monthly payrolls growth

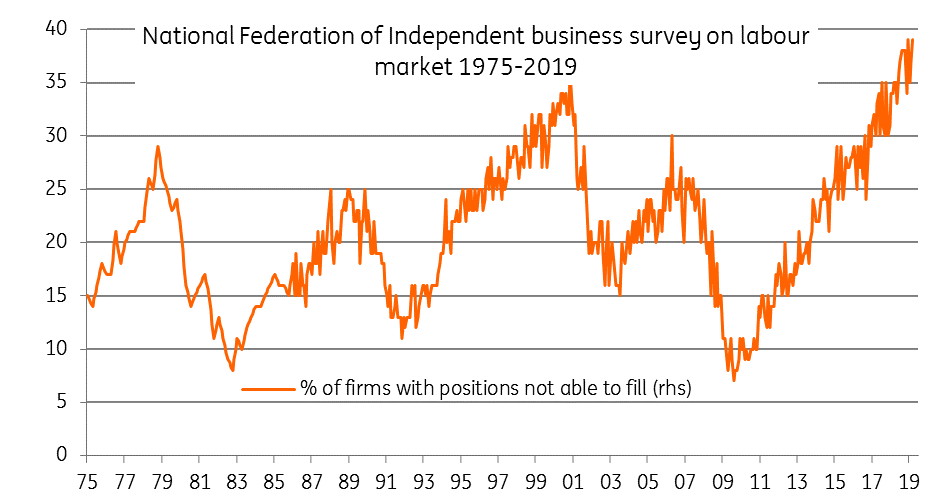

Demand for labour remains strong

We expect payrolls growth to continue averaging 150-200,000 through the summer given reasonable economic activity. After all, the latest economic figures have shown some signs of life with the Atlanta Fed GDPNow measure signalling 2.1% annualised growth in 1Q19 versus just 0.2% three weeks ago. At the same time the National Federation of Independent Businesses released its March labour indices yesterday and they showed a net 18% of businesses are looking to hire while the ISM employment components are also looking healthy.

Nonetheless, we think there will be some lost momentum in hiring, but this is more due to a lack of available labour to fill positions. According to the NFIB the proportion of companies that can’t fill current vacancies is at an all-time high of 39%.

Lack of labour a key constraint for jobs growth

Competition to bid pay higher

This lack of available workers means that the competition for labour remains strong and this has been contributing to rising inflation pressures. The annual rate of wage growth rose from 2.6% in February last year to 3.4% in February – a ten year high. Unfortunately, wage growth disappointed in March, rising 0.1%MoM/3.2%YoY, but we view this as a temporary setback and expect it to soon resume its upward path.

Implications for the Federal Reserve

Despite a period of financial market gloom, we remain relatively upbeat on the US’ economic prospects. The strength in the labour market will continue to underpin consumer sentiment and spending. If progress can be made on US-China trade talks this can remove some of the economic uncertainty hanging over the global economy, which in turn should help to keep demand for workers strong.

While we acknowledge there are more headwinds for the US economy in 2019 versus last year we are in the camp that expects US monetary policy will be left unchanged this year, especially with rising wages likely helping keep inflation at or above target.

Download

Download article5 April 2019

In case you missed it: Europe’s challenges This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more