US jobs report: Mixed messages but rate hikes remain on track

The new low in unemployment will attract the headlines, but wage growth disappoints. Nonetheless, the fundamentals look sound and will keep the Fed hiking rates consistently each quarter

| 3.9% |

Lowest US unemployment reading since December 2000 |

The April US jobs report is a bit mixed. Employment rose 164,000, but when you add in 30,000 upward revisions to the past two months then it is pretty much in line with the market expectation for a 193,000 rise. Unemployment fell to 3.9%, the lowest level since December 2000, but the fall from 4.1% was amplified by a sizeable chunk of unemployed people leaving the labour force – note the participation rate fell from 62.9% to 62.8%. Rounding out the report was a softer wage number. There were some downward revisions and a weaker month-on-month reading for April of 0.1%, which mean the annual wage growth rate remained at 2.6%, rather than coming in at 2.7% as predicted.

It isn’t a particularly exciting report and certainly shouldn’t alter market expectations for monetary policy in any meaningful way, but it just feels a bit soft given the state of the economy. Other surveys paint a stronger picture and we still believe that the wage story will turn higher and be the catalyst for the Fed to take a more aggressive stance on the inflation threat.

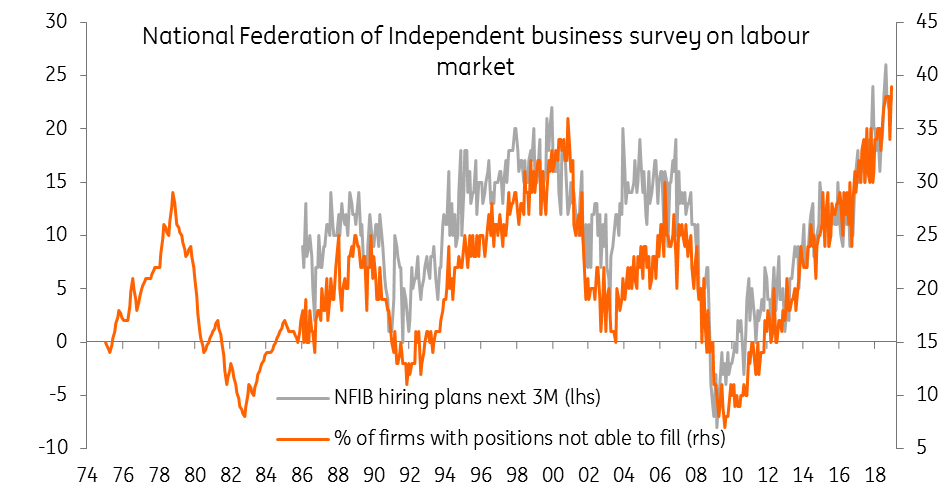

For example, the National Federation of Independent Businesses reported yesterday that 57% of surveyed businesses were hiring in April, up four points on March while a net 33% of small businesses are raising worker compensation – this survey has only been higher once (May 2000) in its 34-year history. We think it is possible we will see annual pay growth hit 3.5% YoY in the latter part of this year.

Given the $1.5 trillion of tax cuts coming through, this will also mean consumers have plenty of cash in their pockets to spend and that GDP growth in the US economy overall will come in close to 3% this year. Meanwhile, next week’s CPI report will likely show headline and core CPI ticking up to 2.5% and 2.2% YoY respectively. As such, a strong growth and firm inflation environment will keep the Fed in tightening mode and we continue to look for three further interest rates rises this year, starting with 13 June.

Wages disappoint, but the NFIB survey suggests companies are paying up...

Download

Download article4 May 2018

In Case You Missed It: US dollar’s ripple effect This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more