US jobs market remains under stress

Jobless claims continue to trend lower as firms look to both hire and retain the staff they currently have. The lack of supply of workers is increasingly becoming a strain on the recovery story and will inevitably add to inflation pressures

Jobless claims trend lower, but stresses remain

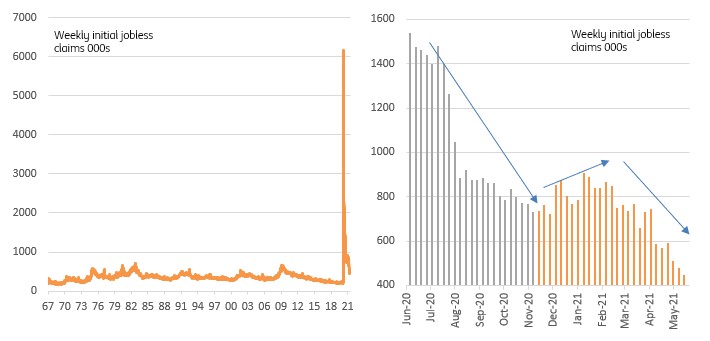

US initial jobless claims continue to edge lower, coming in at 444,000 last week versus 478,0000 the week of May 7th. The consensus had been looking for 450,000 so a modest positive surprise, yet continuing claims actually rose to 3.751mn versus 3.64mn the week before. In a topsy turvy report we also see that the total number of people claiming any form of unemployment benefit fell to 15.976mn from 16.862mn.

This still hints at some ongoing stress, especially when we remember back to pre-pandemic norms when initial claims were typically in the 200,000-250,000 range. Reasons could include some companies re-start and hiring staff, but then find out that they perhaps don’t need quite as many employees just yet given demand dynamics.

While it is clear firms are laying off fewer staff in aggregate, actual hiring levels are disappointing. After all, the economy is likely to have fully recovered all the lost output from the pandemic in the current quarter yet employment levels remain 8.2mn lower than February 2020. The April jobs number was particularly disappointing, coming in at 266,000 versus expectations of a million jobs being added.

New jobless claims per week (000s)

Demand is vastly outstripping supply of workers

Certainly, a different growth composition is a factor that explains this anomaly between activity and jobs. There is more consumer and business spending on physical things (less worker intensive) while consumer services such as leisure and hospitality (more worker intensive) continue to lag. This will re-balance as the economy continues to re-open.

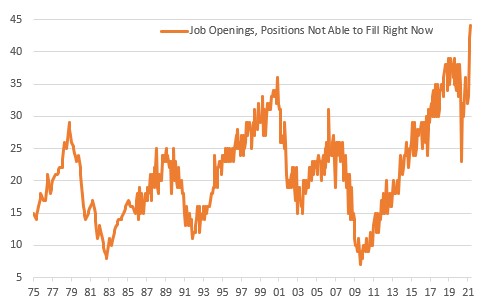

But we cannot get away from the fact that virtually all business surveys suggest companies want to hire, but are struggling to do so. The most obvious is the National Federation of Independent Business, which reports that it has never been harder to fill vacancies in the 46 years they have been asking the small business community – 44% of companies have vacancies they cannot fill.

This supply demand mismatch was underscored by last week’s JOLTS data (Job openings and labour turnover statistics), which showed there were a record 8.123mn job openings yet only 6mn hires – a huge difference.

NFIB - proportion of companies with vacancies that they are unable to fill (1975-2021)

Supply constraints set to persist

The biggest problem in the jobs market does appear to be the lack of supply of workers, which can be attributed to 4 key areas:

- Not all schools have returned to in person tuition, meaning many parents that would be going out to work are having to stay home to look after children

- Some workers remain nervous about returning to work given the pandemic is not yet over

- Some older workers who lost their job may have opted for early retirement

- Expanded and uprated unemployment benefits may diminish the attractiveness of seeking work – especially when factoring the cost of commuting and/or childcare

At least two of these four factors should ease in the coming months. Schools will likely re-open fully in September allowing parents to return to work while 21 states have already opted out of the extended unemployment program, meaning payments will soon end. In any case, this program will end in September, which means the loss of the additional $300 weekly Federal payment for all recipients.

We remain hopeful that the rollout of the vaccine program will remain successful and the concerns some workers have will ease, thereby bringing them back into the workforce. We are less optimistic that people who have opted for early retirement will return.

Employment costs to rise further

Nonetheless, this still means we are going to have perhaps three or four months where the labour supply issue remains a major constraint as companies look to re-open and expand. The competition for workers will remain strong with companies having to pay more to both attract and retain the staff they currently have. A good indicator to watch here is the “quit rate” – the proportion of the workforce leaving their current role to work elsewhere. We expect it to rise to a new all-time high versus the current 2.4% figure (currently matching its all-time high).

Companies are going to be reluctant to raise actual wage rates, which are a permanent move, with a likely preference to “bonus” payments for turning up. This is still going to push up costs with the employment cost index already having hit a 15-year high in the first quarter of this year. We also expect to see companies asking staff to work longer hours, which means more overtime payments and more costs.

Inflation risks more and more on the upside

Consequently, we may not see particularly strong gains in jobs over the next few month, with the bigger improvements seen later in the year as the labour supply strains ease. However, workers are likely to benefit financially due to the competition for staff. This of course is yet another additional cost for business and in an environment of vigorous, stimulus fueled demand companies are in a decent position to pass these extra costs on to customers.

Once again, the implication is that inflation is likely to stay higher for longer, which we suspect will soon force the Federal Reserve to shift away from its ultra dovish position on leaving interest rates on hold until 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article